The Federal Reserve continued its battle with inflation by increasing interest rates in the first quarter. Complicating the matter, several regional banks collapsed, causing turmoil in the banking system. What is unprecedented is the following:

- The Fed has never hiked rates in the middle of broad financial turmoil

- The Fed has never increased rates while the yield curve is inverted—Fed Funds to 10-year treasury

- The Fed has never boosted rates when liquidity, M2, is contracting. The monetary and fiscal response to the global pandemic was unprecedented, the Fed’s recent action was unprecedented…again.

The Banking System

The health of the U.S. banking system was brought into question due to concerns regarding uninsured deposit losses. The banking system will not collapse; however, the turmoil may continue. Banks and credit are the lifeblood of the economy, the concern now turns to a broader economic discussion. Tighter lending standards coupled with potential new banking regulations will curb available capital for business investment and spending, having a negative impact on economic activity. The banking turmoil may assist the Fed in its fight against inflation. As lending slows, economic growth and inflation should also slow. This supports our annual economic theme, Prepare for Landing. We expect a bumpy landing, a mild, short-lived recession in the second half of the year.

Inflation

Inflation is trending lower, but the low-hanging fruit has been picked. Inflation (CPI) peaked in June 2022 at 9.1% and is now down to 5.0% year over year. We expect inflation to continue to move lower, however the speed of decline will no doubt slow. Several inflation variables that spiked due to COVID or military conflict have cooled significantly, with commodities being the best example. Shelter, measured by rents, represents 33% of the headline CPI index. Home prices have finally stabilized, and we got our first glimpse of relief when year over year prices fell in April. Eventually, this should abate rent inflation. Lower inflation and weakening economic growth may change the Fed’s narrative, suggesting the hiking cycle is close to an end.

A risk to our forecast, which we have discussed previously, is if inflation moves lower at a slower pace than the Fed or the markets expect, or if inflation comes down and gets “stuck” at a level higher than the Fed target. This would cause the Fed to react with more rate hikes and possibly force the economy into a more severe recession.

Interest Rates

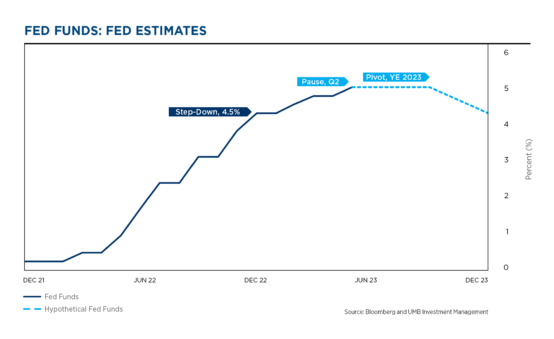

We think the Fed has reached the end of its hiking cycle. The Fed delivered one more 0.25% hike in May and we expect a pause for a prolonged period, allowing the economy to digest higher interest rates. There is also a substantial “lag effect” that delays how/when interest rate changes impact economic activity—higher interest rates today don’t have their full economic impact for 12 to 18 months. Higher rates coupled with banks tightening lending standards should slow economy growth and keep inflation in check. This will allow the Fed to “pivot” and begin lowering interest rates near the end of the year.

Slowdown or Recession?

The odds of an economic slowdown along with a mild recession have increased due to new headwinds from the banking turmoil. The economy was already vulnerable with stubborn inflation and high interest rates. Given the lag effect of higher interest rates, economic activity is expected to slow, perhaps to the point where a recession is declared. In addition, our primary recession indicators (Leading Economic Index, Yield Curve, and Consumer Confidence) are all flashing orange, signaling a looming recession. There is a high probability that toward the end of the year the slowdown will be labeled a recession.

Outlook

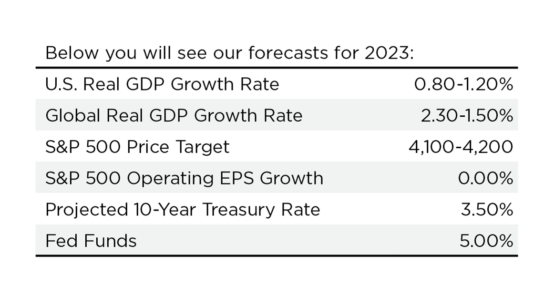

Our recession indicators continue to hint at an economic slow-down along with a mild recession in the second half of the year. We think this recession will be mild and short-lived due to the forecast of tame inflation and the Fed moving interest rates lower. We think short interest rates have peaked at 5.25% and will remain on hold for a number of months, then move lower to end the year at 5.0%. We think the 10-year treasury yield remains in a range of 3.3 to 3.7%. Risk-based assets, such as equities, are off to a good start up over 7%. Volatility will remain elevated throughout the year.

Bond Markets

The Ongoing Fallout from the Fed Cycle

The Fed continued to “step down” their tightening campaign during the first quarter, making smaller adjustments to rates. Still, inflation news took the bond markets on a wild ride along the way. For most of the first quarter, inflation seemed to be stuck at higher levels, and interest rates were rising to prepare for more aggressive moves from the FOMC. But late in March, when the turmoil in the regional banking sector hit, sentiment reversed and interest rates plummeted, as investors began assuming that both inflation and overnight rates would be headed lower later in the year.

We’ve been highlighting how interest rates impact the economy with long lag times—and noting that it will likely be mid-to-late 2023 before we know the full impact of the Fed’s aggressive tightening cycle. The Fed has moved overnight rates to 5.25% and is now hinting (as we predicted) that they will take a long pause to see how severely their moves will impact the broad economy. In addition to that, ongoing turmoil in the banking sector will likely slow down lending activity—so it is appropriate for the Fed to pause through most of the summer to see how quickly inflation and the economy decelerate.

We believe that inflation will continue to fall throughout 2023, pushing the Fed to pivot into an easing campaign late in the year. The broad markets shifted aggressively towards this outlook, which has driven yields down and prices up. We believe that last October’s peak rate on the 10-year Treasury (4.25%) will likely mark the high-point for this cycle. We have begun to extend maturities on bonds and moved towards heavier fixed income allocations. Barring a severe recession (which we do not foresee at this time), we believe longer-term rates have likely already fully priced in the most likely path for inflation and the Fed. Therefore, we don’t foresee interest rates on the long end moving meaningfully lower during the remainder of the year—with a high likelihood that the 10-year finishes the year very close to where it is now (roughly 3.50%).

High-Yield Markets

High-yield sectors followed the equity market during the first quarter, posting strong positive returns. All of the trends that helped push stocks higher have also bolstered high-yield bonds—and we believe those correlations will continue. We continue to believe there is a reasonable chance of a mild recession in 2023, so we are remaining neutral on High-Yield allocations, at least until we begin to see signals that the Fed is preparing to pivot toward an easing cycle. Once we have more conviction that a Fed pivot is on the horizon, we will increase allocations to risk assets, including high yield.

Equity Markets

First Quarter Recap

The first quarter got off to a robust start with the S&P 500 up over 7% and the Nasdaq surging more than 17%. There were several driving factors behind the market’s strength:

- Optimism that global central banks may halt interest rate hikes, or perhaps even cut rates by the end of the year

- Better than expected earnings

- An optimistic China reopening following the unexpected zero-COVID policy pivot late last year.

In March, banking sector turmoil grabbed headlines and triggered fears of a global banking contagion, causing investors to flee stocks for safer assets. Authorities took extraordinary steps to calms markets, providing liquidity and easing investors’ fears. However, the uncertainty surrounding the banking system creates a new risk to economic growth and corporate earnings.

Even after the roller-coaster ride for stocks in the first quarter, the S&P 500 rallied due to decelerating inflation and a potential Fed pause. In addition, a driving force of market returns was a rotation into some of the largest defensive growth names.

Earnings

We are in the middle of an earnings slowdown, which coincides with our forecast of an economic slowdown. This is important because eventually earnings drive stock prices. Last year S&P 500 earnings grew nearly 4%. Our 2023 forecast calls for 0% growth as companies look to cut back on spending and raise prices in order to compensate for margin pressures resulting from inflationary pressures and higher interest rates.

If economic conditions were to deteriorate rapidly, earnings could turn negative in 2023.

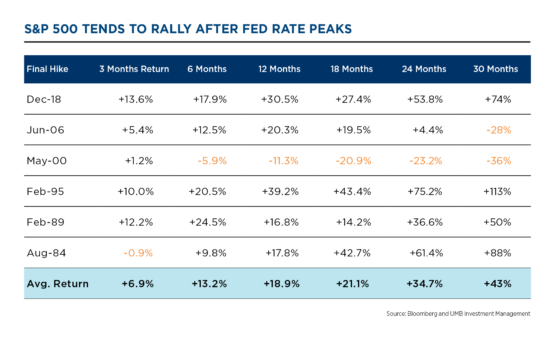

What Does a Fed Pause Mean for Equities?

Historically stocks are weak when the Fed is aggressively hiking rates, as illustrated by last year’s returns. However, history indicates that S&P 500 returns after a Fed pause are much more promising. Looking at the last six Fed tightening cycles, the average return for the S&P 500 1-year after the Fed pauses is 19%. The stock market is a leading indicator. The expectation for a Fed pause in June provides fuel for moving stock prices higher.

Forecast

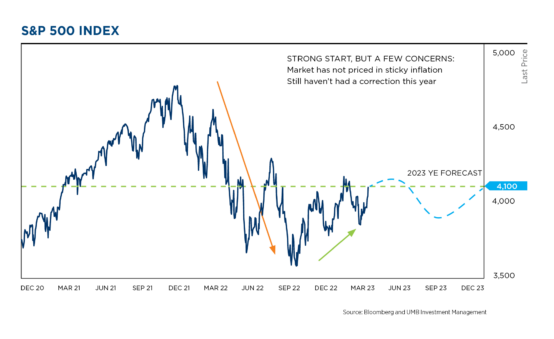

While encouraging to see the S&P 500 gain over 7% for the quarter and reaching our 4,100 year-end price target, we continue to forecast total returns for the calendar year in the 7 to 10% range for a number of reasons. First, we haven’t seen a correction this year, when a typical year experiences a 14% intra-year drawdown. Second, we don’t believe the market has fully priced in the potential risk of sticky inflation.

Alternatives and Privates

Real Assets

Commodities have been mixed year to date as oil and the broad commodity complex have traded down due to global economic uncertainty, as well as questions surrounding geopolitical concerns in countries such as China and Russia. The cyclical element of commodities is showing as market reactions are closely following economic indicators as they are released.

In real estate, there is a dichotomy on multiple levels. By property type, industrial and multifamily continue to appear in favor with attractive trends in vacancy rates and rental growth. On the other side is office space, which is seeing increasing vacancy rates at the highest levels since 2013. Within office there is a disconnect between the best properties and those that can be deemed “middle of the road” in terms of quality and amenities.

Employers seeking to bring talent back into the office are willing to pay premium rents for amenities and location while Class B properties are struggling with vacancy loss and rental growth. As employers continue to emphasize return to work and foot traffic increases, it would not be surprising if this trend continues. Regionally, some of the larger markets in the U.S. which saw population declines as a result of COVID are facing more pressure while the beneficiaries of those moves are less effected and even have tailwinds in some instances for rental growth and vacancies.

Alternatives

Any conversation around alternatives should come with a reminder that the asset class is very diverse, and the returns of underlying strategies have a much higher dispersion than other asset classes.

While 2022 was a proof point for including alternatives in a portfolio for its diversification benefits, the start of 2023 has produced more mild results to start as the broad asset class has underperformed both equity and fixed income market indices. Despite that, the current environment has the potential to create an enhanced opportunity set for investment managers using alternative approaches and investment instruments.

Part one is the return of a non-zero risk free rate which is often used as a base when determining premiums on things such as selling securities short, options pricing, and arbitrage valuations.

Part two is the increased volatility in the market which may create opportunities for alternative managers to act on. While that is true for traditional managers as well, alternative managers have additional methods to express their opinion and are generally more willing to act on dislocations in a meaningful way to add alpha.

Private Markets

The strong outperformance of private markets in recent periods has led many investors to be at or over their target allocations to the space. This combined with uncertain economic conditions has led to a slowdown in fundraising for new private investment vehicles compared to prior years. Some of the downstream impacts have included investment managers delaying or extending their fundraising windows and new firms entering the space may experience some challenges raising assets. As communicated last quarter, while our long-term outlook on private assets is positive, we anticipate near term valuation write-downs to reflect market uncertainty and increased financing costs, both of which we have seen cited by investment managers. Additionally, the IPO market and interest rate conditions have slowed down exit activity for the time being, meaning some private funds are holding on to their investments until a more attractive opportunity to sell comes up.

Economic uncertainties can also play to the advantage of certain segments of private markets, namely private credit. As tighter credit standards are enacted broadly, private credit managers have the opportunity to continue gaining market share as they have been for the last decade. This pull back from certain providers of capital could further bolster the returns available to private credit.

*Private investments require investors to meet the accredited or qualified purchaser requirements.

Banking Turmoil

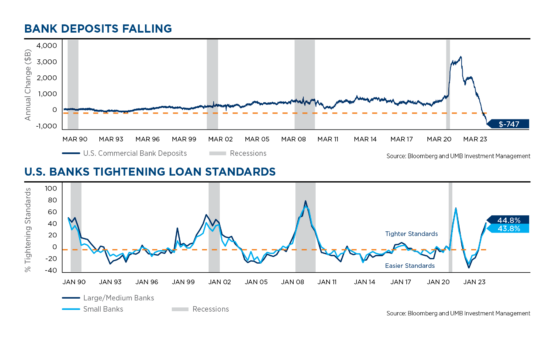

- The banking system was in the spotlight in the first quarter due to concerns on uninsured deposits.

- Stimulus during the global pandemic caused an unprecedented spike in banking deposits. However, after bank failures a significant amount of those deposits have left the banking system and for the first time in 50 years, bank deposits declined.

- Why does this matter? Banks and credit are the lifeblood of the economy. If banks don’t have deposits, they can’t lend. This will lead to slowing economic activity.

- Since the beginning of the year banks were tightening lending standards. The banking turmoil amplifies this.

- Above the orange line, banks are tightening their lending standards and slowing economic growth, below the line banks are easing lending standards, stimulating economic growth.

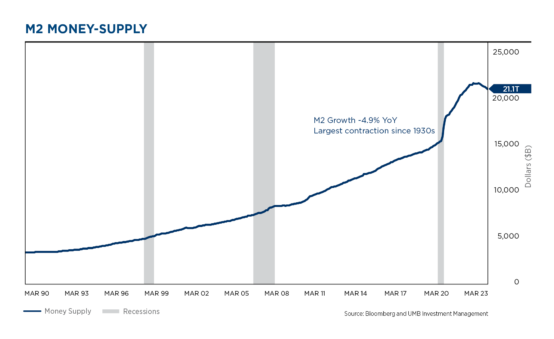

- M2 is a measure of cash and liquidity in the U.S. economy.

- Through the pandemic, we saw a spike in M2, which helped economic activity as well as financial markets. Now, with banks tightening lending standards, we see money supply slowing.

- Last month we saw a contraction of -2.4%, and the forecast for next month is -5.0%, the largest contraction since the 30’s.

- While the drop-off in M2 is unprecedented, we did have room for this drop-off given the massive stimulus and increase in supply since the start of the pandemic.

- All of this aligns with our annual theme, Prepare for Landing, where this decrease in money supply will slow the economy and likely result in a mild, short-lived recession.

Recession Indicators

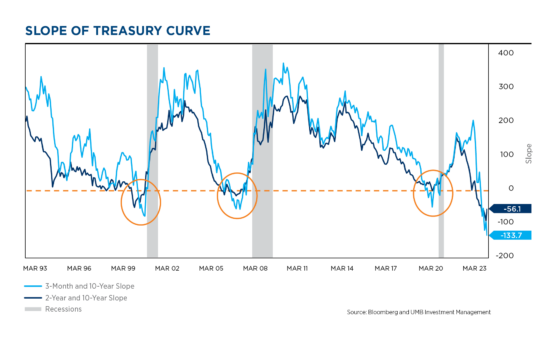

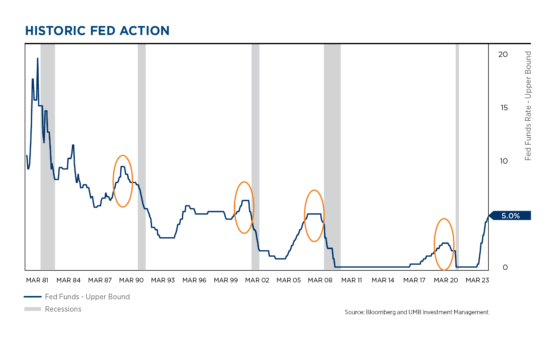

- Historically when we’ve seen inversions in the yield curve (orange circles), the Fed has stopped hiking. In this hiking cycle the Fed continued to hike interest rates long after the yield curve, Fed Funds to 10-yr. Treasury, inverted—unprecedented.

- In this hiking cycle, the Fed was only in the early stages of tightening when the yield curve inverted, causing the inversion to get worse.

- The continued inversion of the yield curve is a good indicator that a recession is likely coming.

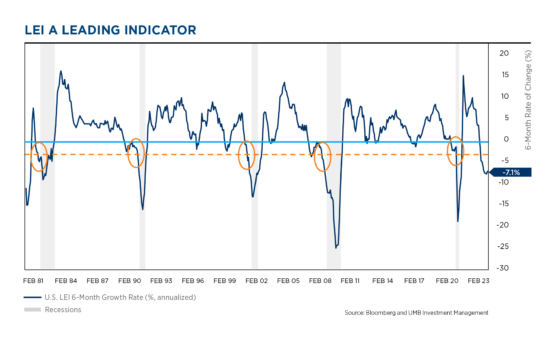

- The six-month rate of change in the Leading Economic Index (LEI) is one of our favorite recession indicators because of its almost perfect track record of forecasting looming recessions.

- Historically, when the six-month rate of change crosses -3.5%, a recession is imminent.

- The index currently stands at -7.1, which supports our theme of a bumpy landing.

- Given the index broke below this threshold a few months ago, it likely puts the timing of a recession closer to the end of the year.

Labor Market

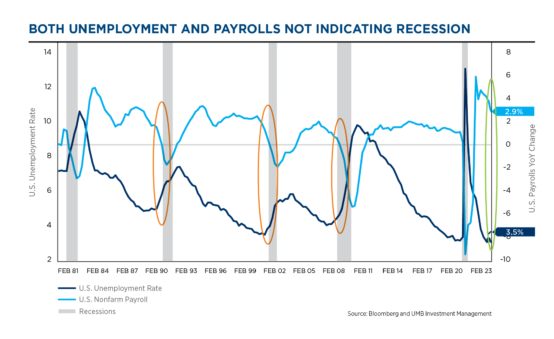

- We get a lot of questions of whether we are in a recession right now, we think the labor market is key to this answer.

- Headline unemployment, shown in dark blue, typically starts to rise as we enter a recession. Unemployment is a coincident indicator, not a leading indicator. We have yet to see an increase in unemployment, even with numerous layoffs that have been announced.

- If people are gainfully employed, they typically don’t change their consumption behavior, supporting our theme of a slowdown, not a severe recession.

- When you also look at non-farm payroll growth, shown in light blue, you see the same thing. When you enter a recession, you start to see payroll growth go down. While we have seen payroll growth slowing, it does not currently indicate we are in a recession.

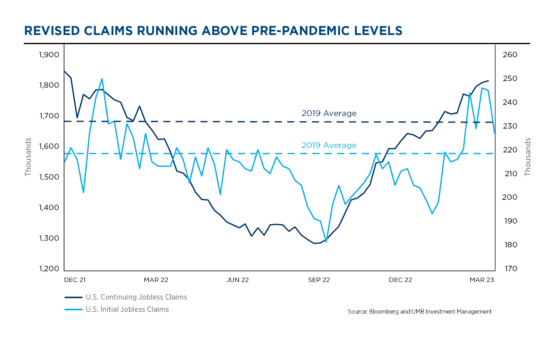

- Another number we follow closely is initial unemployment claims and continuing claims.

- Light blue is initial unemployment claims, people that have filed for unemployment insurance in the last week.

- Initial claims are starting to move slightly higher, giving us clues that economic activity is slowing, but not a sign we’re heading into a recession just yet.

- We still have 9.6 million job openings, that can change rapidly, but it’s hard to find people.

- One of the nuances of this cycle is that we could have a job-full recession, vs a job-less recession. So, if more people are employed it supports a mild, short-lived recession.

Federal Reserve

- The Fed typically gets blamed for causing recessions, and while all cycles have some similarities, they also have their own set of nuances.

- Typically, the Fed walks along with the economy, controlling inflation and controlling growth. Then, late in the economic cycle, inflation often is heating up and the Fed is hiking rates. The Fed usually will pause their tightening campaign, because interest rates work with a lag effect—they need time to see how quickly the economy will cool off.

- The Fed needs to let the economy digest higher rates, pausing well before an oncoming recession (orange circles). Historically, the Fed is easing before most of these recessions hit. It could be different this time, but often that has not been the case.

- Everything indicates we’re nearing the end of the Fed hiking cycle.

- The Fed is now at 5.25%, and likely to take a long a pause through the summer. And while the Fed says they intend to be on hold the rest of this year and into 2024, most strategists do not agree with the Fed and believe rates will be cut later this year.

- Given our forecast of a slowing economy and inflation subsiding, we anticipate that the Fed will lower interest rates at the end of the year. If they move lower quickly and in meaningful increments, they will have a chance of orchestrating a soft landing—avoiding a damaging recession.

Federal Reserve

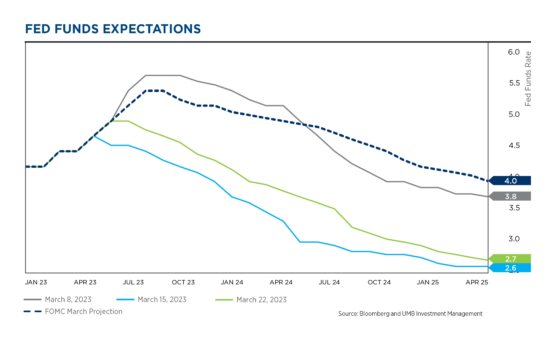

- This chart shows how quickly Fed Fund expectations have changed with all the turmoil we’ve seen.

- Light gray line shows Fed Funds expectations after the first week of March. The futures market said Fed Funds would rise above 5.5% this year and stay high into the first quarter of next year. Then, light blue shows when banking turmoil hit, sending forecasts nearly 200 basis points lower just one week later. Finally, shown in green, as banks calmed down, expectations started to move back up.

- The dashed line is the Fed Funds dot plot, the estimate the Fed established when they met on March 22. The Fed estimates they will still go higher and stay higher longer, which is a huge disconnect from the bond market, which says they will be easing as we get to the second half of 2023.

- Only time will tell who will be right, The Fed or the bond market, but historically the bond market has been a great predictor of future rates.

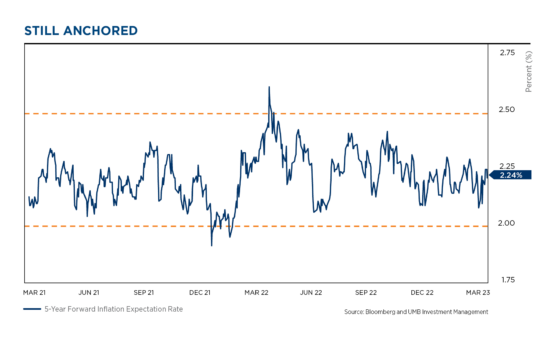

- The inflation expectation futures market has said all along that inflation will come back down to Fed targets. This matches the signals coming from the bond market.

- Shown here are 5-year forward inflation expectations, a datapoint the Fed follows, which indicates what the outlook is for inflation 5-years from now.

- While expectations spiked up a bit last year when we saw our first inflation scare, it has since settled down and is now holding steady in the middle of the long-term Fed target.

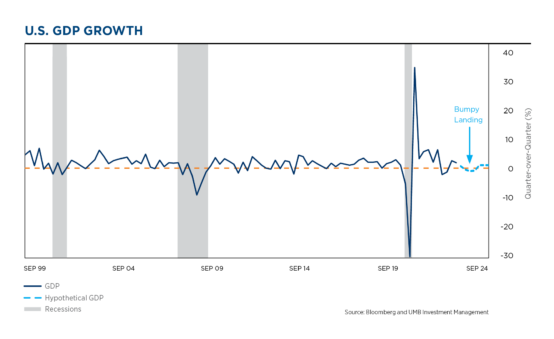

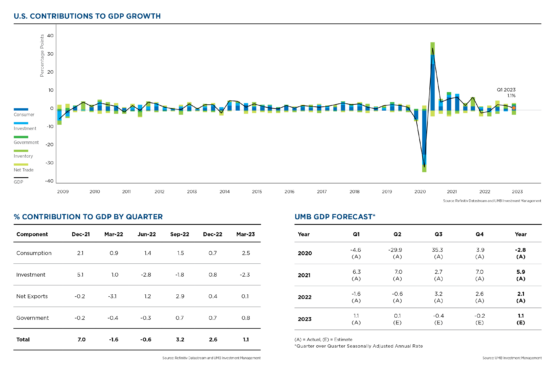

Economy

- Here we show quarter by quarter GDP growth going back to 1999. On the right you can see our forecast for a bumpy landing, a mild, short-lived contraction in economic activity.

- Fourth quarter 2022 GDP was a solid 2.6%. First quarter GDP was 1.1%, showing signs of a slowdown this year. Our annual economic theme is Prepare for Landing, we expect a bumpy landing. While we don’t think we will avoid a recession entirely, it’s more than likely a mild, short-lived recession, sometime in the second half of the year.

- Even with inflation, high interest rates, and stress in the banking system, the S&P 500 is up 7% in the quarter. One of the reasons stocks are up is because a looming recession was priced in the market late last year.

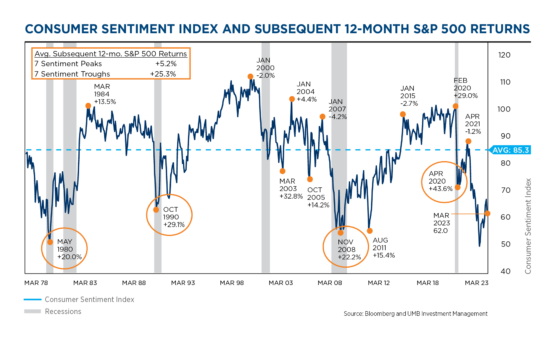

- Consumer confidence and sentiment were both extremely negative as we entered the year, typically when consumer sentiment reaches these levels it sets up stocks for better forward returns.

- Shown here is consumer sentiment relative to 12-month forward returns.

- Past troughs in consumer sentiment are followed by above average forward returns. On average, buying at a confidence peak returned 5.2% while buying at a trough returned 25.3%. We expect positive equity returns, perhaps not 25%, yet it does help explain why stocks are off to such a strong start.

Equity Markets

- We expect a Fed pause after the May Fed meeting.

- Shown to the left are the most recent Fed tightening cycles.

- Historically a Fed pause has been bullish for stocks, with U.S. equities generally rallying in the months following the end of past Fed tightening cycles.

- In the three months following the peak Fed Funds rate, the S&P 500 has returned an average of 7% and risen in 5 of 6 periods. On a 12-month basis, the S&P 500 has returned an average of 19%, again rising in 5 of the 6 periods.

- Coming into 2023, we expected the market to return 7-10% for the entire year. After the first quarter, we’ve already reached this target, but we hesitate to move our price target higher.

- On average, the S&P 500 experiences a 14% intra-year drawdown, regardless of the economic environment. This year, we haven’t seen a drawdown greater than 7%, even with the turmoil in the financial system.

- Due to the lack of material drawdown and inflation that may prove to be stickier than the market has priced in, we expect volatility to remain, and the S&P 500 to end the year up 7-10%.

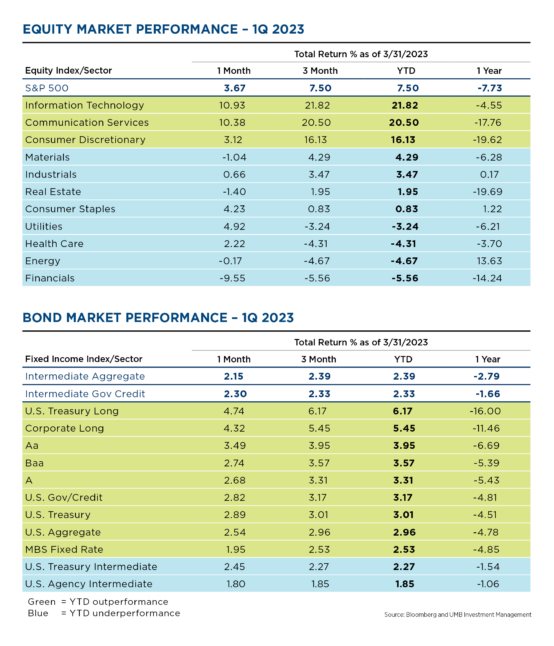

U.S. Market Performance – Equity and Fixed Income

- Q1 got off to a strong start with the S&P up over 6% in January amid optimism that global central banks might halt interest rates hike.

- In February, stronger than expected economic data dashed those hopes.

- In March, bank failures triggered fears of a global banking contagion that caused investors to flee stocks for safer assets and the financials sector to be the biggest laggard in the quarter.

- However, by month-end those fears eased with investors again raising expectations the Fed would cut rates by the end of the year.

- Even after the roller-coaster ride for stocks in the Q1 the S&P 500 still found a way to finish over 7% higher, with tech and FAANG stocks the big stand out.

- U.S. Treasuries saw their worst year in 2022 due to the Fed’s fast and furious rate hikes.

- In the first quarter of 2022, treasuries were stronger with the yield on the two-year note falling ~35 basis points to just over 4.05% and the yield on the ten-year note falling ~40 basis points to just under 3.50%.

- The fall in yields meant bond prices rose as investors wagered that the Federal Reserve won’t raise rates as high as previously expected due to the banking crisis.

Real Gross Domestic Product (GDP)

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

DISCLOSURES AND IMPORTANT CONSIDERATIONS

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2023. UMB Financial Corporation. All Rights Reserved.

*Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division

Insurance products offered through UMB Insurance Inc.

You may not have an account with all of these entities.

Contact your UMB representative if you have any questions.

SECURITIES AND INSURANCE PRODUCTS ARE: NOT FDIC INSURED | NO BANK GUARANTEE | NOT A DEPOSIT | NOT INSURED BY ANY GOVERNMENT AGENCY | MAY LOSE VALUE