Back testing and model validations are effective ways to monitor interest rate risk models. They evaluate the model’s outputs to assess whether the model effectively captures the institution’s risk exposures.

The results of earnings at risk and economic value of equity are driven by data inputs. Unreliable or incomplete data can affect performance and lead to inaccuracies within the interest rate risk model. Interest rate risk reports are utilized by management for strategy development and decision-making purposes. Therefore, the aim is to improve the accuracy of the data inputs to produce reliable results.

Data governance and quality data management

The foundation of interest rate risk models is high-quality, well-governed data. Your bank management should establish policies and procedures for data collection, storage, and usage for the interest rate risk model. Below is a summary of the data flow to better understand how the process works.

Data processing flow

Your bank’s asset liability management servicer uses your raw data files, structuring them into a format compatible with the model. Several validation checks are performed to ensure all essential fields—such as maturity dates, origination dates, reset dates, indices, and others—are included and accurate. Each loan, deposit, and supplemental file is verified against the general ledger (GL) through the data consolidation model.

After data is uploaded into the model, balances for assets, liabilities, and capital are reconciled with the GL trial balance. The model then executes interest rate risk scenarios, during which any errors or warnings are identified and resolved. Processed files are exported from the model, reports are produced, and the results are analyzed and compared to those of the previous quarter.

Data flow summary

- Raw data files are organized into a format suitable for the model

- Various checks ensure required fields are present

- Each loan, deposit, and supplemental data file is validated against general ledgers

- The bank’s assets, liabilities, and capital are compared to GL trial balance

- Interest rate risk is processed within the model (errors and warnings are addressed accordingly)

- Processed files are exported from the model

- Reports are generated based on the processed data

- Report results are analyzed and compared to the prior quarter’s analysis

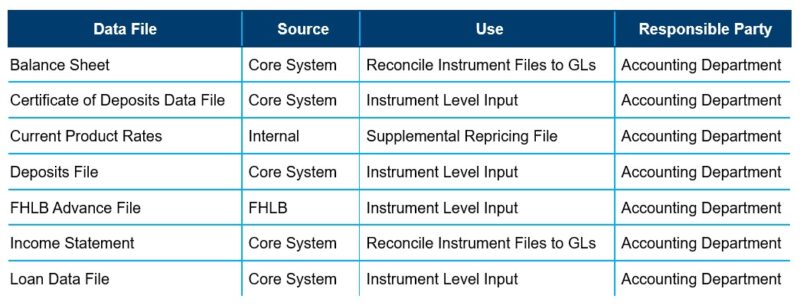

Your management team should create and update a list of inputs that are sent to their ALM provider. This list can include, but is not limited to, the data file type, associated source system, use for the file, and parties responsible for retrieving and validating data in the file.

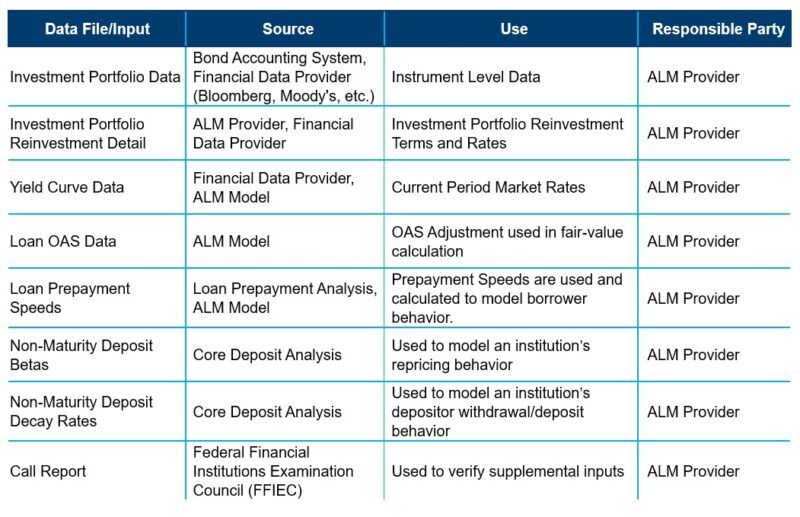

An inventory of the model inputs supplied by your ALM provider for use in your interest rate risk reports should also be available. This list can include, but is not limited to, the data file or input type, associated source system, use for the file, and parties responsible for retrieving and validating data in the file.

The frequency of when these files are pulled or updated should be included in the data documentation. For example, banks that run interest rate risk models quarterly would update the data inputs quarterly, with the exception of the loan prepayment analysis and core deposit analysis. These reports should be updated annually or upon your institution’s request. The method in which files are sent and retrieved can also be found in the model documentation.

Completeness of balance sheet data

The ALM provider needs an institution’s balance sheet data to run the interest rate risk model. It is highly recommended that instrument-level data be provided to model the items on the balance sheet appropriately. Below are examples of data inputs pulled from the core processor.

- Investment instruments. CUSIP, par value, book value, market value, yield, coupon, holdings type (AFS/HTM), purchase date, maturity date

- Loan instruments. Loan number, product type, origination date, maturity date, balance, rate, interest rate type (fixed/adjustable), reset index, margin/spread, lifetime caps/floors, periodic caps/floors, reset frequency, next reset date, prepayment penalties

- Deposit instruments. Product type, balance, rate, term, maturity date

- Borrowing instruments. Product type, balance, rate, maturity date, term

Data should only include pertinent information necessary to run the ALM model. For example, the name on the loan or the address is not necessary for interest rate risk modeling purposes. There are call report-based models that pull values from the call report but make broad, all-inclusive assumptions. These interest rate risk models lack instrument-level detail and can draw additional examiner scrutiny.

If using input spreadsheets, always supplement with the data period end-of-month/quarter balance sheet and income statement to provide a reference point for your model runner to double-check values. The model runner can use call report data, if available, when completing the analysis.

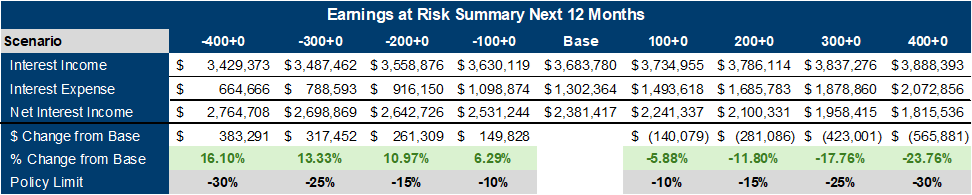

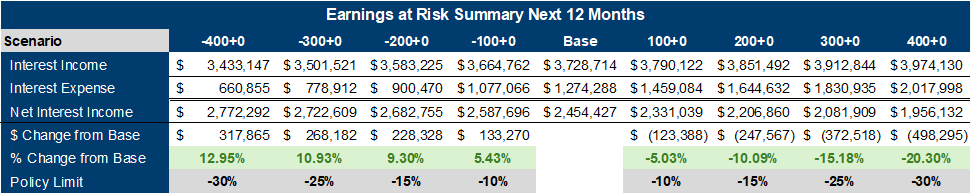

The goal is to ensure all the data submitted is complete and accurate. If interest-bearing accounts are left out of the analysis, this can impact interest rate risk model results. The earnings at risk results below show a $73,000 increase in the base case net interest income estimate when overnight investments were included.

EXAMPLE: Customer profile missing $1 million in an overnight investment

EXAMPLE: Customer profile when $1 million is included in an overnight investment

SAMPLE Interest Rate Risk Report

Source: UMB internal data

Avoiding data errors

The saying “garbage in, garbage out” refers to the quality of a system’s output, which is determined by the quality of its input. Below are common areas where errors occur in data submissions.

- Nonaccrual and participation loans are not identified

- Loans that matured are still included in the data file

- Duplicate records

- Assets or liabilities are overstated

- Data formatting

Changing your core processing systems is difficult, so banks should set aside time to update how they pull the data from the system. They should also speak with the ALM runner to review changes to the data input files. This will help with running the interest rate risk report going forward and should have minimal impact on the results.

Assumption building and monitoring

Bank-specific assumptions are an important component of interest rate risk model inputs. The assumptions offer historical insight into customer and management behavior over various market rate environments. Models that rely on industry averages can create an inaccurate picture of risk exposure, as they ignore the institution’s customer behavior and unique balance sheet characteristics. Regulators also view generic assumptions as a weakness in a bank’s risk management.

Accurate and supported assumptions should be well documented. The data compiled for assumption building should be reviewed for completeness and accuracy. Below are common examples of bank-specific assumptions.

- Loan Prepayment Speeds. Estimates the rate at which loans will be paid off early

- Non-Maturity Deposit Betas. Measures how sensitive deposit rates are to changes in market rates

- Non-Maturity Deposit Decay Rates. Measures the rate at which balances run off over time

The UMB Financial Services Group can run a loan prepayment analysis and core deposit analysis to generate the bank-specific assumptions listed above. The assumptions developed in these studies should be incorporated into the bank’s interest rate risk model. Your bank management might also consider tracking results from these studies to document changes in the assumptions that could impact earnings at risk and the economic value of equity.

The interest rate risk report is typically run on a quarterly basis with the institution’s end-of-quarter data. However, back testing, stress testing and assumption building are often done on an annual basis. Given that these are performed less frequently, they can be easily forgotten. To ensure assumptions are updated, create a schedule for interest rate risk reporting for the bank’s management and your board of directors to follow. This can be a guide to follow and adjust at management’s request. The schedule is in place to ensure the reporting is completed in the calendar year or as needed.

In summary: Data quality is key

The quality of a model’s output is directly tied to the quality of its inputs. Reviewing the accuracy of the data inputs is essential to ensuring the model captures the bank’s risk exposures. Banks often schedule calls with our team to review interest rate risk model results with their board.

It is also recommended to have regular conversations with your ALM analyst to improve the interest rate risk reports. This helps better understand each bank’s unique balance sheet and products, address any challenges, and fine-tune the model accordingly.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED