Private equity refers to investment strategies which primarily pursue ownership of equity positions in privately held companies. These positions are typically acquired through direct negotiations and require a much more laborious due diligence and execution process compared to buying shares of public companies. After investing, private equity managers are typically actively involved in the value creation process through implementation of efficiency initiatives, growth initiatives, or other strategies to enhance shareholder value.

Conversely, public market investors do not generally have any direct impact on the companies they own. The unique characteristics of private equity investing can lead to significantly enhanced opportunity sets and potential incremental returns, versus the public markets.

UMB believes investors who qualify to participate in the private markets should strongly consider including them as an essential part of a well-constructed portfolio strategy.

Expanded opportunity set: What does it mean?

The private markets provide an “expanded opportunity set” for investors, which has historically led to consistent outperformance relative to the public markets. Within private equity, investments are deployed into companies at different points in their lifecycle, including:

- Venture capital (startup companies)

- Growth capital (established companies)

- Buyout (mature companies)

Each of these categories carry a slightly different risk/reward dynamic, so it is recommended to have a diversified private equity portfolio covering all categories. These categories, and the specialties that exist within them, can be compared to how public equity investment managers may follow a certain philosophy (growth/value) or emphasize certain market caps (large/small).

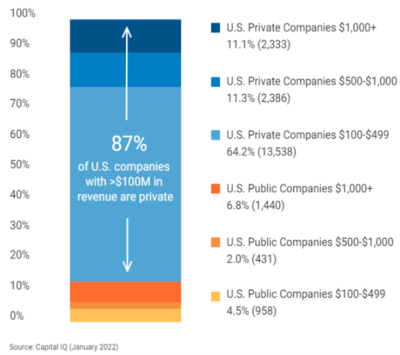

Not only does the opportunity set in private markets include different styles, but it also has a much broader pool of potential investment targets, as the number of privately held companies of meaningful size is many multiples greater than public companies.

Amongst companies with more than $100 million in annual revenue, there were approximately 2,800 public companies in January 2022, according to Capital IQ. Within the private markets, there are approximately 18,000 – more than 6x the potential number of investment opportunities. That multiple grows significantly larger when considering the number of companies with at least $10 million of annual revenue.

Why does that matter?

The good news for investors, and ultimately the primary answer to why to include private equity in a portfolio, is that the larger universe of companies, the lack of publicly available information, and skillset of private equity firms can lead to richer opportunities and meaningful outperformance versus the public markets (such as the S&P 500) — in a repeatable, consistent pattern.

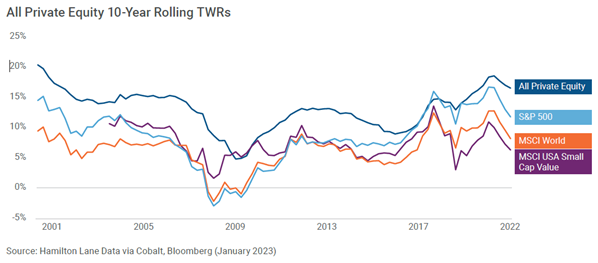

Private markets have enjoyed a consistent long-term track record (see chart below), and UMB believes this success will continue well into the future. Over the last 30 years, private equity has generated excess returns of more than +5.00% annualized versus the S&P 500 (source: Thomson One database). While past performance is never a guarantee of future returns, the historical advantages delivered by private equity clearly illustrate that it is worth consideration, as it has the potential to meaningfully improve investors’ likelihood of achieving their broad, long-term financial goals.

The below chart shows the consistent outperformance generated by private equity (the solid blue line). Private equity has consistently delivered meaningful incremental outperformance relative to the broad public markets, over longer-term cycles. Even more encouraging, this is simply a broad median measure of private equity returns compiled by a 50,000-fund database maintained by Hamilton Lane — the best private equity managers generated returns superior to those shown on this chart.

Building a portfolio – what are the tradeoffs?

Private equity investments are typically accessed through privately structured, pooled vehicles where various investors (limited partners/LPs) commit their assets to be invested by a private equity firm (general partner/GP) according to the terms outlined in the fund’s legal documents. Most of these vehicles have a stated term of around 10 years, though there are often possibilities for extensions. Instead of funding the commitment up front, the GP will request money from all the LPs as investment opportunities are discovered – executing “capital calls” — which typically occur over the first few years of the fund’s term.

Over subsequent years, as the GP implements their management process and builds value in the holdings, they will eventually sell the companies and return the proceeds to the LPs. The timing of both capital calls and distributions is uncertain for most funds when the initial investment commitment is made.

Additionally, private investments are “illiquid” – there is no public secondary market to access if an investor changes their mind and wants to liquidate committed capital. Liquidations are sometimes possible, but can be quite punitive and should not be part of the investment plan. Private equity allocations are long-term commitments with little or no liquidity until the GP begins to distribute cashflow from sales.

Investors must have comfort with the illiquidity of their private equity portfolio. Additionally, because sale proceeds are returned to LPs, an investor must continuously commit new funds to maintain their allocation.

Private equity investing is an active, ongoing process that continues for up to 10 years, or longer.

Additional considerations

Before investing in the private markets, one must consider additional factors which do not exist in the public sphere. There is much less regulation of private equity than public markets, and the data available to evaluate a private markets investment is often quite limited and requires a different skillset to analyze. Other factors include illiquidity, blind pool risk, tax implications, minimum investments to name a few.

Just as in the public sphere, diversification is paramount in the private markets. This may be true to a greater extent because the dispersion of returns is greater. For example, managers within the same private equity category can have as much as a 10% annualized return variance between the top and bottom quartiles – the same measure for large cap mutual funds is closer to 2%. Because of this, manager selection and diversification are of great importance and requires thorough analysis.

Returns also vary by “vintage” – the year a private equity firm closes its fund to new capital and begins making investments. The market environment at the time of closing can positively or negatively influence all investments of a given vintage, so is important to diversify over multiple time periods in addition to fund managers, styles, and market cap.

Private equity in summary

The private markets present an outstanding opportunity for investors to enhance portfolio returns and improve overall diversification by gaining access to a large opportunity set which is many times greater than publicly traded securities.

This space requires additional considerations and specialized skills to implement effectively. But investors who are willing and able to accept the trade-offs while following a disciplined approach will have an opportunity for significantly enhanced long-term returns.

Private equity terms to know:

Capital Call or Draw Down: When a private equity fund manager requests that an investor in the fund provide additional capital. The fund manager draws down on the committed capital as needed for investments and expenses. This is typically a multi-year process.

Carried Interest: A share in the profits of a private equity fund earned by the general partner. Typically, a fund must return capital and expenses before taking a share in the profits. Some partnerships also require a minimum—or preferred—return. The general partner will then receive 20% of all profits earned, although some successful firms receive 25-30%.

Catch-up Provision: Once the hurdle return is reached, this clause in the partnership agreement allows the general partner to receive all or a larger portion of distributions until the total distributed to the general partner equals (or “catches up” to) the carried interest percentage of all distributions to date.

Claw-back Provision: A clause in the agreement between the general partner and the limited partners of a private equity fund. The claw-back gives limited partners the right to reclaim a portion of disbursements previously made to a general partner if that partner has received distributions in excess of the stated carried interest. Excess distributions may occur if early gains are followed by significant losses.

Committed Capital: The amount that investors, individually or in aggregate, commit to invest in a partnership.

Distribution: The transfer of cash or securities to a limited partner resulting from the sale, liquidation, or IPO of one or more underlying investments.

Distribution Waterfall: The steps in the calculation of distributions of income and capital gains. Typically, this order follows (1) a return of capital, (2) return of fees and expenses, (3) preferred or hurdle return, (4) catch-up of 0% to 100%, (5) standard split of profits (e.g., 80/20). Payments may be based on total fund profits or on an investment specific basis. The former is preferred, but the latter is acceptable so long as investors recoup any write-offs or write-downs prior to item (4) above and the agreement includes a Claw-back Provision.

Extension Options: The option to extend the partnership beyond its stated term. Often stated as three one-year extension options either at the discretion of the general partner or with agreement of the limited partners.

Fund Term: The time it takes a fund manager to start-up, draw-down, invest, and distribute the capital committed to the partnership. Depending on the nature of the underlying investments, the term may last between 7 and 15 years.

Fee Scale-Down: A fund manager typically charges higher annual management fees during the Investment Period when the manager is actively investing capital. Following the investment period, the management fee decreases to reflect the lessened amount of management activity and the likelihood that a subsequent fund will have been raised. The scale down may be affected by a lower fee percentage (e.g., 1.5% to 1.0%) or a change in the basis to net invested capital or net asset value. If the scale down is affected by a lowering of the fee percentage, it is typical to see a continual lowering of this percentage through the remaining partnership term (e.g., an additional 10% per year).

Hurdle or Preferred Return: A minimum return before a general partner receives the carried interest. For example, for a fund with a 10% hurdle and a 20% carried interest, the general partner must return all of the limited partner’s capital, plus a 10% return, before earning their 20% of the profits. A hurdle return includes a catch-up provision while a true preferred return does not.

Interest Rate Charge / Credit: If a fund has multiple closings and a capital call is issued to investors in the initial closing, then investors in subsequent closes might experience an interest rate charge that flows to the earlier investors. This charge/credit essentially makes all investors “whole” and compensates earlier investors for the time value of money. The rate is usually not meaningful and based on LIBOR.

Investment Period: A defined period during which a fund may invest in new opportunities. Typically, this will last anywhere from 3-7 years. After the investment period, the fund manager may call capital only for follow-on investments or fund expenses.

Internal Rate of Return (IRR): The standard return measure used by private funds to calculate performance. This measure considers the timing of capital flows into and out of the partnership and assumes reinvestment. Technically, IRR is defined as the interest rate at which a certain amount of capital today would have to be invested in order to grow to a specific value at a specific time in the future.

J-Curve: Private equity investment funds typically show a decline in value in early years as investments are held at cost while organizational and management expenses are charged to the partnership. In later years, the value increases as investments are realized and more than offset fund expenses.

Key Man Provision: A clause in the limited partnership agreement that allows recourse for limited partners if one or more key individuals are no longer actively managing the partnership.

Limited Partner Control Provisions: General provisions in the partnership agreement dictating what voting rights limited partners have under various circumstances. Typically, these include rights to remove or replace the general partner with or without cause, rights to amend or terminate the partnership, and the authorities granted a limited partner advisory committee, if any.

Organizational Expenses: Expenses incurred in organizing a partnership. These may include marketing, travel and legal fees incurred by the partners. Typically, there is a stated cap on the amount of organizational expenses that may be charged to the partnership.

Remaining Fair Market Value or Net Asset Value: The value of an investor’s partnership interest that reflects the existing underlying portfolio holdings, net of all distributions.

Vintage Year: The year a private equity firm closes its fund to new capital and begins making investments. The market environment at the time of closing can positively or negatively influence all investments of a given vintage.

Interested in learning more about Private Wealth Management? With UMB, you have a guiding partner from financial advising and wealth-building strategies, to retirement and legacy preservation plans.