At the time of publish, a federal budget impasse and government shutdown are underway. These events rarely have a lasting economic or market impact, and we do not expect this time to be any different. Perhaps the most difficult aspect of the shutdown is the disruption of economic data coming from many of the primary research sources, especially the Bureau of Labor Statistics. The market is unphased by the current budget impasse, and we do not foresee needing to adjust our forecasts or strategies because of the wranglings in D.C.

Falling leaves, falling uncertainty and rising markets

The third quarter of 2025 was marked by improving market sentiment, driven by growing confidence that the Fed will initiate an ongoing easing campaign throughout year-end and into 2026. Inflation continued to build as new tariffs were implemented, but concern over the labor market pushed the Fed into a “dovish” narrative — igniting hopes for a more stimulative rate environment for the foreseeable future. Equity markets rode this positive sentiment sharply higher throughout the quarter. Watch the replay of the quarterly economic webinar below.

GDP data is a mixed bag

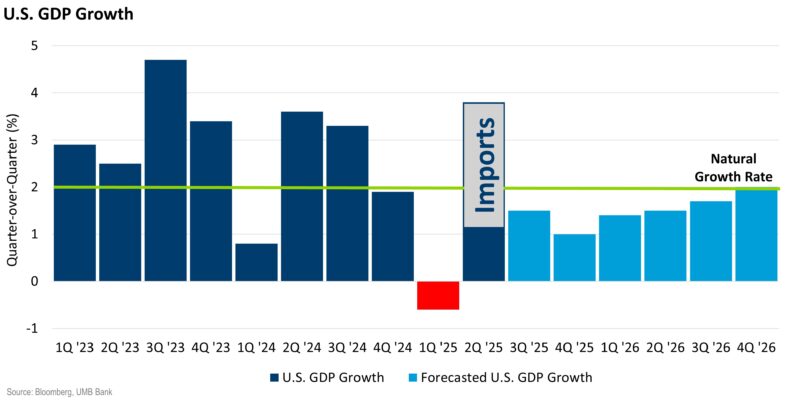

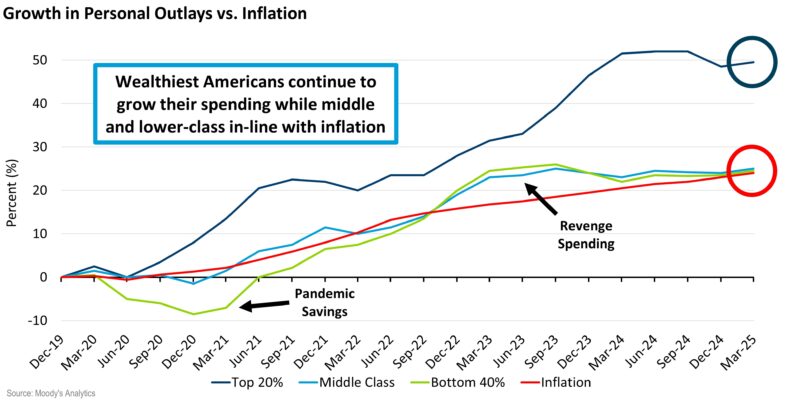

The second quarter of 2025 enjoyed an incredibly strong burst of economic activity with GDP growth being revised up to a robust 3.8% (annualized). Much of this was likely due to front-loading of import activity in anticipation of the impending tariff regime. It is broadly believed that the economy is likely to slow to below-average growth rates (below 2%) for the remainder of the year. Consumption remains steady, albeit concentrated amongst upper-income households. Median and lower-income households appear to be under increasing pressure from both inflation and weakening job prospects.

Tariff fears slowly abating

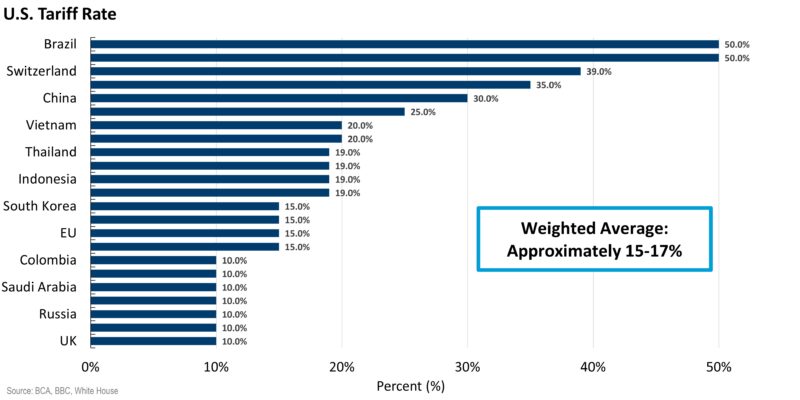

As summer progressed, it became clear the tariff package would land with an average rate of around 15-17%. Contrary to initial concerns, the world quickly adapted and confidence grew in a smoothly functioning global economy despite a historic shift in trade policy. The emerging clarity about tariffs helped ignite a strong jolt of optimism amongst market participants, providing a nice tailwind for stock prices throughout the third quarter.

News around tariff issues with China has added a bit of turbulence to the markets in recent days, but the broad story seems to have calmed. Of course, the Supreme Court is still scheduled to review the legality of the tariffs in November.

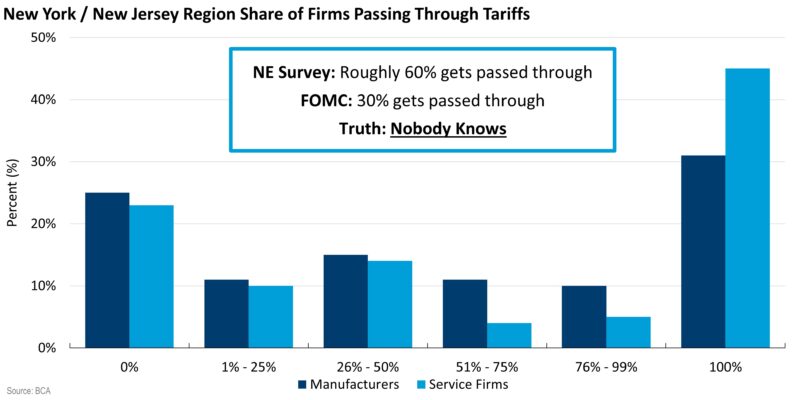

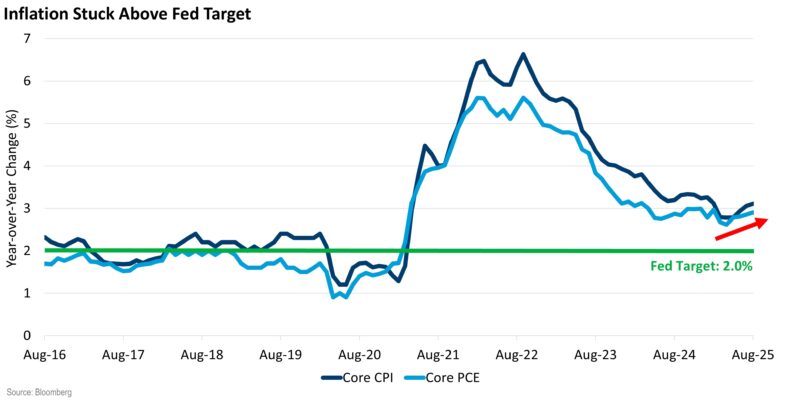

Inflation uncertainty continues, but the Fed isn’t concerned

Inflation data is all well above Fed targets, after grinding higher throughout the summer months. Consumer Price Index (CPI) and Personal Consumption Expenditure (PCE) measures both ended September in the 3% range – versus a long-term target of 2%.

As the full tariff package comes to fruition in the coming months, there is broad consensus that inflation will continue to grind higher early next year – but also that it will taper off and move lower throughout the second half of 2026. Given that tariff-based inflation is a one-time adjustment, the Fed believes that inflation data will crest and begin to drift lower naturally, without any need for higher interest rates.

Given this assumption, the Federal Open Market Committee (FOMC) announced that they were going to focus less on inflation and more on economic softness (most clearly evidenced in the weakening labor market data).

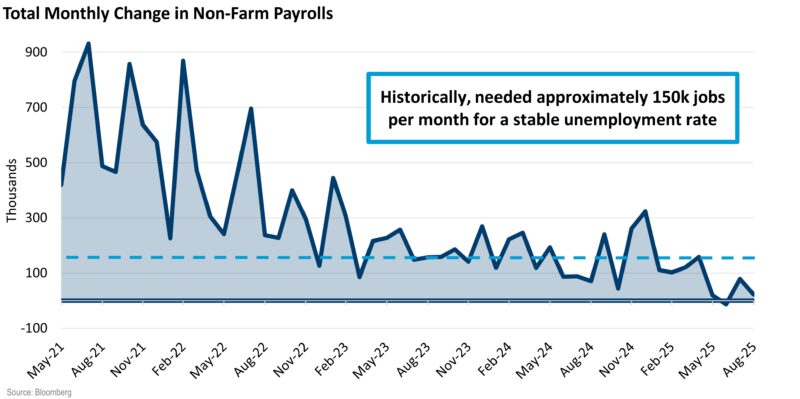

Labor market showing consistent signs of weakness

Over the last several months, the monthly payrolls data weakened significantly, with several downward revisions of previous months’ data. Currently, it appears that the U.S. labor market has ground nearly to a halt, with no meaningful increase in payrolls for several months.

Monthly payroll growth is in a range that would normally be associated with a recession. However, we have not seen a meaningful increase in jobless claims — causing this period to be referred to as the “no hiring, no firing” cycle. This is a curiously unique situation, likely caused by ongoing evolution of the overall labor force, largely due to immigration restrictions and discouraged workers dropping out of the job hunt.

Whatever the underlying cause of this unique mix of data, the Fed is clearly more concerned with weakness in the labor market than with the temporary increases to inflation. At their August summit, the Fed stated a clear intention to focus primarily on economic weakness and followed through on that promise with a rate cut in September. They appear to be divided on whether they will cut rates at the remaining meetings in 2025, but there is no doubt that they intend to take rates lower over the next 6-12 months. This shift towards “dovishness” gave the equity markets another strong boost of optimism, helping drive prices even higher.

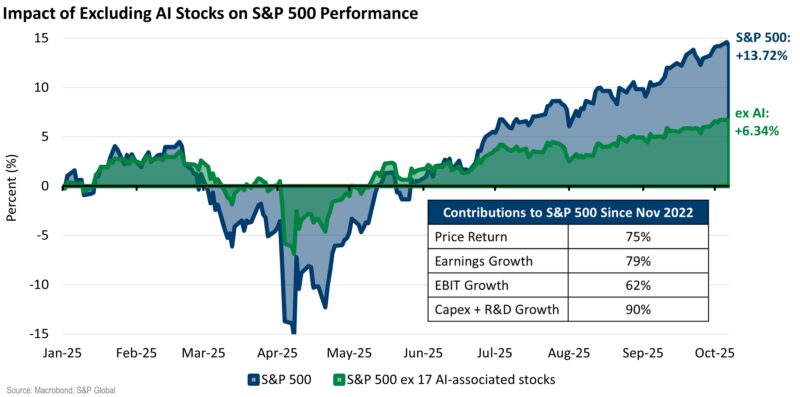

Riding this wave of increasing clarity around both tariffs and rate expectations, the S&P posted a powerful 8.11% return for the third quarter – a truly amazing result in an environment with so many challenging uncertainties. Year-to-date (YTD) returns are around +11% for the S&P at the time of this update, which is well above early estimates for the calendar year 2025. Earnings growth remains healthy, but also heavily concentrated in the group of companies that are focused on the artificial intelligence (AI) arms race.

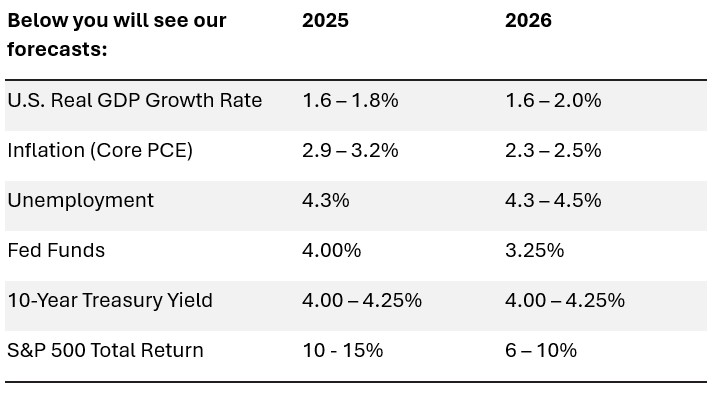

Looking ahead through 2026

We expect the Fed to continue focusing on softening economic fundamentals to rationalize further rate cuts. We expect one more cut (to 4.00%) this year and two or three more in 2026. Lower rates should help businesses feel more confident heading into 2026, which could improve the outlook for broader capital expenditures (not just in the AI space) – bolstering business activity, jobs and the overall economy.

Median and lower-income households in the U.S. are under stress, and the Fed hopes lower rates will help stabilize their consumption patterns heading into 2026. The current environment, with economic growth based primarily on upper-income spending and AI investment is not sustainable long-term. The current market thesis posts that these two forces will sustain activity in the short-term, until lower interest rates help stabilize the average household. This should put economic growth on a more broad, sustainable trajectory over the longer-term.

The ongoing risks to this economic outlook are two-fold

- Inflation could unexpectedly rise sharply due to tariffs, stopping the Fed easing campaign,

- Very weak payroll data could cause a serious economic slowdown, pushing consumption sharply lower before the Fed can rescue the economy via lower rates.

We do not foresee either of those outcomes as the most likely base-case scenario at this time, but they are primary risks heading into next year.

Rate changes remain mercurial

Another possible flashpoint in the coming months is around longer-term rates. Even after the dovish shift from the Fed, the 10-year treasury rate has barely moved – stuck around 4.10-4.20%. With high levels of uncertainty surrounding inflation, budget deficits, and even Fed independence, it appears that global bond investors are reluctant to push longer-term rates lower, even as the Fed cuts overnight rates.

For businesses and households to fully benefit from Fed rate cuts, longer-term rates must also fall. If longer rates stay stuck above 4%, the Fed may be encouraged to re-initiate quantitative easing to force 5-, 10- and 30-year rates lower. This would be a highly controversial tactic, but one that could emerge over the coming months. We are hopeful that longer rates will fall without intervention from the Fed, but we are prepared to face this politically thorny situation if it arises.

What does it mean for your portfolio and assets?

We are slowly growing more optimistic but are still cautious about the potential risks to the economic and market outlook. The Fed is riding a razor’s edge in managing conflicting issues: Inflation is too high and moving higher, while the economy (especially the labor market) looks to be weakening.

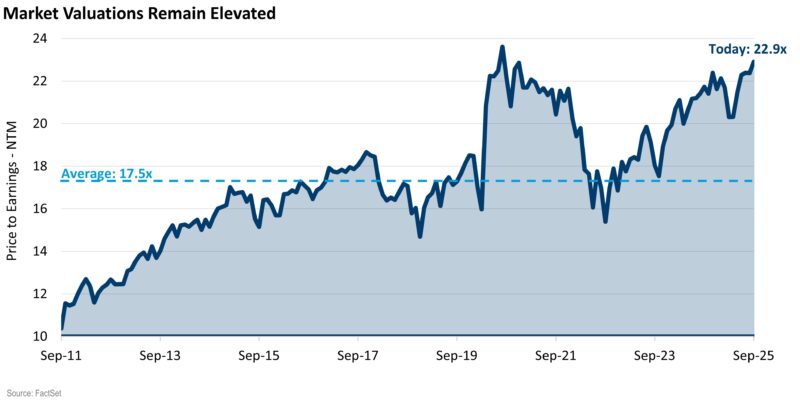

We are hopeful that the FOMC will adroitly massage rates lower in a manner that keeps the delicate economic situation in balance moving into next year. That said, we wish to see a few more months’ data before we consider moving into a more bullish mindset. We are becoming more optimistic that we could be back on a strong economic trajectory as we move into 2026, but remain cautious at this time, given the multiple risks to the economy and lofty valuations in the equity markets.

We continue to remain neutral in our risk allocation – believing that the time for heavier risk exposure is still yet to present itself. If market turbulence erupts, we will maintain a strong re-balancing discipline. Over the longer-term, those who adhere to a strong discipline of re-balancing – especially when the outlook is highly uncertain and markets are volatile – tend to be the investors that secure the best long-term progress towards their goals.

Anchoring to a financial plan created for your individual goals is a great strategy to weather turbulent times like these. Financial teams are here to help you through challenging markets like we are seeing today. With a steady plan, we can get through this economic cycle together.

Equity outlook

The stock market continued its upward trajectory through the third quarter, with the S&P 500 now sitting almost 15% higher year-to-date. This strength reflects resilient earnings and a supportive macro backdrop, even as valuations remain elevated. Market leadership is concentrated in a handful of mega-cap names, underscoring the dominant role of AI in today’s equity landscape.

AI remains the defining force behind this rally. Since the launch of ChatGPT in late 2022, AI has reshaped investor expectations and corporate spending priorities. Semiconductor makers, cloud providers, and hyperscalers have committed hundreds of billions to data center infrastructure, creating a powerful tailwind for equities. As long as this investment cycle persists, markets appear comfortable grinding higher—even with valuations above historical norms. Elevated valuations could make for a bumpier ride, but strong earnings growth continues to provide support.

The ongoing government shutdown adds another headline risk, but history suggests these episodes have minimal market and economic impact. While average peak-to-trough drawdowns for the S&P 500 during shutdowns are about -3.5%, in half of the 20 government shutdowns since 1976 stocks were still positive half the time. On the economic side, it’s estimated that for every week the government is shutdown, it subtracts about 0.1% from annualized GDP growth. The most recent example was the 2018-2019 shutdown which lasted 35 days but is only estimated to have reduced quarterly GDP by 0.4%. In the end, markets typically look through these disruptions rather quickly and prioritize longer-term fundamental drivers over budget standoffs, which are typically short-lived.

Looking ahead, all eyes remain on the Fed. Historically, equities have performed well after the first rate cut, even when cuts occur near market highs, like they did in September. Since 1984, the Fed has cut rates 28 different times when the S&P 500 was within 3% of an all-time high. After the cut, the broader market traded higher by an average of 13.0% 12 months later, with 93% of periods producing positive returns.

While elevated valuations and policy uncertainty may introduce volatility, AI-driven investment, resilient earnings, the One Big Beautiful Bill Act and a shift in monetary policy remain powerful tailwinds that should continue to support stocks. As always, we lean on our core philosophies—discipline, diversification, and a focus on quality—to help clients navigate uncertainty and pursue long-term success.

Fixed Income outlook

Longer-term interest rates continue to be stuck in a range from 4.00-4.25%, despite the recent cut to overnight rates. Bond investors are grappling with building uncertainty around the outlooks for inflation, budget deficits, and now the independence of the FOMC. Economic momentum is moderating, but inflation is still stuck well above the Fed’s target, and likely to move higher after tariffs become fully implemented.

The Fed has clearly indicated that they are focusing primarily on the weak labor market, with less concern for the inflation situation, and they are relying on historical evidence that tariff-based inflation is typically temporary and tends to resolve on its own. After a rate cut in September, the Fed has indicated an intention to cut rates several more times in coming quarters. Despite this clearly telegraphed path lower for overnight rates, longer term interest rates have simply not fallen, due to the previously mentioned concerns.

These longer-term concerns could put a “floor” under rates that may be hard to penetrate without an outright recession. We expect the yield curve to steepen as the Fed cuts rates over the next year, with overnight rates likely dropping to 3.25% over the next 12 months, but with very little drop to longer-term rates.

Fixed income returns are strong in 2025 – with intermediate investment grade bonds generating roughly 5% returns through September. Yields across much of the investment grade spectrum are still well above 4% and with the Fed pushing rates lower we would expect returns over the next 12-18 months to match or exceed what we’ve enjoyed thus far in 2025.

The massive run-up in the equity market has carried high-yield bonds with it, driving high-yield spreads to historically low levels. Therefore, valuation seems stretched in that sector. However, if we are correct that the Fed will execute a successful easing campaign that helps the broad economy regain its footing, then we would expect the high-yield market to continue to deliver a relatively stable excess return stream.

Key highlights

- The tariff drama is approaching resolution

- It is broadly assumed that the average tariff rate will settle at 15-17%

- This is the largest increase in tariffs in nearly a century, yet financial markets and businesses have adjusted

- Global economic activity appears to be largely unaffected by the new tariffs

- Some adjustments to global growth are expected as all tariffs are implemented

- Inflation is very likely to rise over coming months, but not expected to remain high

- Longer-term, it is assumed that revenue from the new tariffs will help reduce the budget deficit

- Re-patriation of previously offshored jobs is another potential long-term positive

- Re-balancing of long-term trade deficit issues could help bolster both economic and even military security for the U.S.

- Both CPI and PCE are rising, now around 3.00%

- The tariff war is nearly certain to increase prices of many goods in the U.S. over coming months

- Inflation rates are expected to rise from current levels throughout the first half of next year

- The Fed is assuming that tariff-based inflation will be transitory, as it should taper back off 12-24 months from now

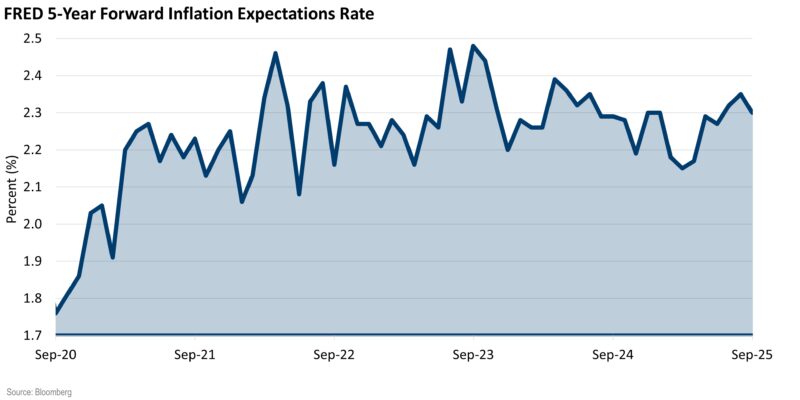

- Longer-term estimates indicate that inflation will remain well-contained in the acceptable range between 2-2.5%

- Long-term inflation expectations tend to drive behaviors, making inflation expectations an excellent leading indicator for the path of inflation

- Several measures of long-term inflation expectations are giving the Fed confidence that inflation will come back down to an acceptable range on its own, without intervention from the Fed (higher rates)

- The U.S. economy experienced a massive rebound during the second quarter of 2025, largely due to front-running of import activity in anticipation of impending trade tariffs

- It is broadly assumed that GDP growth will drop to below average during the back half of 2025

- Consumption is holding steady, but appears to be driven almost exclusively by high-income households

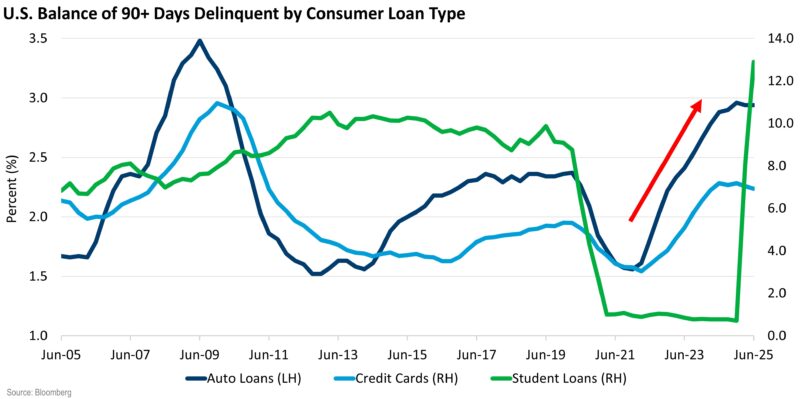

- Lower income households appear to be under pressure, with rising credit card balances and rising default rates on consumer debt

- The labor market is showing clear signs of weakness

- Monthly payrolls growth has been exceptionally weak over the last several months

- Payroll growth has fallen close to zero, which is a range only previously seen when the U.S. is entering a recession

- Middle and lower-income households are barely keeping pace with inflation

- The wealth effect from equity market and real estate gains is likely helping drive consumption amongst high-net-worth families

- Student loan delinquencies have spiked dramatically in recent months, to all-time highs

- Consumers in the lower 50% of income distribution appear to be under financial distress

- The Fed is using labor market weakness and consumer stress as their primary reason for pushing rates lower, and they are expected to cut rates by at least 1.00% over the next year

- Valuation multiples continue to climb higher, with current valuations well above long-term averages.

- Valuations near 23x are extended, but margins have gone from 7% to 12% over the same time frame. Better profitability should cost more.

- Earnings growth are responsible for half of YTD returns, not just multiple expansion

- While markets aren’t cheap, they aren’t terribly overextended if you consider the market’s strong earnings growth and improved profitability

- AI-related stocks have driven most of the market’s gains; the S&P 500 is up +13.7% YTD, but only +6.3% excluding AI names

- Looking back to November 2022 when ChatGPT was first launched: AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth

- While spending on the AI build-out is expected to continue, with the biggest spenders supported by strong free cash flows, heavy reliance on AI-related investments raises risks if growth or demand unexpectedly shifts

The economic outlook: A summary

The new tariff package is settling in a range that appears to be acceptable to the economy and markets. Inflation is high and rising – expected to continue higher over coming months. However, the Fed is convinced that inflation will roll over and return to an acceptable range naturally, without the need for higher interest rates. The broad economy is still expanding, although appears to be driven primarily by high-income households and the AI infrastructure miracle. Middle and lower-income families are feeling the pressure from higher prices and a weak job market.

Payroll growth has crawled to a stop, and the Fed is focusing on getting the broad economy moving back towards more normalized growth patterns. Overnight rates are expected to move lower over the next 12-18 months, and it is hoped that lower rates will help stimulate activity, creating payroll growth, bringing the middle and lower-income households onto stronger footing.

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

DISCLOSURES AND IMPORTANT CONSIDERATIONS

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2025. UMB Financial Corporation. All Rights Reserved.

*Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division Insurance products offered through UMB Insurance Inc.

You may not have an account with all of these entities. Contact your UMB representative if you have any questions.

|

SECURITIES AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED | NO BANK GUARANTEE | NOT A DEPOSIT | NOT INSURED BY ANY GOVERNMENT AGENCY | MAY LOSE VALUE |