Timestamps:

0:00: Introduction from Nikki Newton, president of UMB Private Wealth

2:20: Economic outlook factors

3:45: Considering a soft landing

6:46: Economic growth and outlook

9:50: Inflation and the Fed

12:00: Job market

14:38: Household finances

19:07: The housing market

20:17: An election year

21:34: Geopolitical landscape

23:03: Impacts to your portfolio

26:10: Financial markets

29:14: A summary of the year ahead

We are, and will continue, navigating many crosscurrents during the next 12 months—some of which may worsen. The lagged impact of higher rates, naturally slowing economic activity, excess savings runoff, uncertain inflation behavior, geopolitical conflict and election uncertainty are all factors that will make 2024 a challenging year for both the economy and markets.

Soft landing hopes amid ambiguity

In the simplest of definitions, soft landings occur when an inflation spike is brought under control without causing a recession. Soft landings are elusive, and nearly impossible for central banks to execute. However, current data hints that we could be in the early stages of a soft landing in the U.S. Inflation is falling, dipping down to 4% in December, and the unemployment rate is low and stable, reaching 3.7% at the end of 2023.

Nevertheless, we have difficulty identifying clear definitions for what a soft landing might look like. Nobody knows how far inflation must fall to be considered “under control,” allowing the Fed to declare victory and begin easing rates. Additionally, we no longer have a precise definition of recession. Most experts believe that moderately negative GDP is acceptable for a short while, if we don’t experience severe spikes in unemployment.

This lack of clarity has worked its way into many of the 2024 forecasts, meaning we are entering 2024 with more than a little cloudiness around soft landings and moderate recessions.

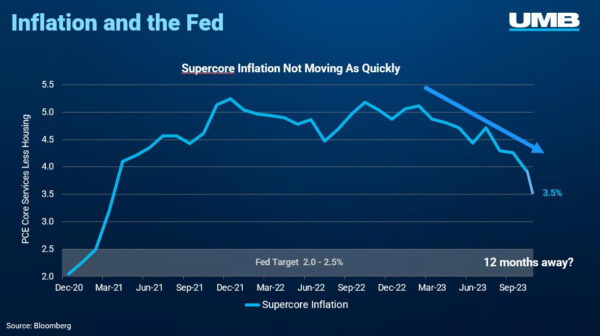

The inflation path is not certain

While several broader measures of inflation have been falling rapidly, the core inflation measures most important to the Fed have not. The massive rally in financial markets at 2023 year-end has dramatically improved financial conditions, which could prevent inflation from moving lower in a steady fashion. However, if various measures of core inflation don’t behave perfectly, the Fed may be unable to cut rates as quickly as the markets are now predicting.

The bottom line is inflation has always been difficult for central banks to manage with any degree of precision, typically returning to target only after outright recessions.

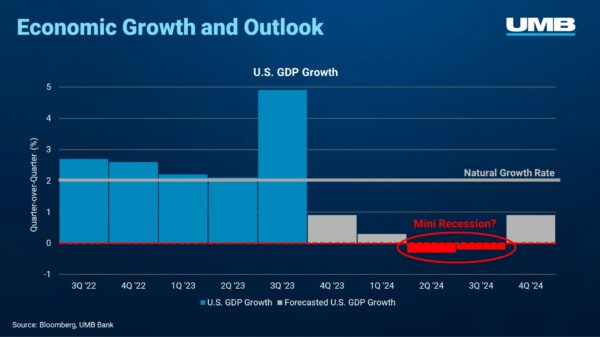

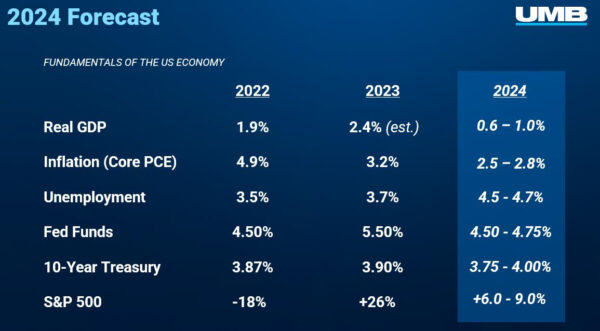

Softening GDP growth is nearly certain

The U.S. experienced a dramatic and surprising surge of GDP growth during the second half of 2023, driven by extremely strong consumption numbers. It is likely that GDP growth rates will be lower during 2024, with a high probability of contraction during the middle of the year.

With unemployment coming off all-time low rates, we believe jobless ranks will climb. Given unemployment tends to be hard to control, and often spikes in a volatile fashion, we expect mid-2024 to result in a mild recession. Others may decide to label this outcome as a new type of soft landing, but that is simply semantics. If the lagged impact of higher interest rates finally begins to bite more severely into economic activity, the contractions could be more dramatic, resulting in an outright recession.

Extremely strong household balance sheets, specifically exceptionally healthy leverage and debt services ratios, are an important positive factor for 2024. The average household is on very strong footing as we head into 2024, which should help increase the odds that any recession will be mild and short-lived.

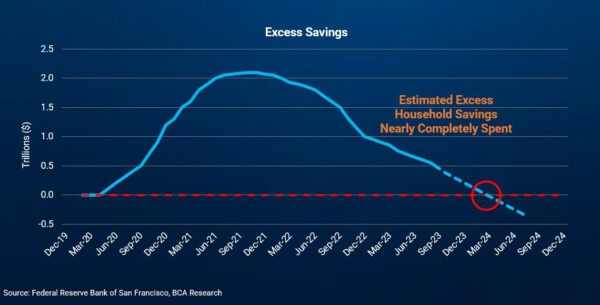

Excess savings likely depleted soon

One of the primary drivers of the surprising consumption strength in 2023 was the final drawdown of the excess savings accumulated during the pandemic. There is broad agreement that several trillion dollars of excess savings built up between 2020 and 2022.

This excess savings helped bolster economic activity throughout 2023; however, the massive savings supply is now nearly depleted and will likely be gone early this year.

This will remove a very strong tailwind for consumption, increasing the probability of a mild recession in 2024.

Geopolitical unrest

From a strictly economic perspective, geopolitical conflicts typically do not disrupt global economic activity if they remain regionally contained. The risk of a global spillover is not insignificant, but we do not believe it to be the most likely outcome. At this time, we do not believe current conflicts will cause meaningful damage to global activity to a level that requires us to alter our investment strategy; however, the psychological impacts of these conflicts could be severe, increasing uncertainty which will likely drive volatility higher in coming months.

Election year ripples

The U.S. has entered a presidential election year, and it looks to be one of the most challenging we have seen in some time as political polarization seems to be at an all-time high. Fortunately, the data consistently shows election outcomes do not have meaningful direct impacts on the economy and markets over the long-term.

The uncertainty leading up to the election can cause market turbulence throughout the year but doesn’t have lasting impacts after the election has concluded. Therefore, we do not foresee the need to let either the noise of the election cycle or the outcome influence our long-term investment strategies.

The stock market

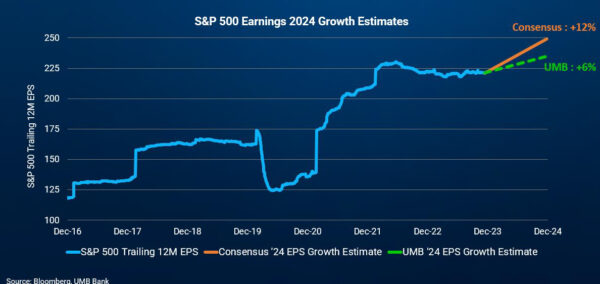

Equities enjoyed a phenomenal year in 2023, with returns of 26% for the S&P 500. Returns were driven mostly by the “Magnificent Seven” group of growth names. While the concentration of returns in such a narrow group of companies is noteworthy, we do not see it as a major threat to the broader markets in 2024. The primary driver of the market will be the softening economic outlook, which will impinge on earnings growth across all sectors.

Given our outlook for below-average GDP growth, earnings growth could fall in the 6-8% range in 2024.

As stated above, the election could cause turbulence this year. While not an important factor for long-term equity returns, the uncertainty surrounding the outcome often results in choppy markets in the first half of an election year. We expect a “relief rally” after the election, with market returns ultimately matching earnings growth somewhere in the 6-9% range.

Interest rates

If we are correct about a mini-recession occurring mid-year, inflation should be falling and unemployment rising enough to inspire the Federal Open Market Committee (FOMC) to begin cutting rates during the second half of the year. If inflation is still above their target (as we think it will be), the Fed is most likely to cut rates in a steady, measured way as they do not want to reignite inflation. We expect overnight rates to have been cut by 1.0% by the end of next year, down to 4.5%.

The bigger question is around longer-term rates. Long rates dropped dramatically at year-end 2023, in anticipation of much lower rates from the Fed. The 10-year treasury dropped almost 1.00% in the last several weeks of the year, to finish at 3.88%. We believe long rates have already positioned for most of the Fed moves that will occur in 2024, so we do not foresee longer rates moving much lower. For the 10-year treasury, we are targeting 3.75% at year-end. Given we are starting the year with 5% yields on average intermediate duration bond portfolios, total returns for 2024 could easily land in the 5-6% range.

2024 economic forecast summary

What does it all mean for your financial plans and investments?

Our investment portfolio strategy has remained unchanged throughout the latter stages of 2023 and into 2024. We remain cautious in this environment, maintaining neutral allocations to risk assets. We believe 2024 will be a period of above-average uncertainty for the economy and the markets.

A mild recession is likely sometime in the next 12 months, and we will remain cautious until a recession unfolds or the elusive soft landing becomes more apparent. If market turbulence erupts, we will be on the lookout for opportunities to move more heavily into riskier asset classes.

2024 is certain to be a choppy ride with many crosscurrents. We look forward to navigating it together.

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

DISCLOSURE AND IMPORTANT CONSIDERATIONS

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2022. UMB Financial Corporation. All Rights Reserved.

*Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division.

Insurance products offered through UMB Insurance Inc. You may not have an account with all of these entities. Contact your UMB representative if you have any questions.

SECURITIES AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED | NO BANK GUARANTEE | NOT A DEPOSIT | NOT INSURED BY ANY GOVERNMENT AGENCY | MAY LOSE VALUE