Earlier in 2024, the Fed and markets were concerned about inflation and confident about employment, and market yields of 4-5% were abundant. Now, in the fourth quarter of the year, we have a jumbo rate cut under our belt and market yields have been quick to price more cuts ahead. With the economic landscape changing, it may be a great time to review your investment and portfolio strategy.

It seems one central theme going forward will be a steepening yield curve. As the Fed continues cutting overnight rates, we expect a “bull steepening” environment, meaning the slope of the curve increases, though short-term rates fall more than longer-term rates. A tried-and-true strategy for this type of move has always been a bullet structure.

With a bullet bond strategy, the portfolio is constructed so the maturities of securities are highly concentrated at one point on the yield curve. Bullet structures are attractive because your cashflows do not accelerate as market yields fall, causing you to reinvest at lower rates. You also have the opportunity for price appreciation over time as the bond “rolls down the curve.” Still, with current 3-5-year bullets well under 4%, opting for yield over structure can be tempting.

However, some bullet-like structures are still available at 4%+ yields, with even better-than-expected performance. Below is a delegated underwriting and servicing (DUS) bond, an agency commercial mortgage-backed security (CMBS) structured with yield maintenance and a balloon maturity for a very bullet-like structure. These work well at a discount and with low wholesale acquisition costs (WAC).

These are Federal National Mortgage Association (FNMA) wrapped with an underlying loan for a multifamily property:

- 73 debt service coverage ratio (DSCR)

- 62% loan-to-value (LTV) ratio

- 97% occupancy

- 49 months of seasoning

- 03 WAC

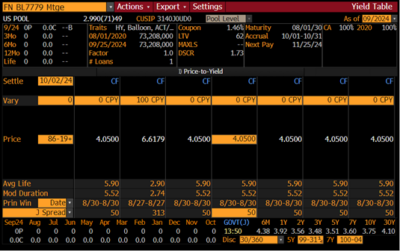

The bond pays a 1.46% coupon and is offered at a mid-$86 price for a 4.05% yield to maturity in August 2030. This equates to a 5.9-year average life and a 50 basis points spread. The yield maintenance premium runs until August 2027, but, with the discount price, any early payoff would result in accelerated accretion income. See the yield table and prepurchase analysis below.

Yield table

Source: Bloomberg

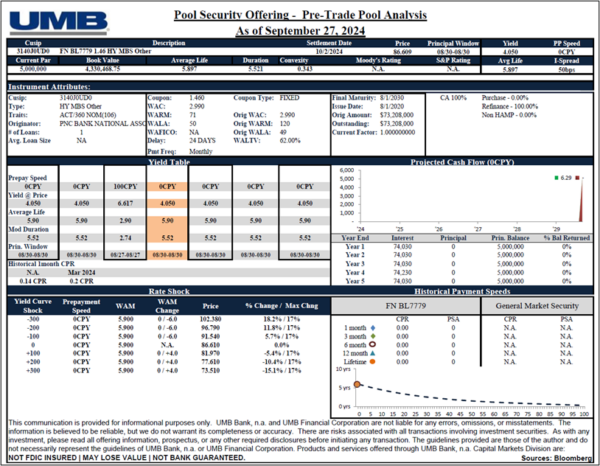

Prepurchase analysis

Next, we will look at the total return on a 1 and 2-year horizon and compare it to a newer issue MBS pool from a total return perspective.

Total return analysis

Below is a total return analysis with a 1-year horizon. This demonstrates the roll-down effect of a bullet-type structure when we eventually have some slope in the curve. This structure will roll down the curve on a 1-1 basis. For example, if in a year, market yields for similar structures in 4.89 years are yielding 3.55%, our 1-year total return would be more than 6% (2%+ price appreciation + 4.05% book yield).

The horizon analysis shows the average life is precisely 1-year shorter. This stability is significant in an uncertain environment. The potential gain would also help offset losses when emerging from pandemic-era holdings. (Implied forward rates: 1-year forward 5-year treasury yielding 3.37%.)

Bullet alternative – 1-year total return

Source: Bloomberg

Implied forward rates

Source: Bloomberg

This type of stability is not free; this route requires you to give up some yield in the process. For comparison, let us look at a newer issue, as demonstrated in the yield table below.

A 20-year, 4.5% pool is a very reasonable place for 15-year buyers looking to extend a bit. This has a 5.26% WAC, 20 months of seasoning, and is offered at 100-30 for a 4.25% base case yield and 5.12-year average life.

So, a similar average life profile to the bullet structure and a 15-basis-point higher yield.

Source: Bloomberg

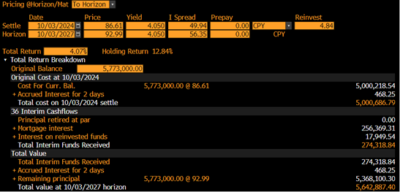

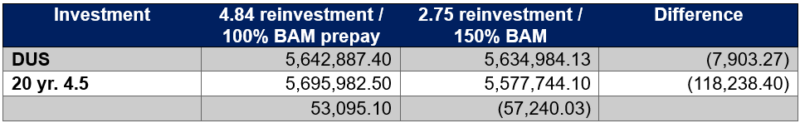

Next, let us compare the two using a 3-year horizon. It is true that if nothing changed, we would make more by owning the 20-year, 4.5% pool. The two tables below show the value at the horizon in 3 years.

In an unchanged environment and a $5 million investment, we would have a value at the horizon on the bullet alternative of $5,642,887.00 and $5,695,982.50 owning the 20-year pool, ahead by more than $53,000. However, we know the environment is anything but predictable. This assumes we are reinvesting P&I cash flows using the current Fed effective rate of 4.84% and base-case prepayment assumptions.

Total return breakdown – 3-year horizon

Bullet alternative

- Approximately $5 million total settlement

- Reinvestment rate of 4.84%

Source: Bloomberg

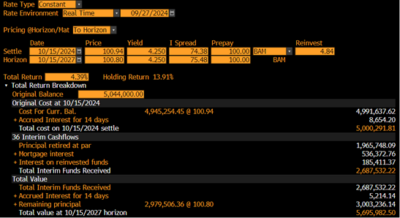

Total return breakdown 20-year, 4.5% pool

- Approximately $5 million total settlement

- Reinvestment rate of 4.84%

- 100% BAM prepayment speed

Source: Bloomberg

Now, assume rates fall to the projected 2.75-3.00% Fed Funds Target, and prepayment speeds accelerate to 150% of a base case — roughly an 18 conditional prepayment rate, which is fairly conservative. Instead, you have a value at horizon of $5,577,744.10. This is $118,238.40 less than expected above and $57,000 less than the potential value of the bullet alternative.

Total return breakdown 20-year, 4.5% pool

- Approximately $5 million total settlement

- Reinvestment rate: 2.87%

- 150% BAM prepayment speed

Source: Bloomberg

Total value at horizon – 3 years

It is challenging to not to go for the yield, given any investments are either coming out of Fed Funds paying a higher rate or expensive borrowings. While we have seen rates come down quickly, it is not too late to help your portfolio. We suggest adding as much structure as you can afford, which may pay off down the road.

As with all investment advice, there is more than one way to achieve a goal. Agency CMBS are not the only answer. If you are more comfortable with traditional pass-throughs or CMOs, seasoning and lower WAC options can limit negative convexity.

Learn how UMB Bank Capital Markets Division’s asset liability management and performance consulting can support your bank or organization, or contact us to be connected with a team member.

Disclosures and Important Considerations

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information and opinions expressed in this message are solely those of the author and do not necessarily state or reflect the opinion of UMB Bank, n.a. or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED