The technology for cars continues to improve and your options are nearly endless. You can buy a small compact car, a big SUV to haul the family around, a truck to carry your supplies, or even an RV or van to use for a long road trip. No matter what you decide to buy, this is a large purchase that you need to prepare for.

Tips to consider when buying a car

First things first, you need to check your budget. With interest rates on the rise, you will need to determine how a monthly car loan payment would fit in your budget or if you can pay for a car in full. Don’t forget to build in the extra costs of ownership like insurance, maintenance and repairs.

Financing your car

You’ll also want to consider how you want to finance your car if you need a loan. A loan from your bank allows you to seek out pre-approval and rates before making your purchase, which can strengthen your ability to negotiate. Financing through a dealer could help you access specials or discounts, so research to see what the seller is offering.

If you already have an auto loan, it might be worth it to ask if you can consolidate everything to one loan and refinance depending on interest rates. Be sure to talk to your banker as rates are on the rise and you’ll want to make sure you are securing the best rate for your needs.

Extra costs

Once you’ve made the purchase and have your keys in hand, there are a few more costs to consider. If you have to commute to work, you might have to start paying for parking at your workplace. Or if you buy an electric car you will need to factor in the cost of charging the car while you are out and about.

A larger vehicle like an RV will also come with a few extra costs like a propane tank to heat and cool it along with campground fees while you travel. Then when you are done traveling, you’ll need to consider where you are going to store the RV and that will be another hit to your budget.

Your vehicle might also be a means to enjoy your hobbies while means you’ll need to invest in some equipment like a hitch, or a bike rack or a small trailer.

A car is a large purchase that can last you several years and help you get from point A to point B safely; however, it can have an impact on your budget and monthly expenses that lasts for several years. Explore your options and talk with a banker about your specific needs so you can achieve your car ownership goal.

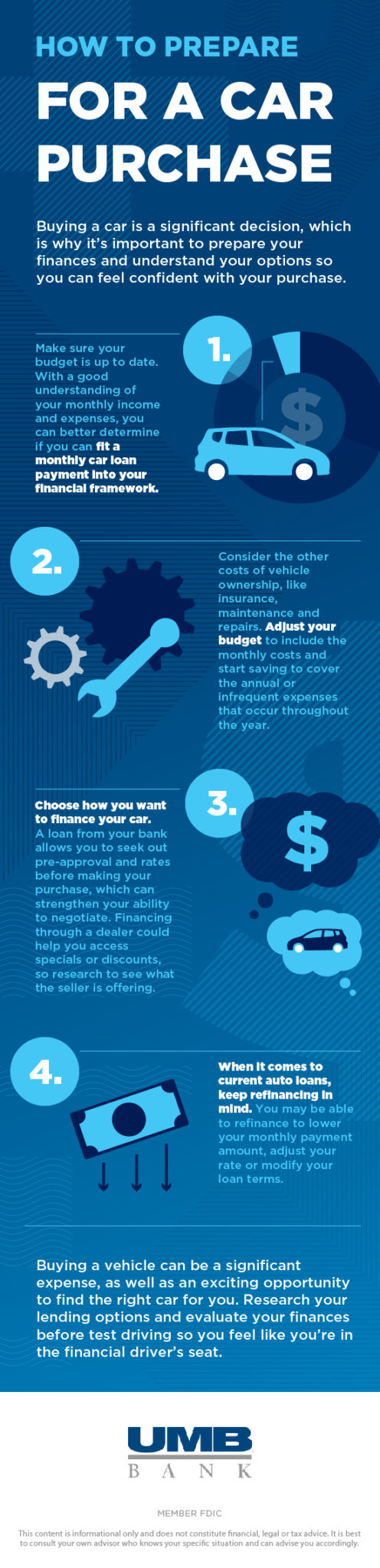

Four tips to help you prepare for a car purchase (infographic)

How to prepare for your car purchase

- Make sure your budget is up to date. With a good understanding of your monthly income and expenses, you can better determine if you can fit a monthly car loan payment into your financial framework.

- Consider the other costs of vehicle ownership, like insurance, maintenance and repairs. Adjust your budget to include the monthly costs and start saving to cover the annual or infrequent expenses that occur throughout the year.

- Choose how you want to finance your car. A loan from your bank allows you to seek out pre-approval and rates before making your purchase, which can strengthen your ability to negotiate. Financing through a dealer could help you access specials or discounts, so research to see what the seller is offering.

- When it comes to current auto loans, keep refinancing in mind. You may be able to refinance to lower your monthly payment amount, adjust your rate or modify your loan terms.

UMB personal banking solutions offer convenience and simplicity to meet all your financial needs. From home loans to auto financing and everything in between, see how UMB personal banking can work with you to find the right products for your life and lifestyle.