The Federal Reserve and its actions

The Federal Reserve (Fed) is the most powerful economic institution in the United States, perhaps the world. Their core responsibilities involve setting interest rates, managing the money supply and regulating financial markets. Their main goals, specified by Congress, are to maximize employment, stabilize prices, and moderate long-term interest rates.

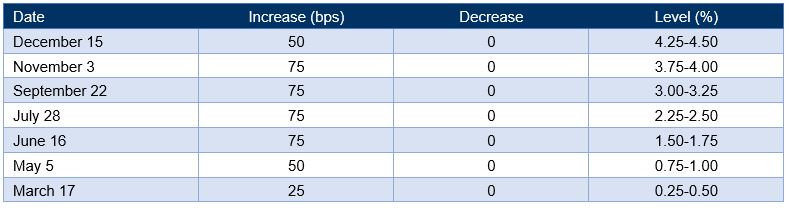

The Fed has taken a reactionary role based off economic data. In 2020, the unemployment rate nearly tripled due to COVID, with an uptick in inflation occurring in early 2021. A year later, in March of 2022, the Fed raised interest rates in hopes of stabilizing inflation. They also used open-market operations at that time to increase reserves by buying U.S. treasuries.

What can we expect from the Fed going forward?

As mentioned above, the Fed has usually taken a reactionary role based on economic data and have shown this time around they will continue to use the same method. Jerome Powell, Chair of the Fed, noted in his April 3, 2024, speech, that, over the past year, the Fed has come a long way toward its goal of lowering core inflation from 4.8% to 2.8%.

We have held our policy rate at its current level since July 2023 and my colleagues and I continue to believe that the policy rate is likely at its peak. If the economy evolves broadly as we expect, most Federal Open Market Committee (FOMC) participants believe it to be appropriate to lower the policy rate later this year.

Higher for longer interest rates

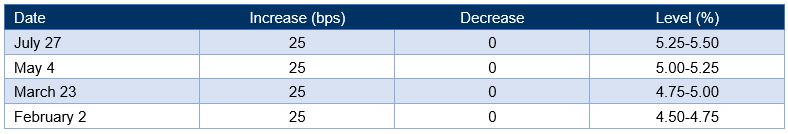

The million-dollar question right now is: When will the Fed cut interest rates? As seen in the above chart, the last interest rate hike occurred in July 2023 and took the overnight borrowing rate to a range of 5.25%-5.50%. Since then, rate cut expectations have varied dramatically.

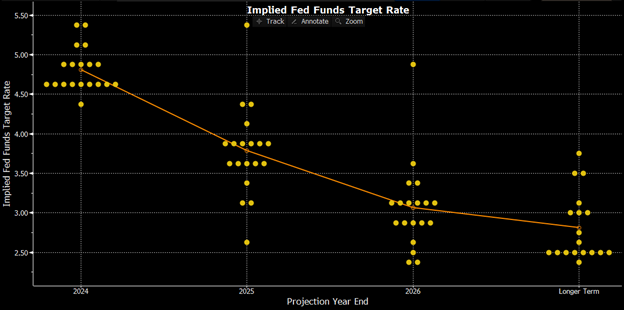

At this point, there is an expectation of only one interest rate cut by the end of the year. Inflation and economic growth have been the main two drivers of interest rate expectations and have been delivering some very interesting data recently.

Based on the economic data, the Fed has signaled they are satisfied with the current level of tightening. This level of tight monetary policy has been decreasing inflation, just at a pace slower than previously expected. The Fed publishes a Dot Plot quarterly showing a visual representation of where the individual Fed members think interest rates will be. The March 2024 Dot Plot shows a weighted average rate of 4.80% by the end of 2024 and a 3.78% by the end of 2025.

Source: Bloomberg

Community bank portfolio trends and strategies

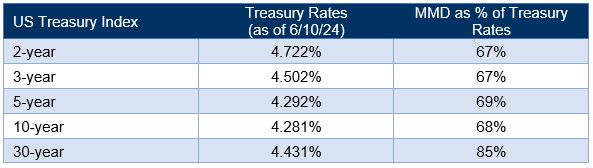

Regarding investment purchases (or lack thereof), banks have been taking advantage of higher rates in agency product. It’s been an easy choice, especially on the short end with municipal bonds at near record lows of percent-to-treasuries, yield wise. An expectation of rising tax rates is the main culprit, but a reluctance of funds and separately managed funds (SMAs) to adapt strategies to a more efficient total return also help demand for tax-exempt paper, including bank qualified paper.

Their reluctance might also be warranted considering the lack of growth in the issuance over the past few years compared to other securities. It would not be the first time scarcity has led to this type of hoarding of securities, leading to higher prices for product. Recently, it has not been uncommon to see short-end East Coast deals price at 50/51% to treasuries. SMAs with a need for state allocation to check the box would be our guess for those looking for that paper. Rising state tax rates, and an expectation of further rising of state tax rates have led to a crowding in this space.

Banks that can afford or benefit from taking losses have been doing so by selling intermediate and longer end tax free municipals and buying agency product on the short end. Not only can this be a beneficial yield pickup, but also shorten duration and improve overall credit weighting of a bank’s portfolio.

Thankfully, over the past few months we have slowly seen municipal bonds start to cheapen, not yet to historically averages, but off the lows causing many investors to stay away.

Current municipal market data (MMD) levels as % of treasury yield:

Source: Bloomberg

Some current trade ideas that have been working:

VADM CMOs:

- Eliminates extension risk

- Preferred coupons at or out of the money to still provide some duration in a possible falling rate environment

- Wider collar paper cheap historically on larger pools to provide bullet like returns within PAC bands bound by 0 prepayment rate

Short callable AGY paper

- 6-month – 2-year call protection with current coupon

- Short finals in case of higher for longer but providing nice yield on the short end

Front AGY Sequentials/Short pools

- Both mitigate against extension risk while still providing attractive yield

- Should ramp up a bit for next few years even in a lower rate scenario to provide some needed duration

8- to 12-year final lower coupon BQ paper

- Even higher credit lower discount 2.5% to 3% look cheap here with shorter finals

- In a flattening or lower rates scenarios, these should begin at some point to roll down the curve while providing nice yield boost, especially to S corps

About the authors:

Christopher Cronin is vice present at UMB Bank, n.a. Capital Markets Division. He is responsible for helping customers manage and select investments that fall within the parameters of their investment policy.

Tyler McAllister is an investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for helping institutional clients understand how to best manage their bond portfolios and interest rate risk.

Nick Meletio is senior vice president at UMB Bank, n.a. Capital Markets Division. He is responsible for investment portfolio strategies, fixed-income securities selection and asset-liability management.

The first step in the process is speaking with your UMB representative about what the best option is for your bank. Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED