The first half of 2025 has ushered in a mixed economic landscape marked by decelerating disinflation, evolving global trade tensions, and the Federal Reserve walking the tightrope between maintaining credibility and fostering stability. After holding the federal funds rate steady throughout the year at 4.25%–4.50%, the Fed signaled increasing caution as inflation plateaued above the 2% target and labor markets remained tight. Community banks—already dealing with deposit repricing, margin compression, and duration mismatches—continued rebalancing portfolios, leaning into agency callables, municipals, and short corporates to defend net interest margins while maintaining liquidity optionality, the ability to access cash or convert assets into cash easily and quickly.

The first quarter 2025 GDP unexpectantly contracted to an annualized rate of 0.2%. While core personal consumption expenditures (PCE) inflation remained sticky, hovering around 2.3% year over year in March. Treasury yields, which began the year elevated, saw volatility in response to the shifting rate-cut expectations. The 2-year Treasury note, for instance, moved from year-to-date highs of 4.39% in early January to year-to-date lows of 3.60% in April as markets priced in fewer cuts in 2025.

Volatility has since continued with the 2-year Treasury note ranging around 4% in May and June. These developments have brought bond portfolio strategy back into sharp focus for community banks, who must now contend not just with the domestic rate environment but also the secondary effects of tariffs and geopolitics on monetary policy.

The economic crosscurrents: Data-dependent, but no longer linear

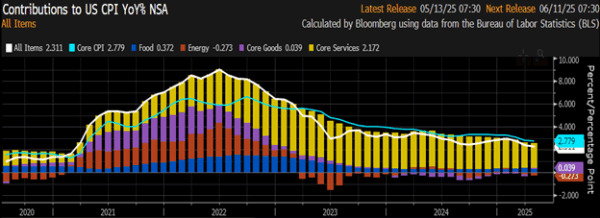

Over the past 12 months, the Fed has consistently signaled a “data-dependent” stance. However, the term has become increasingly ambiguous given the number of conflicting signals in the economic data. The labor market remains resilient, with total nonfarm employment increasing 177,000 in April 2025, significantly exceeding consensus estimates of 130,000, and the unemployment rate holding steady near 4.2%. Meanwhile, the core consumer price index (CPI) hovered around 2.7%, while services inflation—especially in housing and healthcare—remains stubbornly high.

Source: Bloomberg

The result: While inflation is far below its 2022 peak, it is not falling quickly enough to justify aggressive rate cuts.

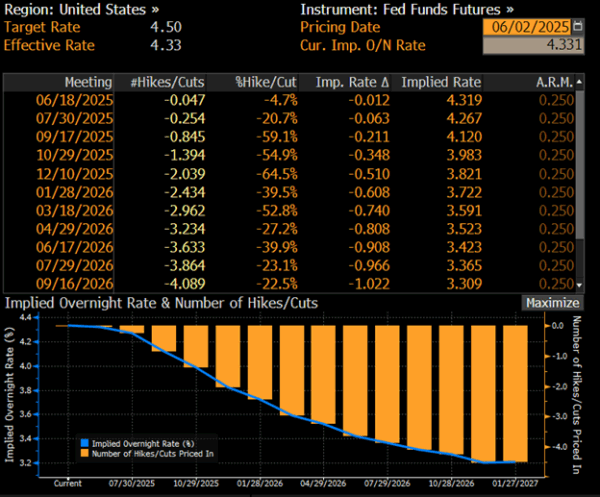

The Fed’s March Summary of Economic Projections (SEP)‡ showed a median expectation of two rate cuts in 2025, down from three in December. This reassessment reflects growing concern among the Federal Open Market Committee (FOMC) members that inflation’s last mile will be harder to conquer. More importantly, the Fed appears increasingly focused on not relenting too early, fearing the repeat of 1970s-style stagflation dynamics.

Source: Bloomberg

For community banks managing fixed income portfolios, this implies more time spent at the top of the rate cycle. Reinforcing this, Federal Reserve Chairman Jerome Powell has emphasized that while policy is “restrictive,” it may not be sufficiently restrictive if inflation’s momentum returns. That makes reinvestment strategies, call structure risk, and spread pickup vital in sustaining performance.

Implications for community bank portfolios

The implications of this dynamic environment are both practical and strategic for community banks.

First, margins remain under pressure. With deposit betas rising and asset yields already locked in at lower coupons from the past rate cycle, banks face continued net interest margin compression. In the first quarter, net interest margin (NIM) declined on average by 12–18 basis points year over year across banks under $10 billion in assets, according to S&P Capital IQ.

Second, unrealized losses in bond portfolios persist. Although mark-to-market losses narrowed in the first quarter with the modest Treasury rally in April, they remain significant, particularly in mortgage-backed securities (MBS) and municipal holdings acquired pre-2022. Banks continue to face pressure from both regulators and stakeholders to manage duration and liquidity proactively.

Third, liquidity optimization is now paramount. As the rate environment remains uncertain and inflation data are volatile, community banks must ensure their portfolios remain flexible. Callable agencies, bullet corporates, and high-quality tax-exempt municipals offer attractive risk-adjusted yields without locking in too much duration. For example, new-issue callable agency spreads widened in the first quarter, offering plus-15 to plus-20 basis points over bullets with a 1- to 2-year call protection—an opportunity for strategic yield pickup with contingency planning.

Finally, credit risk must be monitored closely. While spreads have remained resilient in the investment-grade market, rising bankruptcies in the small business and consumer sectors suggest underlying stress. Community banks holding subordinated debt, longer-duration corporates, or lower-tier municipals must evaluate credit risk with a forward-looking lens, particularly if rates stay elevated into 2026.

Preparing for what’s ahead: Strategic action for community banks

Community banks can no longer rely on rate cuts to bail out legacy portfolio decisions. Instead, they must approach balance sheet management with rigor, optionality, and realism.

Here are four key strategies to consider going into the third quarter and beyond:

- Adopt a barbell strategy with optionality: Blend short-term instruments that mature quickly and allow for reinvestment with intermediate-term securities that lock in yield. Prioritize call protection and diversify issuers to mitigate extension risk.

- Re-evaluate deposit strategy: Proactively assess deposit repricing risk and prepare for further shifts in depositor behavior. Consider targeted certificates of deposit (CDs) offerings and relationship pricing for key commercial clients to stabilize funding.

- Stress-test liquidity under multiple scenarios: Ensure both primary and secondary liquidity sources are adequate under fast-moving market conditions. Scenario-based modeling should include slower rate cuts or even higher-for-longer environments driven by geopolitical inflation.

- Leverage tax-exempt municipals where possible: With tax-equivalent yields on high-quality bank-qualified municipals offering 5.00% plus in the 7- to 10-year range, these remain a strong tool for banks in higher tax brackets, especially those needing earnings support with reduced capital charges.

Conclusion

Community banks have weathered the volatility of post-pandemic monetary normalization with resilience, but the next phase requires sharper foresight and discipline. The Fed is not operating in a vacuum. Trade policy, inflation stickiness and labor resilience have created an environment where the path of interest rates is no longer linear or predictable.

Banks that succeed in this landscape will be those that balance prudence with adaptability—those that protect their margin today while positioning their balance sheets for tomorrow.

About the authors:

Nick Meletio is senior vice president at UMB Bank, n.a. Capital Markets Division. He is responsible for investment portfolio strategies, fixed-income securities selection and asset-liability management.

Christopher Cronin is vice present at UMB Bank, n.a. Capital Markets Division. He is responsible for helping customers manage and select investments that fall within the parameters of their investment policy.

Tyler McAllister is an investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for helping institutional clients understand how to best manage their bond portfolios and interest rate risk.

The first step in the process is speaking with your UMB representative about what the best option is for your bank. Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Disclosure:

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED