Climbing a wall of worry

The second quarter of 2025 was filled with unexpected, sometimes volatile events in both the geopolitical arena and the financial markets. We endured ongoing confrontation and uncertainty on two fronts: the global tariff war and an unexpected military conflict that erupted in the Middle East. As June ended, it appeared the worst of the issues were behind us, and optimism was returning to the markets. Yet, uncertainty remains elevated.

The global tariff war raged on

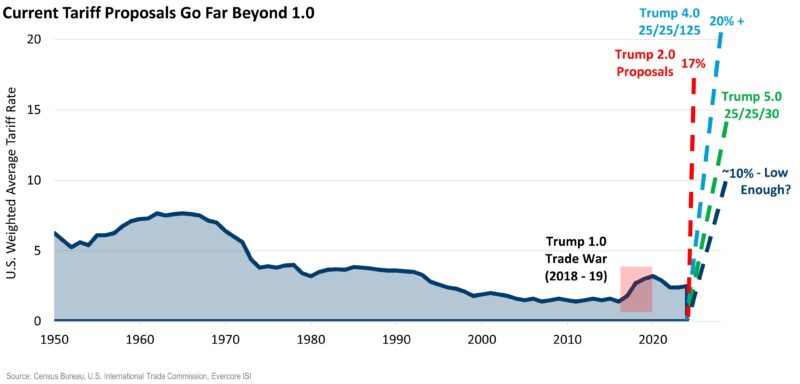

Early in the quarter, a quid pro quo of heavy tariffs was launched between the U.S. and its primary trading partners, and it appeared that no negotiations were going to occur. For several weeks, we were faced with a growing likelihood that the tariff war was going to lead to global gridlock. By mid-April, we had experienced a 19% selloff in the S&P. Simultaneously, the bond markets came under pressure, pushing interest rates significantly higher. It was at that point that the administration expressed a willingness to negotiate with our trade partners, and the markets began to stabilize.

In the weeks since, we’ve suffered through ongoing fits and starts with regard to the tariff negotiations, but the fact that negotiations are occurring gives us hope that the tariff issues will be resolved before year-end. The administration has postponed the implementation deadlines more than once – a clear sign of willingness to find a workable solution. After initial estimates of average tariffs landing in the 20%+ range, it now appears that the final package will land somewhere in the 15% range, on average, for our trade partners (but the numbers seem to change daily). As we began to have more hope of a reasonable conclusion to the tariff skirmish, estimates of the probability of recession began to recede, moving from as high as 65% in April to below 50% at quarter-end.

Investors and consumers seemed to be quite pleased that the tariff war was turning in a more productive direction, and both consumer sentiment and the equity markets rebounded through the back half of the quarter. The S&P 500 staged one of the most rapid rebounds in history, eventually ending the second quarter at new all-time highs.

As the markets were recovering from the tariff war, we were also faced with a military conflict with Iran

In mid-June, Israel initiated military attacks against Iran in an attempt to eliminate their nuclear capabilities. During the next week, the U.S. decided to join in the campaign by initiating a strike against three key nuclear sites. This type of event would typically trigger a powerful risk off-cycle, driving equity prices sharply lower. However, the financial markets were largely stable during the episode, and eventually a ceasefire was enacted between Israel and Iran.

As the quarter came to a close, it appeared that the strikes were successful and no further conflict would occur – a truly astounding and unexpected outcome. Consequently, the markets continued to push higher through the end of June, with the S&P up nearly 11% for the quarter and 6% for the year-to-date (YTD).

The Fed, still in a pickle

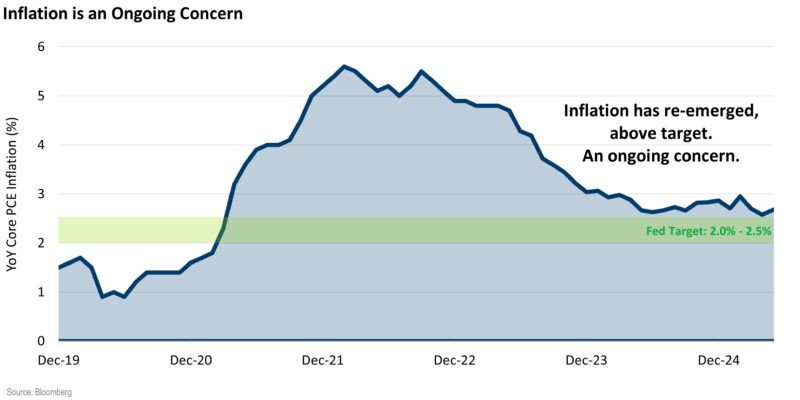

As the tariff wars and Middle East conflict unfolded, the Fed was under constant pressure from the administration to cut rates (in order to improve sentiment). However, inflation continues to be stuck well above the Fed’s long-term target, and virtually all historical experience suggests that tariffs are certain to push inflation even higher.

With the news around tariff efforts changing literally daily, it is nearly impossible for the Federal Open Market Committee (FOMC) to estimate what the future path for inflation will be. They have steadfastly communicated that their next move for rates is almost certainly lower, but they have also made it clear that they need more clarity on the tariff situation before they can initiate cuts. It is broadly assumed that tariffs, wherever they land, will likely dampen economic activity while simultaneously pushing inflation higher (although likely only temporarily).

The Fed also knows that there are underlying signs of stress inside the U.S. economy. Leading indicators from the labor market have been pointing toward a meaningful slowdown for many months. Additionally, consumer and business sentiment have been under severe pressure due to uncertainty around the global trade war. Recent progress toward a resolution of the trade war is hoped to help spur a rebound in sentiment. This could help improve the outlook for business activity and, therefore, the labor market.

We believe the Fed is simply looking for some level of certainty about where the average tariff rate will land before it begins cutting rates. We would expect that the administration would like to have these issues nearing resolution as we approach year-end. For that reason, we see the Fed rate cuts starting late in the year.

Post-June update: The Big Beautiful Bill Act lands

Just days after the end of the second quarter, Congress enacted the Big Beautiful Bill Act – a massive set of spending and tax cuts designed to stimulate the economy and reduce government spending. At the time of this writing, it is unclear what the ultimate impact will be, but early analysis concludes it is virtually guaranteed to increase the budget deficit for several years, pushing our debt burden even higher. This has put additional upward pressure on interest rates, as concern grows that U.S. fiscal practices will lead to longer-term issues around debt burdens and borrowing needs.

The markets

After the severe selloff in early April, the equity market began to “climb the wall of worry,” looking past the short-term challenges and positioning for better times in 2026. A quick, powerful rally pushed the S&P back to new all-time highs, with returns of nearly 11% for the quarter. Earnings estimates began to push higher for 2026, bolstered by assumptions that the Fed would be cutting rates later this year. The equity market has displayed amazing resilience, given the scope and magnitude of the unprecedented geopolitical events taking place.

The bond market (10-year Treasury rate) has been moving in a volatile range between 4.00 and 4.50%, struggling to digest higher inflation, slowing growth and growing budget deficits. The uncertainty around these issues will make it unlikely that long-term rates will move meaningfully lower, even as the Fed begins cutting rates (unless we fall into recession).

The outlook

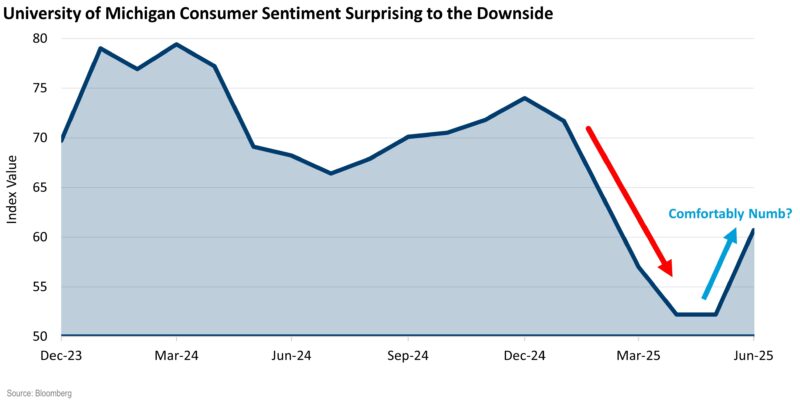

The resilience of the equity market is encouraging and welcome. As the market climbs the “wall of worry,” there is lingering concern that investors may have become “comfortably numb.” The markets seem to have become desensitized to what would normally be alarming events. Equity valuations (P/E multiples) have pushed back up to historically high levels, which is cautionary given the amount of uncertainty still in the system. The tariff campaign will continue to throw surprises our way for some time (Europe is rumored to be the next flash point).

There is no precedent for the ultimate impact tariffs will have on growth and profitability, and there is a risk that both will suffer in the early stages after tariff implementation. We can be certain that it will temporarily push inflation even higher than it is now. We believe the administration intends to have the tariff campaign headed towards resolution as we approach year end, which should allow the Fed to begin lowering rates. This should help boost consumer sentiment and economic momentum heading into 2026.

In times like these, we lean heavily on many of our core philosophies

- All long-term financial success is anchored in a strong financial plan, one that doesn’t shift in response to market volatility or elevated noise in the media.

- Asset allocation and diversification are key to long-term success. A solid understanding of your long-term risk posture/objectives is much more important than security selection or tactical trading.

- Quality tilts will help enhance risk-adjusted returns over time. Quality has shown resilience across various market regimes, due in part to its lower volatility, which was again proven during April’s sell-off.

- Private markets have an important place for clients who qualify. Investments in the private space do not experience the short-term volatility we’re grappling with today.

Financial teams are here to provide our clients with peace of mind about their financial future. Anchoring to a sound, long-term financial plan and investment strategy will help everyone weather storms like these. We recommend remaining disciplined and consistent in our strategies and mindful of our long-term philosophies. We are confident that together we will manage our way through this challenging time.

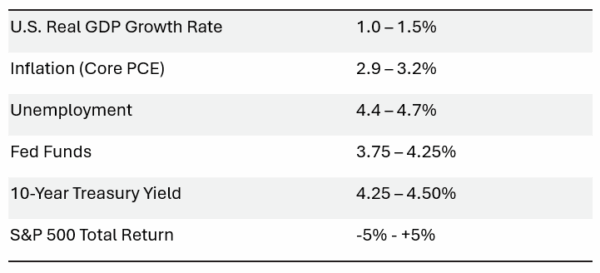

Below you will see our forecasts for 2025

Financial markets

Equity outlook

Markets are known for their resilience, often rising despite a barrage of concerns, which is how they got the slogan, “markets constantly climb a wall of worry.” The second quarter was a textbook example of this. Despite facing tariffs, inflation concerns, geopolitical tensions, and elevated valuations, the S&P 500 still managed to surge nearly 11%.

Tariffs and trade tensions

The market initially stumbled in April after sweeping tariffs were announced, but worst-case fears eased as trade negotiations progressed. Still, the effective U.S. tariff rate is on track to be the highest since 1937, raising concerns about inflation and corporate margins. Upcoming earnings reports will be key to gauging the real impact.

The Fed and interest rates

Fed Chair Jerome Powell has held off on rate cuts, citing inflation risks from tariffs. However, markets are pricing in multiple cuts by year-end, with the first expected in September. Political pressure on the Fed has added another layer of uncertainty.

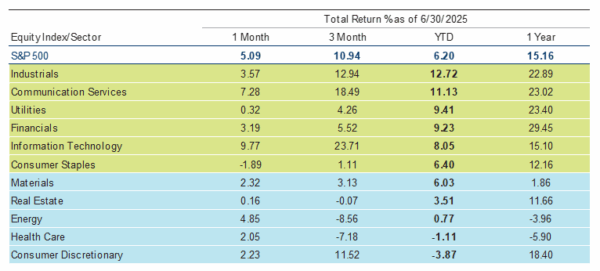

Tech leadership and market breadth

Tech stocks, especially the “Magnificent Seven,” led the rebound, making the sector the top performer in Q2. Yet, concerns remain about narrow market leadership. Broader participation will be needed to sustain the rally, as the equal-weight S&P 500 is up just 4% year-to-date.

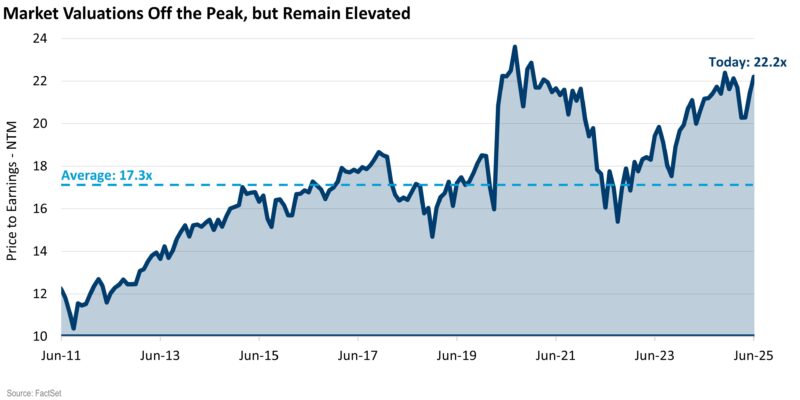

Valuations and earnings outlook

Valuations have climbed, with the S&P 500 reaching 22.2 times forward earnings – well above the long-term average. Investors are now looking to 2026 earnings growth and lower yields to help justify current prices.

Geopolitical risks

While the Israel-Iran conflict briefly rattled markets, history shows geopolitical flare-ups rarely derail long-term equity returns. Still, any escalation—especially one that spikes oil prices—could trigger renewed volatility.

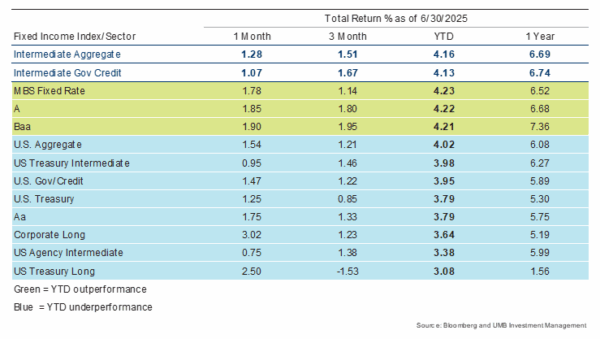

Fixed income outlook

Interest rates have been churning in a volatile range between 4.00 and 4.50% (10-yr Treasury). Bond investors are struggling to digest the ongoing uncertainty around inflation, economic momentum, and growing budget deficits. Economic momentum is moderating, but inflation is still stuck well above the Fed’s target— and likely to move higher after tariffs become fully implemented. The tariff war is expected to push inflation higher and economic activity lower in coming months, leaving the Fed in a very difficult situation. We expect they will indicate that they intend to cut rates, but not until later in the year when there is more clarity around the tariff/inflation situation.

Interest rates could be mired in the current range, even if the Fed begins to cut rates. Longer-term concerns about budget deficits and debt burdens could put a “floor” under rates that may be hard to penetrate without an outright recession. We expect the yield curve to steepen as the Fed cuts rates headed into 2026 – with overnight rates dropping as much as 1.00% over the next 12 months, but very little drop to longer-term rates (barring recession). However, with current yields near 5% in most corners of the bond markets, fixed income offers an attractive low-risk alternative for investors — producing returns we haven’t enjoyed in many years.

- The tariff war rages on.

- Tariff proposals and countermeasures are changing almost daily.

- Negotiations have been initiated, which is a positive sign.

- Latest figures show an average tariff rate on our trade partners around 15%.

- This is the largest increase in tariffs in nearly a century.

- Prices on imported goods are certain to see upward price pressure.

- Overall global economic activity is likely to be put under severe pressure if current proposals are left in place longer-term.

- War erupted between Israel and Iran—and eventually the U.S.

- The markets had very little reaction to this potentially devastating conflict.

- Market resilience in the face of turbulent events is welcomed and encouraging.

- It appears that investors may have become de-sensitized to the news cycle.

- The cease-fire was quick and encouraging, it may be difficult to maintain.

- Inflation is currently too high, stuck well above the Fed’s target of 2.00%.

- The tariff war is nearly certain to increase prices of many goods in the U.S.

- Inflation rates are expected to rise from current levels over the next several months.

- It is possible that core inflation will be pushed back up to the 3 – 3.5% range.

- The Fed is likely to remain on hold until later in the year, hoping to get some clarity on the final tariff package and its impacts.

- Tariff-based inflation may be transitory, as it should taper back off 12-24 months from now.

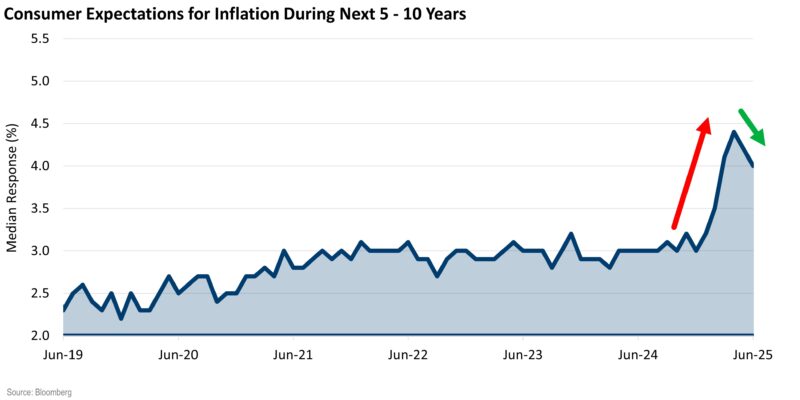

- The Fed is concerned about long-term expectations for inflation.

- Long-term inflation expectations tend to drive behaviors, making inflation expectations an excellent leading indicator of inflation’s trajectory.

- The Fed will likely need to see these variables continue to soften before they can move rates meaningfully lower.

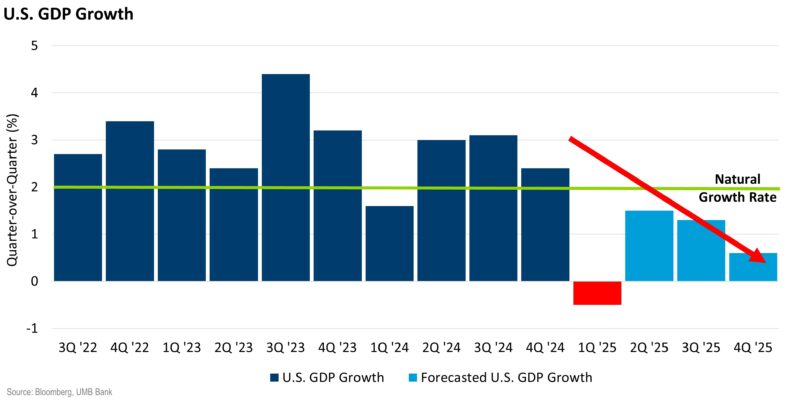

- The U.S. economy contracted during the 1st quarter of 2025.

- A rebound is expected in the second quarter, but is likely to be followed by several quarters of below-average growth.

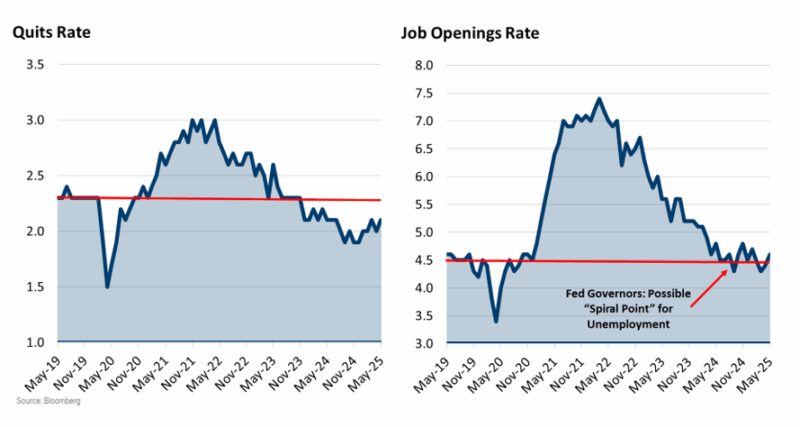

- Labor markets have been showing signs of deceleration for quite some time.

- Consumption patterns had been driven, in large part, by excess savings from the COVID stimulus. Household excess savings appear to be completely burned off and consumers are showing some signs of stress.

- The probability of recession in 2025 has dropped to roughly 45%

- Leading indicators on jobs are in clear decline, indicating a weakening labor market.

- The unemployment rate is expected to climb over 2025.

- Softening labor conditions could put further downward pressure on consumption.

- Uncertainty over global trade will exacerbate trends in the labor data.

- Resolution of the tariff conflicts, and lower rates from the Fed could reverse these trends heading into 2026.

- Consumer sentiment has been exceptionally depressed, largely due to trade uncertainty.

- Sentiment has gotten a small boost in recent weeks, likely due to more positive news on the trade/tariff front.

- Despite the rebound, sentiment is still quite low, and needs to recover meaningfully.

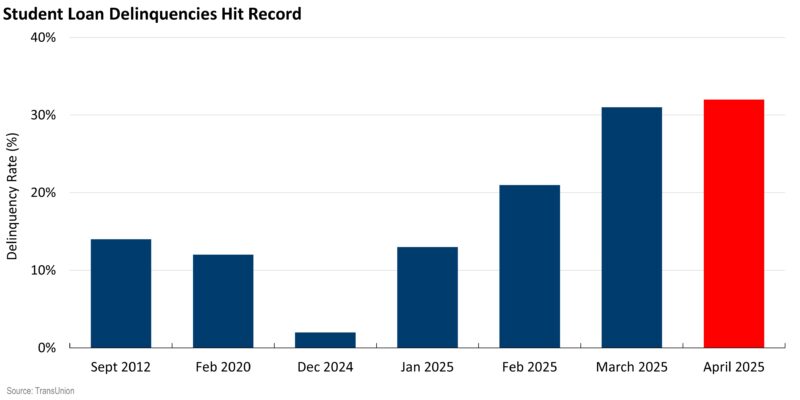

- Consumers are showing some signs of stress.

- Delinquencies are rising in the credit card space.

- Student loan delinquencies have spiked dramatically in recent months, to all-time highs.

- Consumers in the lower 50% of income distribution appear to be under financial distress.

- Valuation multiples have expanded powerfully over the last two years.

- Current valuations are well above the long-term averages.

- Elevated valuations will require ongoing robust earnings growth, which may be challenged if the economy decelerates.

- Current valuations remain elevated, and make the equity market vulnerable to higher levels of volatility.

- Lofty valuations can be partially explained by very strong corporate profits (relative to overall economic activity).

- Lofty equity valuations can be a cause for concern for many investors.

- Historical data shows that the S&P 500 sitting at all-time highs should not deter investing in the market.

- The quarter began with a sharp sell-off, as the S&P 500 dropped over 12% in early April following the U.S. administration’s surprise announcement of reciprocal tariffs.

- A rapid policy pivot and trade negotiation signals quickly reversed the panic, triggering a dramatic rebound of over 25% off the lows by quarter-end, with the S&P 500 closing at new all-time highs.

- Despite the volatility, the S&P 500 still finished the quarter up 10.94%, underscoring investor resilience and optimism about future trade negotiations.

- Tech was the best-performing sector with upside leadership from the semi space, where AI plays led the rally.

- Bonds acted as a safe haven during the early April equity sell-off, reinforcing their role as portfolio ballast in times of distress.

- The U.S. Aggregate Bond Index rose by 1.2%, bringing its year-to-date gain to 4.0%, as intermediate-term bonds provided stability during equity market volatility.

- The Treasury yield curve steepened, with long-term yields rising slightly while short-term rates remained anchored, reflecting shifting expectations around inflation, future Fed policy and increased concerns over fiscal deficits.

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Disclosures and important considerations

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2025. UMB Financial Corporation. All Rights Reserved.

*Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division Insurance products offered through UMB Insurance Inc.

You may not have an account with all of these entities. Contact your UMB representative if you have any questions.