Our annual peer group comparison allows you to get a glimpse into how your institution compares to your peers from an interest rate risk perspective. As balance sheet composition shifts and interest rates move, your interest rate risk profile is impacted as well.

Interest rates, although up from 2020 levels, remained stubbornly low throughout 2021. The Fed Funds Target Rate remained unchanged at 0%-0.25%. The two-year point of the curve went from 0.125% in December 2020 to 0.694% in December 2021, while the 10-year point of the curve went from 0.918% to 1.51%. The yield curve steepened at the beginning of the year providing a little relief; however, the long-end of the curve had come back down by year end.

As we move into 2022, the Fed Funds Target Rate has remained unchanged thus far. Yet, rates across the rest of the yield curve are up across the board. Looking forward, the consensus is that rates are rising. At year-end, Fed Funds Futures had three rate hikes priced in by the end of 2022.

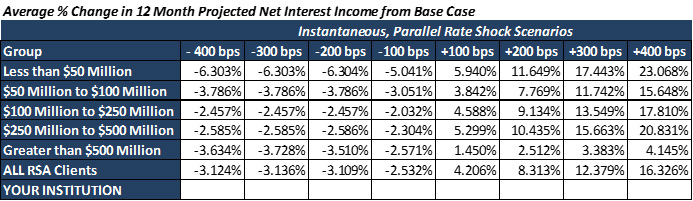

As of the date of this writing, Fed Funds Futures have six rate hikes priced in by the end of 2022. Forecasts call for the rest of the yield curve to increase in a similar fashion. While interest rate risk models are used to manage risk for all rate scenarios, and forward rate estimates are just that, given the current expected rate trajectory, special attention should be paid to the +100 bps scenario.

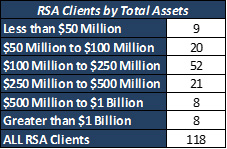

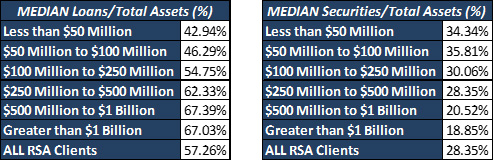

We have completed December 2021 Risk Sensitivity Analyses (RSAs) for 118 clients as of publication of this newsletter. For comparison purposes we have broken down the results by asset size. A smaller sample size can be more easily skewed so keep that in mind if you fall into a group that has a smaller number of peers.

The deposits that poured onto balance sheets in 2020 remained put for the most part. As the yield curve gained some steepness, financial institutions put that money previously being held in overnight funds to work, primarily in the investment portfolio. While loan-to-total assets were down for the year for many clients, securities-to-total assets increased.

At year-end, the median securities to total assets for all December reporting clients was 28.35%.

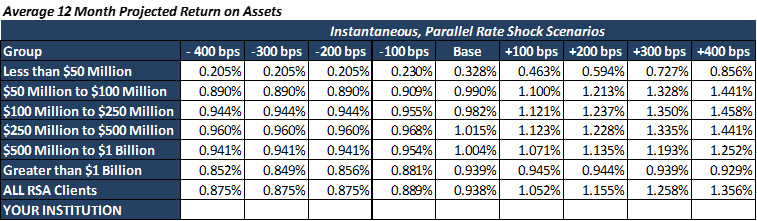

Earnings at risk

As we go through the interest rate risk results, it is important to remember that an individual institution’s estimates may vary greatly based upon the underlying assumptions of the model. The results of the earnings-at-risk simulations show that, given the structure of their balance sheets as of December 31, 2021, most of our clients are positioned to see an increase in net interest income should market interest rates rise over the next 12 months.

Overnight cash balances have declined for most of our clients as institutions have been investing those dollars out. The result is slightly lower asset sensitivity. Falling rate declines continue to be tempered given the current rate environment and instruments hitting natural floors fairly quickly.

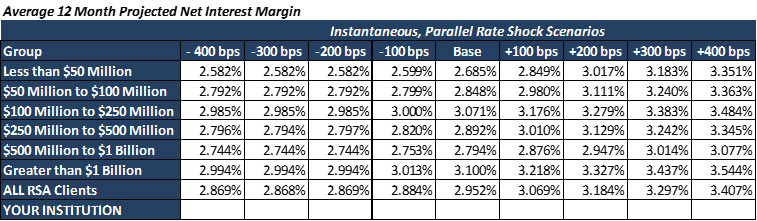

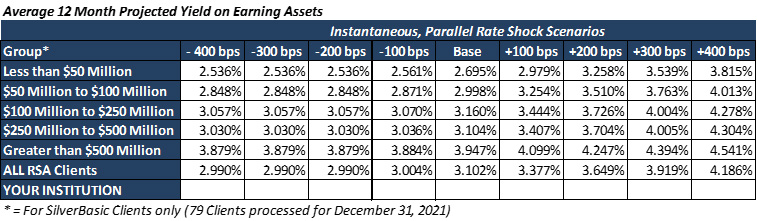

The prolonged low rate environment has led to small declines in projected base case net interest margin. The added steepness to the yield curve has not created a big enough move to have much of an impact.

The projected average yield on earning assets for all clients is 3.102% in the base case scenario (3.377% in the +100 bps shock). This is down 37 bps from December 2020, which foretells the impact the continued low rate environment has had on asset yields.

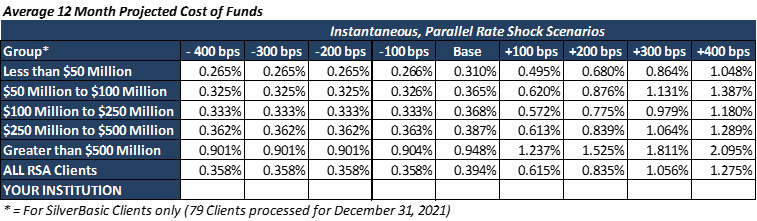

The cost of funds also declined as banks have responded to the low-rate environment. Unfortunately, with rates so low, there is not as much room for liabilities to price down before hitting floors, thus margins are being squeezed.

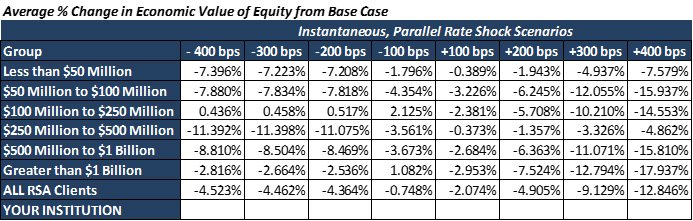

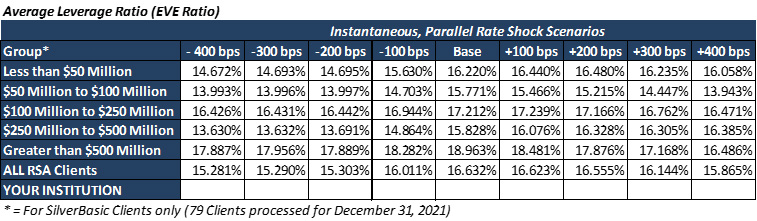

Economic value of equity

The following tables show the results of the economic-value-of-equity (EVE) simulations performed using December 31, 2021 data. (Note: Economic Value of Equity = Net Present Value of Assets – Net Present Value of Liabilities). Overall, EVE volatility has increased due to the trend of investing out dollars that were previously being held in overnight funds. This extended the duration of assets which creates a larger mismatch with liability duration, resulting in higher volatility. It should be noted that the EVE volatility outlined below remains within healthy and acceptable levels. Leverage ratios increased across the board.

If interest rates do increase over the next year, we would expect prepayment speeds, both from the loan and investment portfolios, to slow down which would add some extension to assets. In that same rate environment, on the liability side of the balance sheet we would expect there to be some decay in dollars held in non-maturity deposits with those dollars either moving into time deposit accounts or leaving the financial institution entirely as depositors search out higher returns. Higher decay rates on non-maturity deposits would shorten liability duration. Should those scenarios prevail, the extension of assets and shortening of liabilities would lead to smaller gains in earnings in rising rate environments and larger volatility in EVE.

With the anticipated rising rate environment, is your institution positioned to benefit from an earnings perspective? What is your potential risk to capital? How does your financial institution compare to your peers? Asset-liability management modeling continues to serve as a valuable and strategic tool for better decision-making and enhanced balance sheet management for all rate environments.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

All charts and data above are sourced from UMB internal data and reports.

This communication is provided for informational purposes only. UMB Bank, n.a., UMB Financial Services, Inc. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank, n.a., UMB Financial Services, Inc. or UMB Financial Corporation.

Products offered through UMB Bank, n.a. Capital Markets Division and UMB Financial Services, Inc. are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED