As we wrap up the 2023 year-end rate sensitivity analyses (RSAs) reporting for our clients, we always like to take time to do a lookback at how balance sheets and interest rate risk profiles have changed over the year. Additionally, a peer group comparison allows us, and you, to get a glimpse into how your institution’s balance sheet compares to your peers from an interest rate risk perspective. All those deposits that poured onto balance sheets so easily in 2020 have since seen substantial run-off. Deposit outflows began in 2022 and continued through the first half of 2023. They have since stabilized; however, attention continues to be on how to best fund balance sheets as liquidity remains tight.

After the rapid increase of interest rates in 2022, those increases slowed down in 2023. The Federal Reserve’s Open Market Committee (FOMC) continued to hike the Fed Funds Target rate but at a much slower pace than what we experienced in 2022. We saw four rate hikes in 2023 with the last being at the July 26 meeting, when the target rate was set at a range of 5.25%-5.50%. It has remained at that level ever since. The yield curve continues to be inverted, where it has been since last year. No doubt a tough environment to navigate.

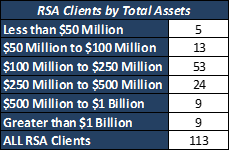

Let’s take a look at how those trends impacted December 2023 results for our clients. We have completed December 2023 RSAs for 113 clients as of publish date. For comparison purposes we have broken down the results by asset size. A smaller sample size can be more easily skewed so keep that in mind if you fall into a group that has a smaller number of peers.

Source: UMB Internal Data

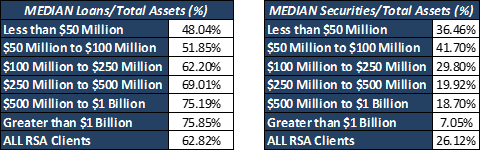

While each balance sheet is unique, some general trends emerged over the past year. Liquidity continues to remain a focus for financial institutions. As previously mentioned, deposit outflows have slowed down for the most part, but have not gone away entirely and has come at the cost of increasing rates. At the same time, loan demand has picked up leaving institutions with the decision on how to fund the balance sheet. Many are letting their investment portfolio run off or are slowing down reinvestment. With tightening liquidity, many financial institutions have turned to, or maintained, a borrowing position. Wholesale funding is being widely used as well. Loans to total assets were up for the year for most clients, while securities to total assets decreased in 2023.

Source: UMB Internal Data

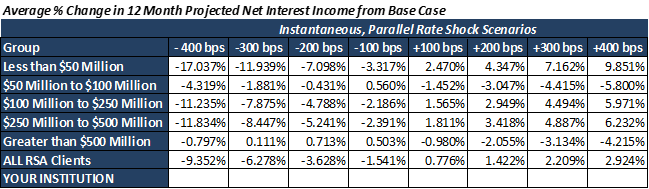

Earnings at risk

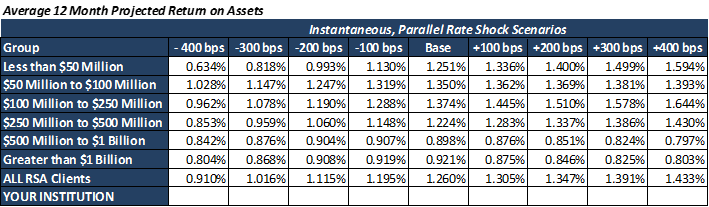

The results of the earnings at risk simulations show that, given the structure of their balance sheets as of December 31, 2023, most of our clients are positioned to see an increase in net interest income should market interest rates rise over the next 12 months — although results are mixed.

Overall increases in rising rate scenarios have come down. Two groups, the $50 million to $100 million group and the greater than $500 million group are now positioned to benefit from a falling rate environment and would expect to see declines in earnings if rates went up. The overall increases in earnings in the rising rate shocks is much lower than what we were seeing two years ago when institutions were flush with cash and held large overnight investment balances.

Many financial institutions have not only seen overnight investment balances decline, but at the same time have added short-term borrowings to the balance sheet. The result is lower asset sensitivity and smaller increases in earnings in rising rate shocks. It is important to remember that an individual institution’s estimates may vary greatly based upon the underlying assumptions of the model.

Source: UMB Internal Data

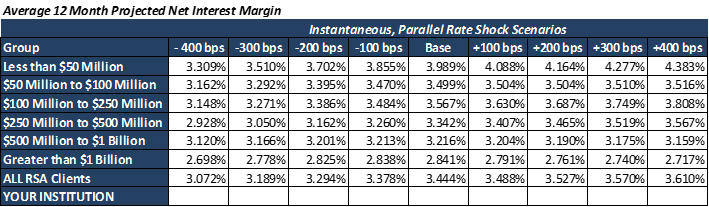

Industry-wide, net interest margins (NIMs) have been getting squeezed with higher funding costs. An average of all RSA clients demonstrates this same trend. Projected NIM declined by 82 basis points (bps) between December 2022 and December 2023 reporting in the base case scenario. This translates into a decline in return on assets (ROA) as well. The base case NIM and ROA for all RSA clients with December 2023 data came in at 3.444% and 1.260%, respectively.

Source: UMB Internal Data

Source: UMB Internal Data

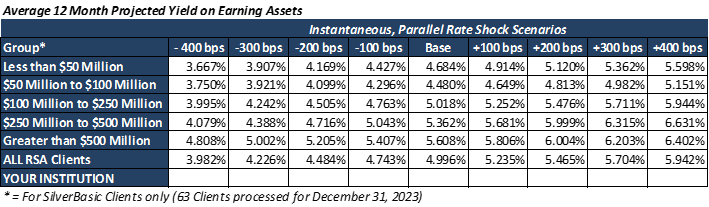

The projected average yield on earning assets for all clients is 4.996% in the base case scenario. This has continued to climb over the year with the continued higher rate environment.

Source: UMB Internal Data

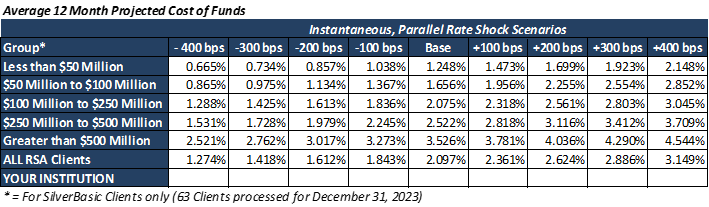

The cost of funds increased as well and is now out-pacing asset yield increases. The cost of funds for all RSA clients came in at 2.097% with December 2023 reporting. This is up 102 bps year over year.

Source: UMB Internal Data

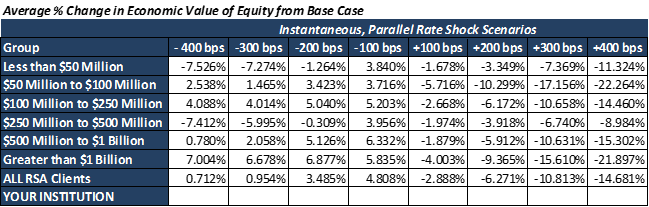

Economic value of equity

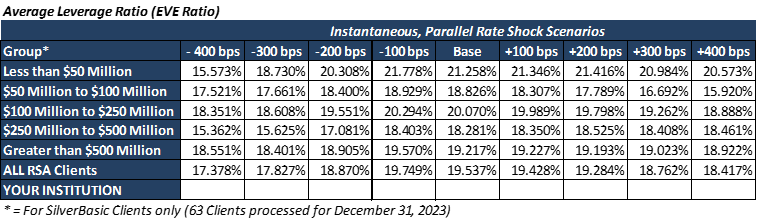

The following tables show the results of the economic value of equity (EVE) simulations performed using December 31, 2023, data. (Note: Economic Value of Equity = Net Present Value of Assets – Net Present Value of Liabilities).

Overall, EVE volatility remained stable over the year. The falling rate shocks continue to revert back to more natural results in the falling rate shocks with EVE increasing. This can be attributed to the higher rate environment and higher funding costs, which now gives yields more opportunity to decline before being floored out at the natural 0% floor.

Note that the EVE volatility outlined below remains within healthy and acceptable levels. Leverage ratios, though down slightly year over year, remain quite high. Non-maturity deposits are still being held at rates lower than market yields which benefit financial institutions not only from an earnings perspective, but also from a valuation perspective.

Source: UMB Internal Data

Source: UMB Internal Data

Did your financial institution experience similar trends in 2023? While this analysis gives us a look at where we ended 2023, the usefulness of interest rate risk modeling is in using the results to make future balance sheet decisions. Looking forward, current yield curve projections are modeling a decline in short-term rates over the next 12 months with the yield curve remaining inverted.

Fed fund futures implied probability is projecting the first rate cut to come in the June or July meeting with a total of three rate cuts in 2024. Even with indications of where rates are headed, it’s impossible to predict how much, when, and even which direction rates will actually move. Interest rate risk modeling allows us to identify, assess, and be proactive in managing those potential risks on the balance sheet.

If you have any questions, or if you wish to discuss the results of this analysis in greater detail, please contact your UMB Investment Officer or Financial Services Group analyst for more details.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

Disclosure:

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED