Back in December 2024, the Federal Reserve (Fed) cut rates by 25 basis points‡ to the 4.25%-4.50% target range at its final Federal Open Market Committee (FOMC) meeting. The December 2024 jobs report had put to rest any lingering chances of a 25-basis-point cut in January 2025, as the data showed the U.S. economy had added the most jobs in nine months and the unemployment rate unexpectedly fell, capping off a surprisingly strong year.

With these factors in mind, the Fed’s focus at the start of 2025 had firmly returned to inflation following an upturn in recent months, with several officials signaling they may hold rates steady after lowering borrowing costs by 100 basis points in 2024.

Trading and Treasury

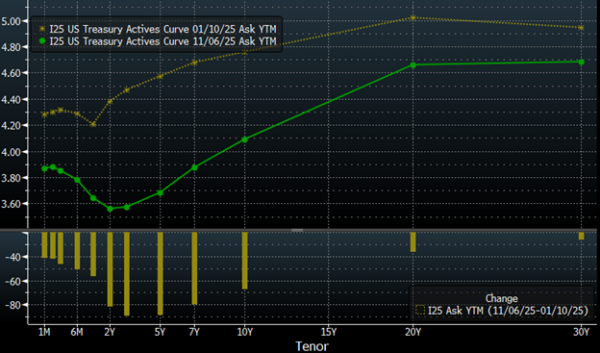

At the end of the first full trading week of 2025, the 10-year Treasury was hovering around 4.75%, the 2-year around 4.40%, and the market was pricing in a single 25-basis-point Fed rate cut to occur in the second half of 2025.

Fast forward to today (as of writing), and the 10-year Treasury is hovering around 4.10%, the 2-year around 3.55%, and the Fed has already cut rates twice as we approach the FOMC’s final meeting on December 9.

Source: Bloomberg

What happened between January and mid-November 2025?

Labor market declines

The first half of 2025 proved stable for the Fed as officials navigated steady economic reports with the potential to approach headwinds. The labor market was holding steady, albeit showing signs of stress toward the latter half of the second quarter, while inflation data was stuck slightly elevated from the Fed’s target.

As economic data was being reported, the U.S. government was aiming for the much-anticipated tax increases on imports. During the first three months of 2025, employers added, on average, 111,000 jobs to the market. Then came April’s uptick of 158,000 jobs. However, the numbers started to decline at the end of the second quarter, with only 19,000 jobs added in May and continued declines resulting in 13,000 job losses in June. The number of unemployed individuals as a percentage of the labor force remained above 4% during the first six months of the year, with a stretch of unemployment rate at 4.2% between March and May. The measure of economic activity during this same period was certainly mixed.

Gross domestic product (GDP) mixed

GDP for the first quarter of 2025 declined for the first time in three years at a rate of 0.6% year-over-year. But it bounced right back to a positive annual rate of 3.8% during the second quarter. The FOMC processed this varying economic data and continued to maintain a “wait and see” approach to interest rates. The overnight Fed Funds rate remained unchanged during the first half of the year, and the Fed reiterated that labor market conditions remain solid, with inflation remaining somewhat elevated.

Treasury volatility

While the economy remained steady in the first half, the executive branch of the government was implementing reciprocal tariffs on nearly every nation worldwide. During Treasury Secretary Scott Bessent’s confirmation hearing, he explained three pillars for which tariffs could be used.

- Remedy unfair trade practices

- Raise revenue for the federal budget

- Leverage with foreign powers in place of sanctions

The markets reacted with considerable volatility following the announcement. Within weeks, the 10-year Treasury note dropped more than 30 basis points to 3.99%, but quickly rebounded to almost 4.50%.

Overall, the 10-year Treasury note experienced a steady decline during the first half of 2025, from approximately 4.50% to 4.20%. The average yield for that period was 4.40%, with a high of 4.79% in mid-January and a low of 3.99% on April 4. The 2-year Treasury note also dropped from 4.25% to about 3.70% during that period.

Closing out the first half of 2025

As the first half of the year drew to a close, the stage seemed to have been set for some Fed activity to begin. September 17‡ brought the FOMC meeting everyone had been waiting for, and they did not disappoint. Fed Chair Jerome Powell and the committee lowered rates again by the standard 25 basis points. Initially, the longer end of the curve crept higher, and the short end moved lower.

Comments from Fed Chair Powell signaled the FOMC was starting to examine the labor market and weigh whether the recent moderation in economic growth would negatively impact employment. The Fed has communicated that it continues to closely monitor the labor market to fulfill its dual mandate of achieving maximum employment and maintaining price stability. The third quarter also marked a significant shift in tone from an exclusive focus on fighting inflation to one that considered employment.

And that’s not all

As if the markets had not been hard enough for investors to navigate, we were all thrown the curveball of the longest full government shutdown in history. The shutdown began on October 1, just two weeks after the FOMC meeting. One of the larger implications for investors is the lack of government data. We are left to rely solely on private releases, which are at best murky.

The shutdown lasted 44 days, ending on November 12, and was the longest on record. It comes at a perilous time for the FOMC. No Bureau of Labor Statistics data meant no government jobs numbers. A small list of important data we did not receive and may not receive includes non-farm payrolls, jobless claims, the Consumer Price Index (CPI), the Producer Price Index (PPI), construction spending, factory orders, retail sales, and any car data sales for the end of September. All of October and surplus releases will be delayed or missed in November. The market outlook is as murky as it gets.

Final thoughts on 2025

As 2025 comes to a close, it would seem the momentum for rates is lower. One important item to keep on your radar is the ending of the FOMC’s quantitative tightening (QT) on December 1. The FOMC has stated that it will begin reinvesting its Treasury roll-off across the entire curve. They will cease mortgage-backed security (MBS) investments; however, they will begin to reinvest the roll-off from their MBS book back into Treasuries.

Further, the FOMC will deem an across-the-curve reinvestment strategy as the most efficient way forward. They could invest anywhere across the curve, and we should remember the FOMC has pivoted in years past.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED

About the authors:

Craig Sutherland is a senior vice president and investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for helping institutional clients understand how best to manage their bond portfolios and interest rate risk.

Michael Kolb is a vice president and investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for helping institutional clients understand how best to manage their bond portfolios and interest rate risk.

Steven Winget is an investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for helping institutional clients understand how best to manage their bond portfolios and interest rate risk.