What we saw in the first quarter of 2024

During the first 90 days of 2024, we learned the economy was even stronger than previously thought –with upward revisions of the already strong GDP growth rate from fourth quarter 2023. Early estimates show that the U.S. continued to run at an above-average pace throughout the first quarter of 2024. The U.S. consumer has been unphased by higher interest rates, and heavy consumption patterns have kept economic activity well above normal for quite some time.

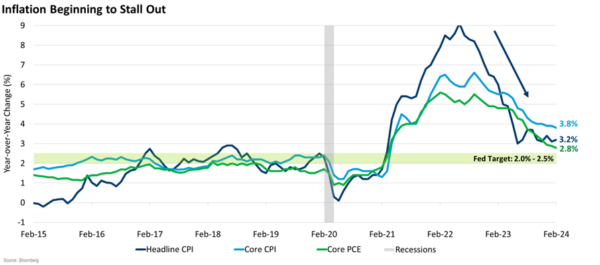

We also received ongoing reminders that above-average consumption tends to run hand-in-hand with inflationary pressure. Many key measures of inflation have stopped falling and have instead begun to rise (the opposite of what the Fed wants). Inflation has come down from the highs posted during the pandemic, but it is well above the Fed’s long-term target (and now showing signs of resurgence).

The final drop from where inflation sits now, which is around 3.5%, to the 2.0 – 2.5% target range is the most difficult part of the journey in “normalization” of inflation rates. This “last mile” that inflation needs to cover will take time and will likely not be accomplished without some turbulence.

While a miraculous “soft landing” had been the most talked about economic outcome for several months, the hotter-than-expected inflation data shifted conversations in the direction of a possible “no landing” scenario. It has become increasingly probable that inflation may become stuck well above the Fed’s target – perhaps calling into question the Fed’s ability to cut rates later this year.

Watch the recording of our economic presentation discussing economic outlook scenarios

The Federal Open Market Committee (FOMC) shifts tone slightly

We started the year with the world convinced that the Fed would begin cutting rates early in the year, and would likely be cutting rates 6 or 7 times in 2024 (the soft landing outcome). However, consistently strong inflation readings forced the Fed to take a more cautious tone — projecting that the rate-cutting cycle will need to be initiated later in the year, and will progress at a more gradual pace.

After the March FOMC meeting, the Fed reduced the expected number of rate cuts from 4 to 3 – taking rates down to 4.75% by year end. Additionally, the Fed reduced the estimated number of cuts for 2025 from 4 to 3 (expecting to take rates to 4.00% by 2025 yearend). In the early days of April, we got even more unpleasant surprises from inflation, which roiled markets with the probability of even more hawkish commentary from the Fed.

Despite stubborn inflation and a slightly more hawkish outlook from the FOMC, the financial markets chose instead to focus on the strong economy and earnings growth – pushing the S&P higher for three consecutive months.

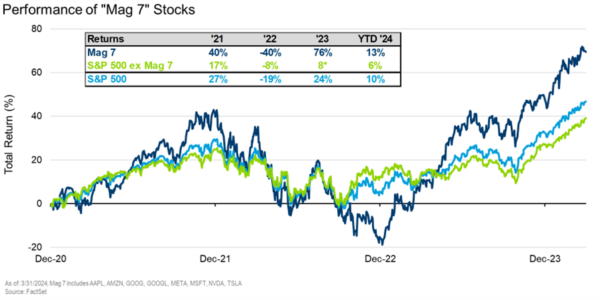

Throughout Q1, the S&P continued to hit all-time highs, ultimately posting a10% return– a remarkable start to the year, particularly on the heels of powerful returns in 2023. Throughout last year and early in 2024, the bull market had been dominated by the Magnificent 7 (Mag 7) technology companies. It is encouraging that this highly concentrated run-up has begun to soften somewhat, with market advances broadening to a larger cross-section of companies.

The economy is strong, but caution is warranted

We continue to remain cautious about the sustainability of the current expansion and have equal concern with the recent “stickiness” in the inflation data. Some important leading indicators continue to point towards a slowdown scenario:

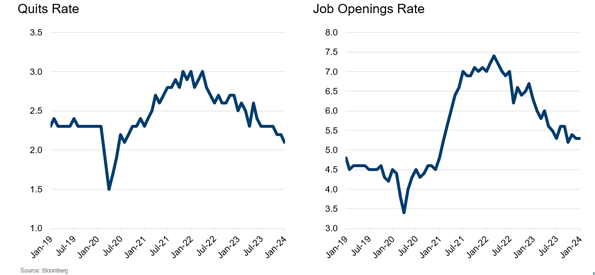

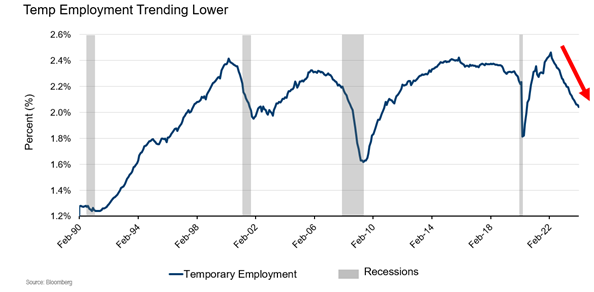

- The labor market continues to show signs of deceleration that are typically associated with broad economic softness.

- Many indicators such as the quits rate and temporary workers usage are in downtrends. This would hint of lower wages, lower consumption, and decelerating economic activity in coming months.

- Higher interest rates may not have enough time to slow the economy just yet.

Yet, perhaps more concerning are the recent trends for inflation, which support a possible overheating scenario (no landing). We’ve had more than three consecutive months of surprises to the upside for most measures of inflation. If inflation continues along the recent path, the “no landing” scenario will shift into focus as the most probable outcome – forcing the markets to accept that the Fed rate increases have been insufficient to bring inflation down to their target of 2.0%.

This will ignite discussions of “higher for much longer,” or even of additional rate hikes – for which neither the economy nor markets are prepared. Early April economic releases and market reactions clearly displayed a shift in this direction.

The range of potential economic outcomes in 2024 has become even more polarized over recent months, and our cautious outlook has deepened.

What does this mean for your assets?

Market returns thus far in 2024 have already met most forecasters’ annual estimates. Nevertheless, previously elevated levels of economic uncertainty have only increased over recent weeks.

Given that this elevated uncertainty is also paired with lofty asset prices, we continue to believe it is wise to refrain from overweighting market risk at this time. We have been harvesting profits from this bull run by trimming risk back to neutral. The highly disparate range of probable outcomes for the U.S. economy will play out during the upcoming election cycle, so increased market volatility is likely for the remainder of the year and caution is warranted.

If market turbulence erupts due to economic softness (or overheating), we will be looking for opportunities to move more heavily into riskier asset classes.

Fixed income outlook: Key points to know

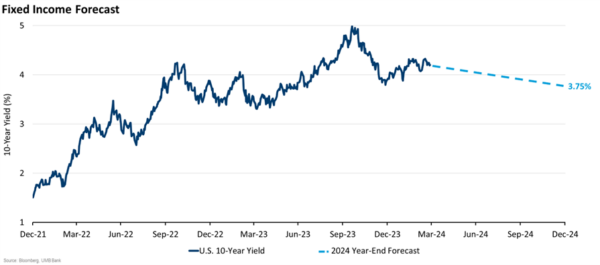

With inflation beginning to push back, the bond markets slowly adjusted to the reality that the Fed would be unable to cut early and often. This means interest rates began to drift higher to account for a more gradual outlook from the Fed. With rates rising across the entire yield curve, returns were pushed into slightly negative territory for the first quarter of 2024.

We believe rates are now more appropriate for the most likely economic outcome, and not likely to re-test previous highs (5% on the 10-year). As long as inflation does not continue to grind higher, the 10-year treasury rate should become quite attractive around the 4.5% area. Recent inflation trends have brought a higher degree of uncertainty to the interest rate outlook, with an increased probability of the “no landing” outcome, where inflation becomes stuck and rates have to make another move upward. We still believe that the economy will begin to soften as we move into summer, allowing rates to move lower — but the risks to that outlook have substantially increased.

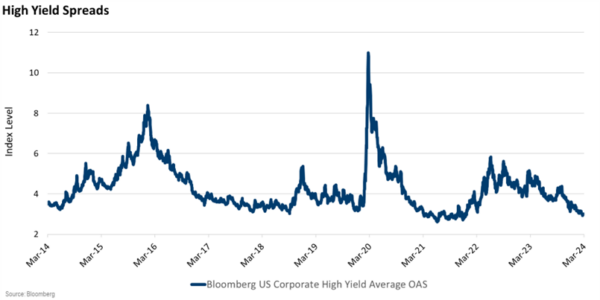

The credit markets have been following the trends in the stock market. With rising equity prices, credit spreads have continued to trend lower. High yield credit spreads are near the lowest levels of any recent cycle, indicating that most spread-related categories are fully valued, with little remaining upside. This further supports our cautious outlook and bolsters our desire to avoid over-exposure to the riskier corners of the market.

Equity outlook and economic impacts

Stocks staged impressive returns in the first quarter of 2024, with the S&P 500 gaining 10.2%. It’s the best start to a year since 2019, the 14th-best since 1926, and took total returns to just shy of 30% over the last 12 months. The good news is, historically, when the S&P 500 rises at least 10% in the first quarter, it has added a median of 7.6% over the remaining nine months of the year.

The rally in stocks occurred despite fears that valuations are stretched and gains are concentrated in just a handful of stocks, evidenced by big first quarter gains in names like Nvidia (+82%), Microsoft (+12%), and Meta (+37%), which were key to the stock market’s resilient performance. AI darling, Nvidia, continues to rise above the rest, contributing 24% of the market’s first quarter gain.

Valuations

While current valuations have given some investors pause, the good news is current valuations are still nowhere near the dizzying heights of past bubbles. The Mag 7 stocks are a good example. These names boast an average price-to-earnings (P/E) ratio of 25x and an enterprise-value-to-sales (EV/Sales) ratio of 4x.

If we look back at the tech bubble’s peak around the turn of the century, the 7 biggest stocks at that time sported a P/E of 52x with an EV/Sales that soared above 8x. Even in the “Nifty 50” bubble of the late 1960s, leading companies had a P/E above 34x. Why are these valuations relatively muted compared to history?

The demand for AI is real, showcased by Nvidia’s blistering 265% year-over-year revenue growth in the fourth quarter of 2023 alone. While Mag 7 stocks have performed phenomenally, the good news is we’re starting to see market leadership expand, which is what you hope to see following the S&P 500’s 24% advance last year. The lifeblood of a continued bull market is rotation. Fortunately, we have already seen some rotation of some of the high-flying tech names and into some of the more cyclical names.

Election volatility

History shows us is that whichever party is in office has little impact on overall stock market performance. However, you typically do see increased volatility during an election year. With that in mind, it’s surprising how little impact we’ve seen year-to-date (YTD). Presidential election years going back to 1952 have produced average gains of just 7%, while we’re already up 10% in the first quarter. The focus has been more on what the Federal Reserve is doing rather than who will occupy the White House in 2025. At this point, it seems if the economy can remain reasonably strong, most investors appear complacent with the presidential pick.

Given markets had a stronger start to the year than most expected, with minimal volatility, we think, for now, markets could be in for a short reprieve. In this environment, we will continue to maintain our exposure to higher quality names, and if fundamentals prove resilient, will look to add risk when there are opportunistic pullbacks.

Economic growth and soft-landing hopes

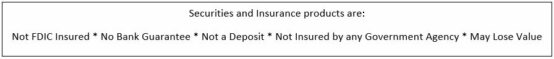

- The U.S. economy has been running at an above-normal pace for quite some time.

- Strong household consumption patterns have pushed strong GDP growth rates.

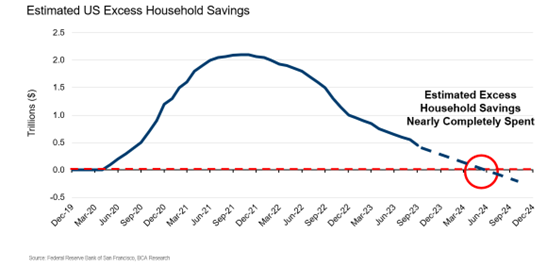

- Consumption has been driven by excess savings and a strong labor market.

- The outlook for both saving and the labor market appear to be slowing

- It is likely GDP growth will slow throughout 2024, with a reasonable probability of below-normal growth for part of the year.

- Recent data paints a picture of a possible soft landing.

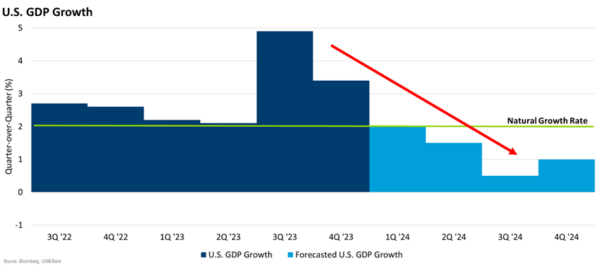

- Some measures of inflation have been steadily falling, with unemployment remaining low (strong labor market).

- While some data appear to indicate a soft landing, we feel that many of the underlying leading indicators point to other more challenging outcomes.

- Inflation is pushing higher again, while the early signals from the labor market are pointing towards a slowdown

- There are equal chances of both a hard landing (slowdown coming soon) AND no landing (inflation stays too high).

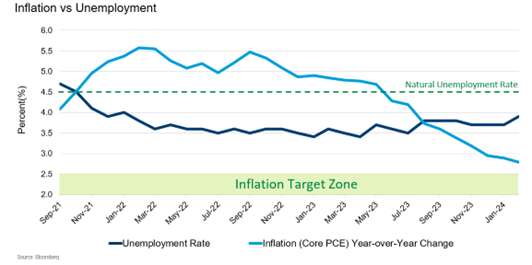

Consumption miracle and powerful net worth

- U.S. households have enjoyed a strong labor market with strong wage growth.

- Asset prices have been robust since the pandemic-related recession

- Stock prices, home values, and overall household net worth are all higher than pre-pandemic levels.

- Covid-19 stimulus helped drive savings to all-time highs

- Excess savings, strong wage growth and powerful increases in household net worth have helped fuel an ongoing boom in household consumption.

- Consumption has increased since the bottom of the pandemic.

- During the pandemic years, consumption was focused on goods, since many services were unavailable.

- Over the last two years, consumption has shifted from goods to services of all types. The U.S. economy is roughly 70% service based, so the switch in consumption has driven powerful GDP growth — and inflation.

Inflation appears to be getting stuck – prepare for a hard landing?

- Most measures of inflation have begun to “stall” in the area of 3-3.5%

- Some measures of headline inflation have been rising over recent months.

- Inflation has always been difficult to manage with any degree of precision, and this cycle is no different

- The final move down toward the Fed’s target of 2% is likely to be choppy.

- While several broader measures of Inflation have been falling rapidly, the inflation measures most important to the Fed, “Supercore Inflation”, have recently reversed course.

- The various versions of supercore inflation track services, while excluding goods, food, energy and shelter. Being focused on services, this measure of inflation is highly dependent on the labor market and wages. The tight labor market appears to have kept wages firmer than anticipated, resulting in recent increases in this important measure of inflation.

- We anticipate some cooling of the labor market as the year progresses, which should help move this measure back towards the Fed target. However, recent upward reversals in this measure have brought the possibility of “no landing” into the forefront of conversations.

- If inflation remains stuck in the current range (or higher), the Fed may be unable to initiate rate cuts in the manner the market expects.

Labor market slowdown

- Leading indicators from the labor market continue to point to a slow-down later in the year.

- Multiple data points from the labor market have been steadily falling for several months, indicating softness in the system.

- The Quits Rate (those voluntarily separating from jobs) has fallen to a level well below where it was before the pandemic.

- The Job Openings rate has traced a similar path and is nearly to its pre-pandemic readings.

- Both of these are strong indications that the labor market will be softening, with unemployment rising, as the year progresses.

- One of the best leading indicators for the direction of the labor market is temporary employment.

- When business appears to be slowing, the first labor that is cut is the use of temporary workers.

- Temporary worker usage has dropped dramatically

- In most previous cycles, a drop off of this magnitude has only occurred when the U.S. was already in, or about to enter, a recession.

- We believe that most of the indicators from the labor market point to a broad economic slowing later in 2024.

Consumption boost may be tapering off

- One of the primary drivers of the surprising strength of consumption in 2023 was the final drawdown of the excess savings that were accumulated during and after the pandemic.

- While there are differences of opinion around the precise numbers, there is broad agreement that several trillion dollars of excess savings built up during and after the pandemic-related recession.

- This amount of excess savings helped bolster consumption throughout 2023, particularly for middle and lower-income households. However, this savings is nearly depleted — and will likely be gone in mid-2024.

- This will remove a strong tailwind for consumption, increasing the probability of an economic deceleration later in 2024.

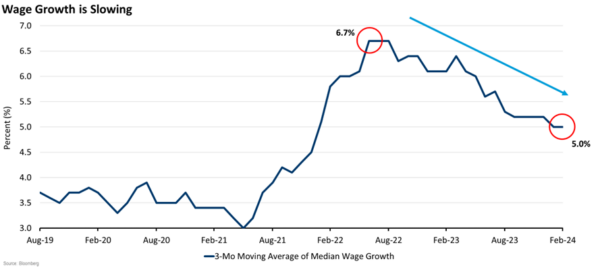

- Wage growth has been decelerating, in line with the softening of the labor market.

- Wage growth is softening, but still well above normal levels. This has been a key driver of consumption, GPD growth and inflation.

- If/when the labor market softens further, wage growth should drop to more normal levels. This should help bring inflation closer to the Fed’s target.

- If households begin to use leverage to fuel consumption (as a replacement for wage growth), then the inflation issues could persist.

Continued caution

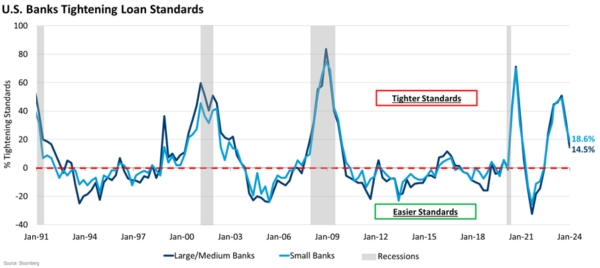

- Banks tightened lending standards throughout 2023 as the impact of higher rates and stress in the banking sector caused concerns about the overall economy.

- More than half of banks reported tightening business lending standards in the second quarter, in the third quarter that number fell to around a third.

- While standards are tightening at a slower pace, the data is still consistent with an economy that should be slowing.

- Historically tight standards are not a guarantee of a slowdown coming, the tightening we’ve seen as of late suggests the economy should slow over coming months.

Market performance

- Credit markets are riding the coat tails of the equity markets.

- Credit spreads are near the lowest ranges of the last several cycles.

- This valuation implies a nearly perfect outcome for the economy and credit markets, and leaves little (or no) room for any upside surprises in default rates.

- Credit markets appear to be positioned for a soft landing, with no below-trend cycle for the U.S. economy.

- We are cautious on valuations in this space, given that we do not foresee a soft landing as the most likely outcome for the U.S.

- The Mag 7 stocks again led the market in the first quarter, but more stocks are starting to join in on the rally, helping ease some concerns that the market’s gains are too narrow to endure.

- The Magnificent 7 stocks were still responsible for 37% of the S&P 500’s 10.2% first-quarter gain as earnings remain robust. Not an insignificant amount, but much less than the roughly two-thirds they contributed in 2023.

- Expanding market leadership is what you hope to see following the S&P 500’s 24.2% advance in 2023.

- The lifeblood of a bull market is rotation. There has already been the start of a rotation out of some of the highflying tech names and into some of the cyclicals, but now we turn our focus to the next earnings season to see if this trend can continue.

- Interest rates were pushed higher in the first quarter due to stubborn inflation data.

- Long rates are positioning for some uncertainty surrounding the outlook for Fed rate cuts, and the uncertain path for inflation.

- Rates have moved back up to reasonable valuations, given our outlook for a softer economy and lower rates later in the year.

- Full allocations to fixed income are appropriate.

- The growing risk of “no landing”, with sticky inflation and perhaps the consideration of even higher rates, is keeping us cautious about extending duration or going overweight fixed income at this time.

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Disclosure and Important Considerations

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2024. UMB Financial Corporation. All Rights Reserved.

- Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division

Insurance products offered through UMB Insurance Inc.

You may not have an account with all of these entities.

Contact your UMB representative if you have any questions.