It’s the looming problem for municipalities nationwide in the wake of COVID-19—lower property valuations mean lower tax receipts. Because Texas uses a calendar-year appraisal period, property valuations as of December 31, 2020, will govern calculated taxes starting with the 2021-2022 fiscal year either September 1 or October 1, 2021. Valuations that rely on use or occupancy measures may be significantly discounted due to COVID. Examples include hotels, conference centers, airports and retail space.

Municipalities may face four basic choices ahead of the next fiscal year:

- Increase taxes, typically by raising the property tax rate

- Increase fees

- Reduce or limit services

- Tap reserve funds, seek bank financing or other new sources of cash

- Reduce other costs, such as interest expense, through taxable advance bond refunding or other bond refunding alternatives.

Typically, neither option one (increasing taxes) nor option two (reducing services) is politically appealing. Option three (tapping into reserve funds or new sources of cash) can in some cases be problematic from a credit-rating perspective but, depending on the situation, may be an ideal way to meet a short-term need.

Option four, reducing other costs such as interest expense, if available, may be the most attractive approach to meeting a revenue shortfall—whether on its own or, if necessary, in combination with another solution. This approach may be especially helpful for municipalities facing tax-revenue compression, even if the refunding doesn’t quite match the traditional rules of thumb regarding their economic value, relating to negative arbitrage.

Interest rates for taxable advance refundings

Investor demand for income streams has compressed rates to the point that rates for taxable bonds are often negligibly higher than for non-taxable. We’ve even seen year-by-year rate comparisons show taxable rates lower than non-taxable at a point or two on the timeline. This strong demand, combined with the prohibition under 2017 tax reform advance refundings on a Taxable basis to the investor, means municipalities are increasingly looking at lowering their interest expense via taxable bonds, when Refunding Bonds prior to the call option date.

Creative taxable advance refundings can lead to significant savings for municipalities

A general rule of thumb regarding advance refundings is to avoid scenarios in which the “negative arbitrage” is two-thirds or more of the present value of interest savings. (Historically, that figure was 50% of the savings, but with rates near zero, many professionals have adjusted the threshold.)

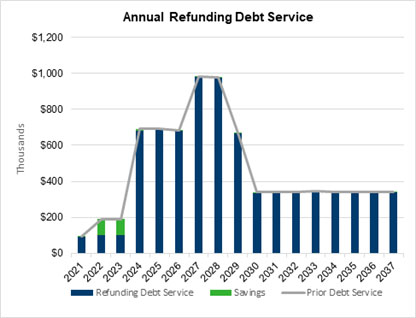

There are situations, however, in which even a much higher negative arb may be still attractive to an issuer facing a temporary cash crunch. Here’s a hypothetical example with a negative arb of nearly 90%. The new issue is structured to front-load the savings into years two and three (given an assumption that year one’s budget is already set).

The savings realized in this scenario is slightly less than one with level, rather than frontloaded, savings. The total savings on this $6.685 million par value refunding is $236,000—with $180,000 of that savings benefiting the municipality in 2022 and 2023.

Despite the high negative arb, the near-term benefit of $180,000 may help the municipality avoid other, less desirable courses of action.

Example 1: Frontloaded savings (green bars) on $6.685 million refunding

Source: UMB Internal Data

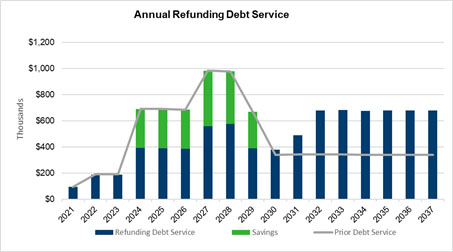

Note that the scenario pictured above involves a substantial step-up in total payments starting in 2024. Following is a second hypothetical—again, with a high negative arb—that features a more gradual increase in principal payments nearer-term, leaving the higher payments for ten-plus years out.

In this case, the net present value of savings is only slightly positive, and the total savings is actually negative. However, due to the restructuring, the issuer can carve out room for other needs before debt service requirement begin to increase, several years out.

Example 2: Smaller net present value of savings approach to frontloaded savings (green bars) on $6.685 million refunding

Source: UMB Internal Data

Closing thoughts

Municipalities should consult with their financial advisors about what approach taxable advance bond refundings, if any, may be appropriate to their needs and what the potential impacts might be with respect to tax rates, credit ratings and other important factors.

What we’d offer from our perspective is that much—or even all—of the stigma sometimes associated with “creative solutions” to short-term cash crunches seems to be absent. Financial professionals, government leaders and the general public all understand that nothing about COVID-19 is business as usual.

UMB Bank Public Finance is committed to helping healthcare institutions fulfill their quality-of-life and growth aspirations. Visit umb.com to learn more about how we can support your organization, or contact us to be connected with a public finance team member.

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information and opinions expressed in this message are solely those of the author and do not necessarily state or reflect the opinion of UMB Bank, n.a. or UMB Financial Corporation. UMB Bank, n.a., 928 Grand Boulevard, Kansas City, MO 64106

Products offered through UMB Bank, n.a. Capital Markets Division and UMB Financial Services, Inc. are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED