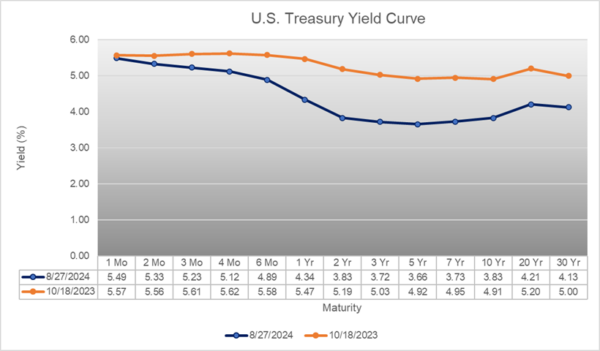

During his speech at the Fed’s annual meeting‡ in Jackson Hole, Wyoming in August, Federal Reserve Bank Chairman Jerome Powell stated: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” This was a clear signal the FOMC was about to alter monetary policy and begin reducing the Federal Funds Target Rate. In anticipation of this change, market interest rates have declined sharply over the past several months.

Source: U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates, 2023-2024.

Since October 18, 2023, the yield on the U.S. 10-year Treasury Note has declined by 118 basis points (bps), while the yield on the U.S. 2-year Treasury Note has declined by 136 bps. Chairman Powell’s revelation indicates that shorter-term treasury yields and the overnight funds rate will also soon decline.

Many banks base the pricing of their loans and deposits on short-term market interest rate indices like the federal funds effective rate, the secured overnight funds rate (SOFR), the 3-month treasury bill yield, or the national prime lending rate. Thus, a shift in short-term interest rates can greatly impact interest rate risk measurement.

The accuracy of any interest rate risk measurement system is dependent upon the accuracy of its underlying data and assumptions. It is prudent to review your model data and assumptions thoroughly before a potential pricing change to ensure that model assumptions align with the institution’s strategies and expectations.

Interest rate risk model assumptions

Loan and mortgage-backed security principal prepayment assumptions

Many income simulation models used for measuring interest rate risk include assumptions that control the rate at which unscheduled principal payments are made on loans or mortgage-backed securities (MBS) in different market interest rate environments. These assumptions can have a major impact on the estimation of asset cash flows in various market interest rate scenarios.

The most common method for measuring the rate of unscheduled principal payments is the conditional prepayment rate (CPR). A CPR is an estimate of the percentage of a loan’s principal that is likely to be paid off prematurely. The estimate is calculated based on several factors, such as historical prepayment rates for previous loans like the ones currently in the portfolio and future economic outlooks. Underlying loan collateral, time to maturity or repricing, and weighted average coupon have the most significant impact on estimating CPR.

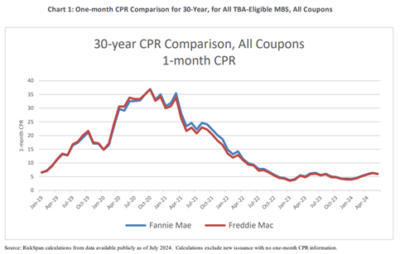

Here is an example: A 1-month CPR equal to 5% indicates that 5% of the loan’s principal balance will prepay prior to the loan’s scheduled maturity over a one-month period. The chart below depicts historical one-month CPRs on 30-year mortgages underwritten by Fannie Mae (FNMA) and Freddie Mac (FHLMC).

Source: FHFA Prepayment Monitoring Report, Second Quarter 2024.

The chart shows that during the previous declining market interest rate cycle, from January 2020 to March 2022, one-month CPRs on 30-year mortgages increased dramatically. During that period, short-term market interest rates declined by more than 130 bps. Financial institutions, in general, experienced significant prepayments on all types of loans. This altered loan cash flows and severely shortened the average lives of those loans.

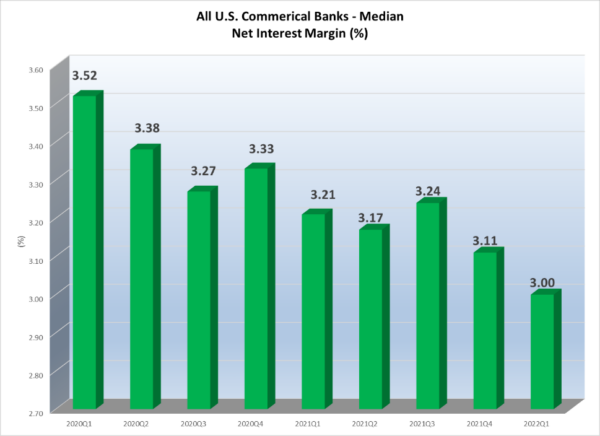

Source: S&P Capital IQ Pro, 2024

The chart above shows the trend in net interest margin for commercial banks during that time period. The median net interest margin declined from 3.52% in the first quarter of 2020 to just over 3.00% in the first quarter of 2022. This was mainly the result of more asset cash flows repricing into lower yields than liabilities repricing into lower costs.

As a result of these accelerated cash flows from a decline in rates, premium amortizations on MBS and collateralized mortgage obligation (CMO) securities were shortened significantly. Many of our clients experienced negative yields on MBS and CMO securities during that period as premium amortizations exceeded interest income. Interest rate risk models that used static or historic prepayment assumptions did not accurately account for the impact of a rapid reduction in market interest rates on cash flows and bond valuations.

These experiences demonstrate the importance of accurate, updated prepayment assumptions in your interest rate risk models. At UMB Bank Capital Markets Division, we conduct loan prepayment analyses for clients to calculate loan prepayment speeds on the client’s specific loan holdings. Those prepayment speeds are then applied to the client’s interest rate risk model and updated annually. We also stress-test those assumptions annually to determine the sensitivity of model results to unanticipated changes in prepayment speeds. These stress tests allow us to fine-tune the model assumptions and provide more accurate estimates of declining market interest rate scenarios.

Non-maturity deposit rate sensitivity assumptions

Many income simulation models used for measuring interest rate risk include assumptions that control how deposit rates change as market interest rates change. These assumptions are often called rate sensitivity factors or “betas”. The models used by UMB Bank Capital Markets Division includes separate beta assumptions for both rising and declining market interest rate scenarios. We assign these betas for each interest-bearing non-maturity deposit account. Our model also includes a “lookback” or lag factor that controls the timing of when offering rates change relative to the change in market interest rates. We often derive these betas and lags via our advanced core deposit study (ACDS). The ACDS uses historical non-maturity deposit account cost and balance data provided by our clients to estimate the beta factors and their associated lags.

One of the inherent problems with using historical data to derive these model assumptions is that we assume the future will be like the past. The declining rate betas were derived from data collected from the last declining market interest rate period, reflecting the bank’s pricing practice during that period. That practice may not be the same in the next declining market interest rate cycle.

The question for those managing the interest rate risk model is: Do the beta assumptions in the declining market interest rate scenarios match the bank’s current practices or expectations for adjusting deposit offering rates?

Suppose the beta assigned to an institution’s money market accounts in the declining market interest rate scenarios is 0.50 with a lag of 90 days. That means if market interest rates decline instantaneously by 100 bps, money market account offering rates will decrease by 50 bps 90 days after market interest rates change. If the institution plans to cut its money market account offering rates by more than 50% of the change in market interest rates as soon as those rates change, then the beta and lag assumptions used in the model are inaccurate.

Conversely, if the institution plans to delay cutting the offering rates on money market accounts for fear of sparking a runoff in account balances or migration of account balances into higher-costing deposit accounts, those beta and lag assumptions are also inaccurate.

These inaccuracies could significantly impact measuring the institution’s interest rate risk in a declining market interest rate environment. Those responsible for managing and monitoring the model’s non-maturity deposit assumptions should thoroughly review the betas and lag factors assigned to each non-maturity deposit account before the next model run.

Like loan prepayment assumptions, we stress-test the non-maturity deposit beta and lag assumptions to gauge the model’s sensitivity. We use the results of these stress tests to make recommendations for any possible changes in beta and lag assumptions.

Early withdrawal of certificates of deposits and deposit migration

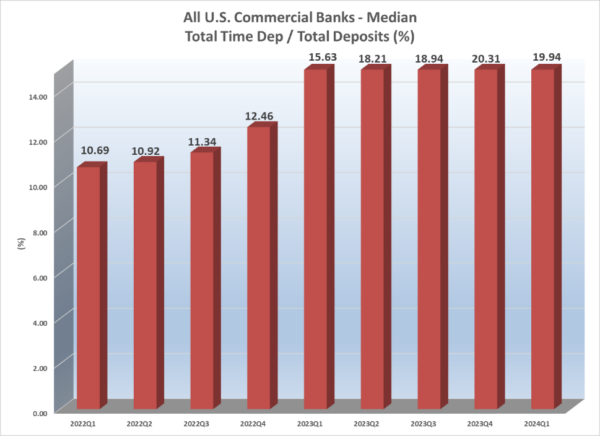

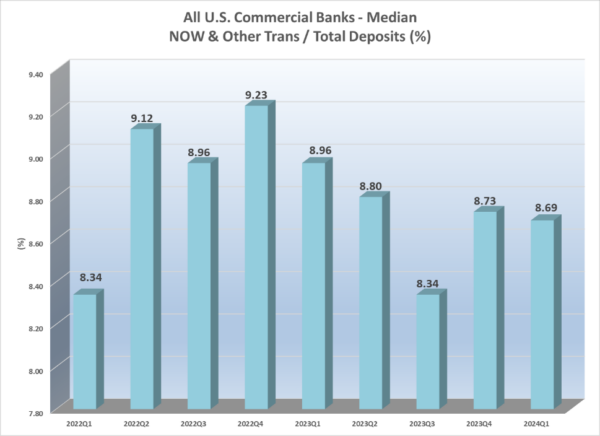

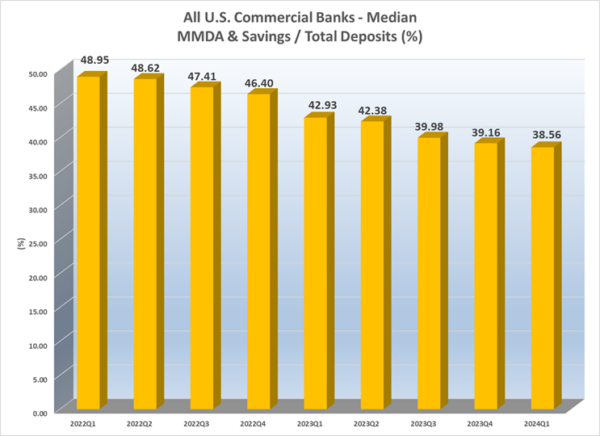

One of the many consequences of the rapid increase in short-term interest rates from the first quarter of 2022 to the second quarter of 2023 was the early withdrawal of certificate of deposit (CD) balances. During that period, the large increase in CD offering rates made early withdrawal penalties inconsequential and spurred many depositors to move their CD balances into higher-yielding offerings. At the same time, many depositors who had balances in transaction accounts like negotiable order of withdrawal (NOW) accounts and money market accounts moved those balances into CD accounts to capture higher returns. CDs as a percent of total deposits increased significantly, which is shown in the charts below.

Source: S&P Capital IQ Pro, 2024

Source: S&P Capital IQ Pro, 2024

Source: S&P Capital IQ Pro, 2024

Total time deposits as a percent of total deposits nearly doubled from the second quarter of 2022 to the first quarter of 2024. NOW and other transaction accounts as a percent of total deposits increased during 2022 but decreased in 2023 and 2024. Money market and savings accounts as a percent of total deposits declined steadily from 2022 to the first quarter of 2024.

This migration of deposit balances out of non-maturity deposits and into time deposits altered many banks’ repricing and cash flow characteristics. This alteration ultimately impacted the interest rate risk measurement. If the interest rate risk model did not accommodate the shift in deposit balances, the model estimates did not fully account for that risk.

Institutions must now consider how a decrease in short-term interest rates will alter the mix of their deposits. If an institution is apt to cut offering rates on CDs in step with a reduction in market interest rates, will CD balances leave the institution? If so, how much will they leave, and when will they leave? Conversely, if an institution maintains above-market rates on CDs, will there be a “surge” of new deposits from other institutions? If so, how much will CD balances increase, and how will that impact the net interest margin?

We recommend a thorough review of all CD accounts, particularly those accounts that are new to the institution and where the depositor has no other relationship with the institution. We also recommend thoroughly reviewing all deposit balances over the FDIC insurance limit of $250,000. Those balances should be considered volatile and should be modeled separately. Income simulations should then consider the possible runoff of at least a portion of those balances. If the institution’s strategy is to offer above-market rates to increase deposits, income simulations should consider the change in beta and balance decay brought on by these new deposits.

Summary

Institutions must monitor their interest rate risk models to ensure the inputs and assumptions are sound and reflect current trends and practices. Key model assumptions like loan prepayment rates, deposit betas, and decay rates should be reviewed and updated regularly. Interest rate environments change, and your interest rate risk model should change with them.

Learn how UMB Bank Capital Markets Division’s asset liability management and performance consulting can support your bank or organization, or contact us to be connected with a team member.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED