2024 interest rate risk trends year in review

After the books are closed and year-end reporting is completed, it is a great time to take a step back and evaluate the balance sheet and interest rate risk trends we have seen over the past year.

Following interest rate increases in 2022 and 2023, we saw the first Fed Funds Target rate cut in September 2024. A gradual steepness was finally added to the yield curve in the later part of the year with further rate cuts while the long end of the yield curve was pushed up. The year ended with the Fed Funds Target rate at 4.25%-4.50%, 100 basis points (bps) lower than the prior year, and with a 33 bps spread between the 2 and 10-year points of the curve.

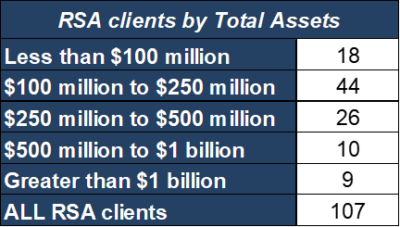

Let us examine how those rate movements impacted our clients’ bank balance sheets and December 2024 Interest Rate Risk results. As of early March, we have completed December 2024 RSAs for 107 clients. We have broken down the results by year-end asset size for comparison purposes.

Source: UMB internal data

Balance sheets stabilized in 2024 as deposit balances started to steady. Funding has been, and continues to be, a focus for banks. The volume and mix of bank deposits remained stable through 2024, with some movement from non-maturity deposits into time deposits. The stabilization of deposits has reduced the reliance on borrowings and wholesale funding, particularly in the later part of the year.

Banks are taking a measured approach to loan issuance to ensure it aligns appropriately with the institution’s funding. Many of our clients continue to allow investments to roll off to pay down borrowings or fund loans. Loans-to-total assets were up slightly for the year for most clients, while securities-to-total assets decreased in 2024.

Source: UMB internal data

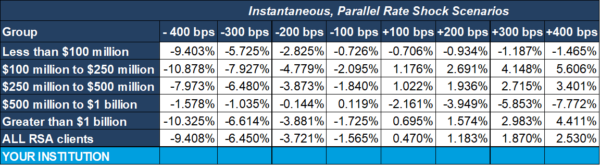

Earnings at risk

The earnings at risk simulations show that, given the structure of their balance sheets as of December 31, 2024, most of our clients are positioned to see an increase in net interest income should market interest rates rise over the next 12 months, although results are mixed. Overall, increases in rising rate scenarios have continued to come down. This is a trend we have seen over the last couple of years.

Declines in the falling rate shocks are larger than the modeled increases in the rising rate shocks due to many liability yields hitting the natural 0% floor quite quickly. For banks with a larger loan portfolio, the increase of prepayments in the falling rate shocks also impacts the volatility. It is important to remember that an individual institution’s estimates may vary greatly based on the model’s underlying assumptions.

Average % change in 12-month projected net interest income from base case

Source: UMB internal data

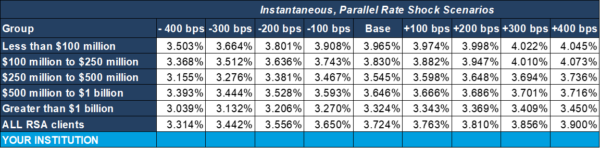

Industry-wide, net interest margins (NIMs) and return on assets (ROAs) have increased in 2024 as deposit costs appear to have peaked and, in some instances, have started to come down while asset yields continue to climb as lower rate items mature off the balance sheet and are replaced with higher rate items.

On average, most of our RSA clients demonstrated this trend. The projected NIM increased by 28 bps between December 2023 and December 2024 reporting in the base case scenario. This also translated into an increase in ROAs, which was up 20 bps from December 2023 reporting. The base case NIM and ROA for all RSA clients with December 2024 data came in at 3.724% and 1.461%, respectively.

Average 12-month projected net interest margin

Source: UMB internal data

Average 12-month projected return on assets

Source: UMB internal data

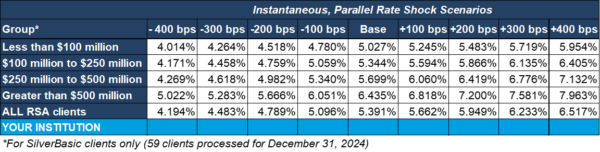

In the base case scenario, the projected average yield on earning assets for all clients is 5.391%. With the elevated rate environment, this has continued to climb over the year and is 39.5 bps higher than the 2023 year-end.

Average 12-month projected yield on earning assets

Source: UMB internal data

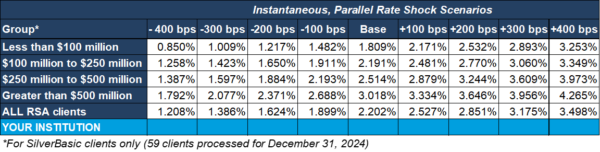

The cost of funds increased over 2024, but the pace slowed significantly from the prior year. The projected cost of funds for all RSA clients came in at 2.202% with December 2024 reporting. This is up just 10 bps for the year compared to the 102 bps increase in 2023.

Average 12-month projected cost of funds

Source: UMB internal data

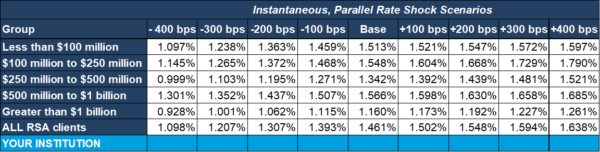

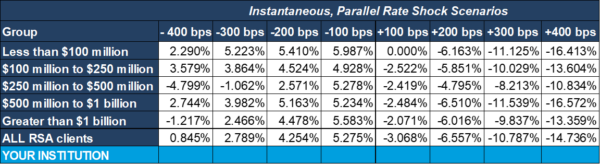

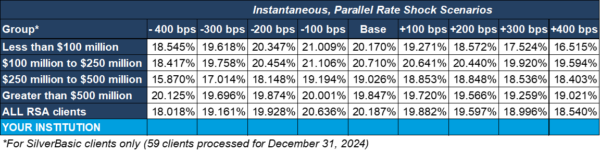

Economic value of equity

The following tables show the results of the economic value of equity (EVE) simulations performed using December 31, 2024, data (EVE = Net Present Value of Assets – Net Present Value of Liabilities). Overall, EVE volatility remained fairly stable for most banks. The falling rate shock results show abnormal trends since many items on the balance sheet are hitting the natural 0% floor at various points in the rate shock.

Note that the EVE volatility outlined below remains within healthy and acceptable levels. Leverage ratios (EVE ratios) increased slightly over the year from high levels. Non-maturity deposits are still being held at rates lower than market yields, which benefit financial institutions from an earnings perspective and a valuation perspective.

Average % change in economic value of equity from base case

Source: UMB internal data

Average leverage ratio (EVE ratio)

Source: UMB internal data

The financial markets anticipate potentially more interest rate cuts in 2025. The most recent Federal Open Market Committee(FOMC) Dot Plot forecasts two rate cuts over the next year. This added steepness to the yield curve should create a more favorable banking environment. If the long end of the yield curve remains elevated, banks will continue to capitalize on the repricing of assets.

The cost of funding is expected to come down with anticipated rate cuts. However, the extent might not be as large as we hope. Depositors may be less willing to accept lower deposit rates while banks are still cautious about liquidity. The balance between deposits and loans will be a focus of 2025.

If you have any questions or wish to discuss the results of this analysis in greater detail, please contact your UMB Investment Officer or Financial Services Group analyst for more details.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED