During inflationary times, municipalities often curtail capital spending knowing the cash flow of their residents are already impacted by higher prices. No one wants to raise taxes on residents who are feeling the pinch at the gas pump, in their utility bills and housing expenses, and at the grocery store. There’s a downside to pulling back, though. Deferred capital spending may not create problems this year or next, but the accumulated deferral of necessary capital expenditures will eventually create issues for the municipality in the future.

For example, a road that is scheduled for replacement now will be in much rougher shape five years from now if the necessary replacement is delayed. Furthermore, deferrals have an unfortunate way of quickly compounding. So, a key question for municipalities now is whether the current level of inflation warrants deviating from their scheduled capital spending plan.

How bad is it? Should municipalities delay projects?

Every year there seem to be words or phrases that, by the end of the year, we all want to go away and never be uttered again. I think if we never have to hear the words “transitory” or “sticky” regarding inflation, we will all be better off.

Unfortunately, “sticky” seems the more apt term. On September 21, 2022, the Federal Reserve (Fed), for the fifth time this year, raised its benchmark Fed Funds Rate‡, the last three of which have been 75 basis point (bps) increases. This brings the benchmark rate to a range of 3.00% to 3.25%.

Chairman Powell, in a press conference following the announcement, went on to say that the Fed is committed to bring inflation down to the 2.00% target. And most of the 19 members believe the benchmark rate will continue to climb through the end of the year, with two additional Federal Open Market Committee (FOMC) meetings scheduled this year, bringing the rate into the 4.25% to 4.50% range.

With September’s three quarter bump, the Fed Funds Upper Target Range has increased 300 basis points so far in 2022. While 2022 has already seen a significant increase, it is nowhere near the 600-basis-point annual increase realized in 1980, which was accentuated with a 200-basis-point increase at the FOMC December 5, 1980 meeting‡.

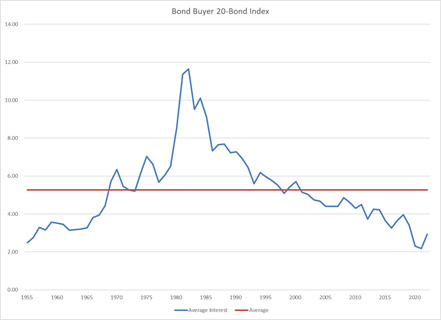

While the increase in the Fed Funds is dramatic, municipal borrowing don’t increase necessarily at the same rate. Rates for municipal issuers may not be as attractive as they were over the past few years, however they remain below the historical average, as seen in the annualized Bond Buyer 20-Bond Index chart below.

Source: Bond Buyer

As shown in the chart, 2020 and 2021 saw index lows not seen since World War II. At the beginning of 2022, the index sat at 2.12%. Since that time, the index has increased 82 basis points to 3.00% as of this writing (September 22, 2022).

Here are some additional data points from the Bond Buyer – BBI 20 Bond Index to put that 3.00% level—and the volatility around it—in context:

- On January 14, 1982, the index recorded its highest daily point at 13.44%

- On January 6, 2022, the index recorded its lowest point at 2.12%

- The index average is 5.266%

- The average annual low to high point swing has been 108 basis points

- The largest calendar year swing was 419 basis points in 1982

- The smallest calendar year swing was 11 basis points in 2021

- So far in 2022, the swing remains below the average annual swing of 108 basis points; while we may exceed that level, we are nowhere near the maximum swing recorded

The million-dollar question is what will happen if the inflationary pressures present in the market continue to persist? The Fed indicated they will review a wide range of data in making future determinations as to whether the pace of rate hikes should be scaled back or curtailed altogether.

While there has been a broadly reported technical definition of a recession, the overall market signals have been mixed. Core U.S. retail sales have been stronger than expected, job and wage growth in July 2022 exceeded expectations, and a recent broader stock market rally (although the market has recently given back those gains) all have pointed towards a lower recession risk.

Potential action steps

With inflation at levels not seen in 40 years, the Fed Funds Rate increasing, and overall borrowing rates on the rise, it’s tempting to set aside financial plans and defer capital spending. Yet it’s important to maintain perspective that government and non-profit borrowers are still able to access capital at rates that just three years ago would have been very attractive.

In this context, government and non-profit borrowers may wish to consider some or all of the following action steps:

- Convert any floating rate debt to fixed-rate debt

- Consider moving up the timetable for larger capital projects to take advantage of rates today versus where they may be tomorrow

- Borrow for today’s projects to preserve cash for potential future projects

- Consider shorter call provisions

Each of these strategies, and others that may be appropriate, should be evaluated based on an issuer’s current debt structure and future financing needs.

Learn more about how UMB Financial Services, Inc. municipal advisors can assist to help find a quality path forward during these complex conditions. Contact us to connect with a municipal advisory team member.