Financial planning and analysis are core functions that require strategic work, software, and financial teams behind you. Some institutions refer to the pairing of financial analysis and performance metrics as a performance consulting suite, and it is often an outsourced capability. Foundationally, performance consulting starts with forecasting and budgeting systems. In this article, we draw on a case study from one of our current client institutions to outline the data used, the forecasting processes, and provide a detailed context for the value of balance sheet and income statement analysis. Additionally, we dive into specific details on data consolidation, how current balance sheet components are forecast, and the various methods available to project growth.

The first step: Data consolidation

Before financial analysis can be conducted, the received data must be complete and comprehensive. From the perspective of our financial team, data is collected monthly from our client institution’s general ledger (balance sheet and income statement), as well as instrument extracts for loans, investments, deposits, and funding sources.

This data is used to update both the data consolidation model (DCM) and the instrument import files, as well as the chart of accounts (COA). All loans, investments, deposits and funding sources exported from the bank are used to create instrument import files. These instrument import files are set up in a format that facilitates the upload to our forecasting engine (UMB uses ZMdesk).

Once the data is received, we proceed with proper data consolidation. The process of combining data into accounts with the most finely tuned “re-pricing” characteristics is the benchmark for accurate forecasting. To maximize the value of forecasting, the data must be accurate and reliable.

All non-interest income and expense accounts are created at the most detailed scale possible, based on the materiality of the data, to enable a reasonable level of analysis. The DCM serves as a control point to ensure that instruments and supplemental information are balanced back to the general ledger. The various balance sheet components are reviewed to determine if the reported interest income and interest expenses align with reported volumes and rates. Interest income and expenses from the general ledger may be allocated, on a pro-rata basis, to several account categories based upon the average volumes and rates. Once the DCM is completed and reviewed for reasonableness, it is uploaded to the historical results database.

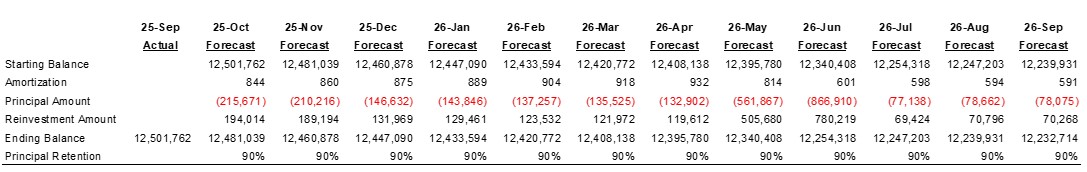

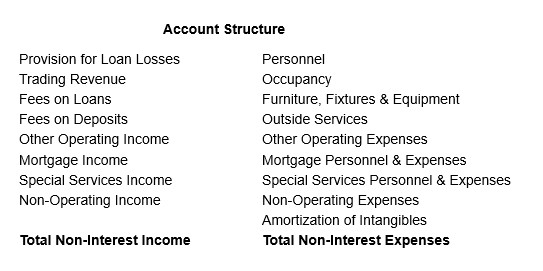

Below is a list of the most common account categories utilized in the DCM and COA:

The COA incorporates the same data collected for the DCM and is used to upload results to the forecasting software, including the instrument import files. Once uploaded to the software, assets, liabilities, and capital are reviewed and compared to the DCM and the data is processed. Bond information is updated through multiple fixed-income datasets to provide the most recent pricing data. Exports are created from the forecasting software, which includes balance sheet volumes, rates/yields, and income statement results, to generate a performance analysis report.

Next up: The performance analysis report

In the performance analysis report, actual performance is measured against budgeted expectations on both a monthly and year-to-date basis. Actual performance is also compared to results from the prior month and the prior year. This report enables the bank to compare the current month’s results with various essential time frames. Once the performance analysis is reviewed, the process of preparing the forecast begins.

Forecasting factors: Current balance sheet components

Each instrument is forecast using a specific methodology. Simulation analysis uses contractual account data to imitate the behavior of each instrument and calculate changes in interest and expenses. Cash flow modeling is calculated for each investment, loan, time deposit, and borrowing as submitted by the institution’s instrument extract files.

Loans

Loans are evaluated at the individual instrument level based on their specific reset information as provided by the institution. All fixed-rate loans are assessed based on contractual maturity dates. All adjustable or variable-rate loans are measured by a contractual tied index, reset frequency, margin to the stated index, floors, ceilings, and rate change caps.

Cash flows are derived from the forecasting software (we use one with a proprietary prepayment model), scaled by a factor determined by the institution’s reported loan prepayment analysis CPR speeds and the model’s calculated speeds.

Investments

For all investments, instrument-specific pricing data is retrieved from various sources, including monthly bond accounting, Moody’s Analytics, and Bloomberg, for applicable coupons, maturities, call dates, adjustable-rate information, and lifetime and periodic floors and caps.

Deposit cash flow

Non-maturity deposit cash flows are generated using the institution’s multi-dimensional decay table as calculated by its core deposit analysis. All interest-bearing non-maturity deposits are assumed to be adjustable at any time, but are scaled by the institution’s applicable rate betas, lags, ceilings, and floors.

Interest-earning deposits

Time deposits and borrowings are calculated using individual maturities and applicable call dates, as necessary. Any adjustable instruments are evaluated individually based on their specific reset information, as provided by the institution.

Looking ahead: Measuring and predicting growth

Growth chart creation

The growth chart, which is a listing of accounts for the upcoming 48 months, is exported from the forecasting software to a spreadsheet to create the forecast. The prior month growth assumptions are applied to the starting volumes (actual month results). At this stage, any board or management assumptions received after the completion of last month’s forecast will also be incorporated.

Assumptions can be emailed, uploaded, or provided verbally. Loan, investment and deposit growth can be in either percentage or dollar amount form. Likewise, non-interest income, expenses, and provisions for loan losses can be reported as a monthly or annual amount.

Balance sheet growth projections (volumes)

Each balance sheet account can be projected in various ways. An account can be forecasted to increase by either a specific dollar amount or as a percentage over a specified period. Another option would be to assume that any principal balances or payments, if applicable, would run off at maturity. Lastly, we could assume that just a portion of those balances is allowed to run off. The remaining balance can be reinvested in the same type of instrument or a completely different one, depending on preferences.

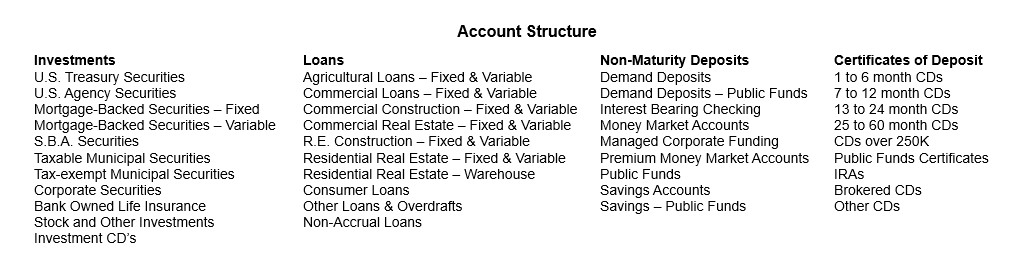

The example below illustrates a commercial loan with an initial balance of $5 million. This account has four quarterly maturities within the following year. In this instance, we have assumed this commercial loan category will grow on a straight-line basis by $2.5 million over the next 12 months, reaching a total of $7.5 million.

Source: UMB Internal Data

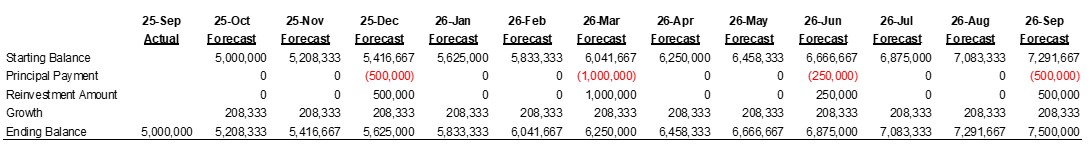

Alternatively, a commercial construction loan, with a $5 million balance and four scheduled maturities, is projected to run off, resulting in a reduced ending balance of $2.75 million at the end of 12 months. As you can see below, the maturities are not reinvested at maturity, and there is no additional growth.

Source: UMB Internal Data

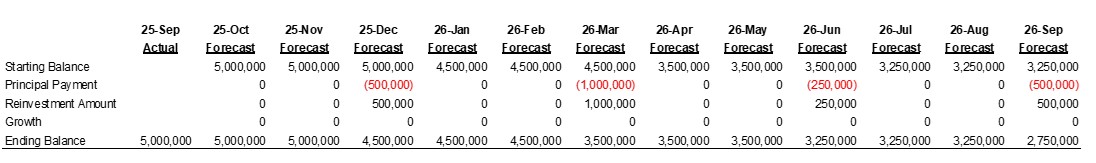

According to the account below, 90% of the principal payments are projected to be reinvested in the same account category. At the end of September 2025, the balance of this mortgage-backed securities account was $12,501,762. Within 12 months, the balance is forecasted to decrease to $12,232,714.

Source: UMB Internal Data

Accounts like cash and due from banks typically have fluctuating balances, making it less than ideal to forecast based upon one month’s reported value; therefore, we create an average balance and override the starting balance. Any growth assumptions would then be based on the average balance.

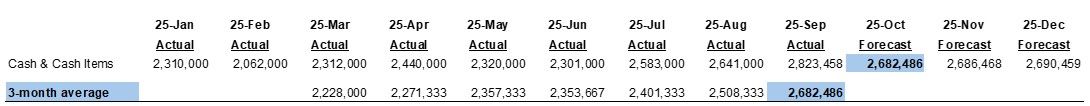

As shown in the example below, the cash and cash items account balance was $2,823,458 as of September 30, 2025. Based on a 3-month average, this account is projected to be $2,682,486 as of October 31, 2025.

Source: UMB Internal Data

Non-interest-bearing, non-maturity deposit balances can also vary significantly from month to month. Therefore, overriding the starting balance with an average balance might be more appropriate. Any growth assumptions would then be based on the average balance.

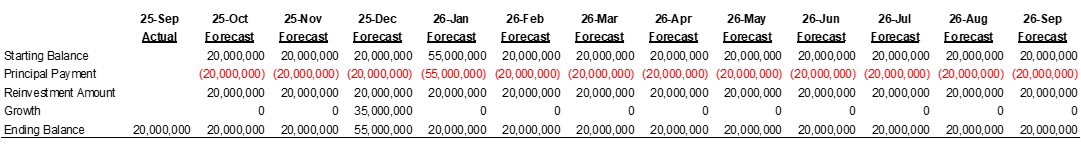

Below is an example of a non-maturity public fund deposit account that has been identified as having a significant seasonal inflow and outflow of balances. Historically, the balance of this account is $20 million. However, this account is projected to increase to $55 million during December, with the additional $35 million forecast to be withdrawn the following month, returning the balance to $20 million.

Source: UMB Internal Data

Balance sheet growth projections (rate/yield)

Reinvestment rates on loans are determined by reviewing the rate of the most recently originated balances within each account. A strong preference is placed on the rates of loan volumes opened within the last 90 days. A longer horizon may be used depending on the changes to market interest rates. All reinvestment rates are compared to a market index, and a margin or spread is created. As interest rate indices change, the spread is maintained, and a new rate is calculated in future periods.

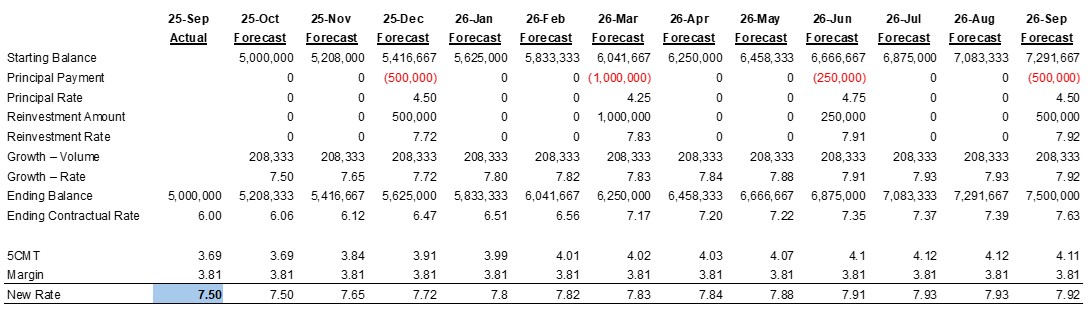

In the example below, the starting balance is $5 million with a weighted average rate of 6.00%. During the third quarter of 2025, new loans in this account were originated at a rate of 7.50%. When the principal payments or maturities occur, they are forecast to be reinvested at the new rate, which is assumed to be the five-year treasury (5CMT), with a margin of +3.81%. Any new volume would also be added at the rate determined by the 5CMT and the margin. As a result, by the end of the third quarter of 2026, this account is forecast to be $7.5 million, with a rate of 7.63%.

Source: UMB Internal Data

For each investment account, the reinvestment yield is determined by first identifying the average term of the most recent purchases. The average term is then matched to UMB’s record of the most recent investment purchases by portfolio type and term, and the corresponding rate will be utilized.

Reinvestment rates on interest-bearing, non-maturity deposits are forecast at the current weighted average rate of the specific account. Projected changes in rates are scaled by the institution’s applicable rate betas, lags, contractual ceilings and floors. Practical ceilings and floors, a reasonably high-rate and low-rate level that an account would be allowed to rise or fall, are also considered.

Projected renewal or new rates for certificates of deposit (CDs) are based on the most recent openings or renewals. However, internal institution rate sheets are also a factor. CDs may be opened or renewed at rates not listed on the rate sheet. Therefore, both methodologies are considered when selecting the most appropriate renewal rate or the rate assumed for growth.

Non-interest income and expense projections

All non-interest income and expense accounts, with minor exceptions, are forecast by first analyzing the results of the last 3, 6 and 12 months of actual data, creating a reasonable average, and projecting forward, assuming 2% and 3% annual increases for income and expenses, respectively. The table below lists the various types of non-interest income and expense accounts, which could be modified.

The reported results of each account, as well as averages and prior month’s forecast projections, are reviewed monthly, and adjustments will be made where necessary. Below are two examples, each with a different methodology: one involves a forecast override, and the other consists of an assumption shock.

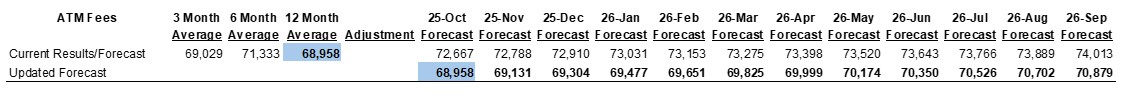

Forecast override example:

The 12-month average ATM fees were $68,958, while the current forecast is approximately $73,000 per month over the next 12 months. The updated forecast reflects a reduction to this account, starting at the 12-month average and then increasing 2% annually.

Source: UMB Internal Data

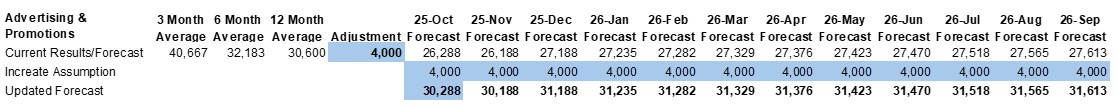

Assumption shock example:

Below is an example of a non-interest expense account. Advertising and promotions have averaged $40,667 and $32,183 over the last 3 and 6 months, respectively. The 12-month average of $30,600 is approximately $4,000 less than the current forecast, which is shown to begin at $26,288 in October 2025. Based upon the 12-month average, it is determined this account should be raised by $4,000 per month.

Source: UMB Internal Data

Both account examples above are straight line, which is probably the simplest to forecast. However, trends in the actual monthly results will be identified and forecast accordingly. Some examples might include non-sufficient funds (NSF) fees, weekly versus monthly payroll periods, year-end bonuses, employee taxes and benefits as a percentage of salaries, and cash payments versus accrual.

Dividend forecasting

Dividends are forecast based on each institution’s specific dividend policy, which may include cash and/or tax dividends.

When applicable, a dividend estimate model may be utilized to calculate quarterly dividends. In the dividend estimate model, tax dividends will be determined by calculating the institution’s taxable income. Taxable income is calculated by net income reduced by tax-exempt items like income on bank-owned life insurance, tax-exempt loans and investments, as well as factoring in provisions and charge-offs.

A simpler cash dividend calculation may be used. Fixed dividends can be incorporated into the forecast. Alternatively, dividends can be projected based on a percentage of earnings or calculated to maintain a specific capital ratio.

Forecast review and data checking

Once all the growth assumptions are in place, the forecast is evaluated for reasonability. The balance sheet volumes, yields and income statement are reviewed at the detailed account level. The results of the current forecast are compared to the forecast from the prior month, including volumes, yields, income, and expenses.

Monthly reporting

Each month for our clients, we produce a three-year forecast, which includes the current year perspective, featuring both actual results and monthly forecasts, as well as next year and third year forecasts. Balance sheet volumes, rates, income statement and performance ratios are included for each year. This allows the institution to have a forward-looking mechanism for its projected future performance.

Annual setting of the budget (baseline)

We prepare an annual budget for our bank clients, reflecting the expected volume changes in each asset, liability, and income statement account. The bank’s management may provide additional input regarding the outlook for the upcoming year, new assumptions, or any changes to the preliminary budget they would like to implement.

We adjust our growth chart and forecast accordingly, and export the updated balance sheet volumes, yields, income statement, and market rates files from the forecasting software.

Finally, the client bank will present this budget to its board for review and approval. Upon approval, we set this as the budget and baseline forecast for the next 24 months.

Wrapping up our summary of performance consulting

Data consolidation and forecasting are key segments to creating financial analyses. Institution-specific data is used, combined into practical accounts, and balanced back to the general ledger to ensure the information is complete and comprehensive.

The forecasting process leverages a range of variables, including contractual account characteristics, reinvestment rates, and growth trends. The value of performance consulting forecasting lies in monthly modeling, which enables an institution to review opportunities and potential risks associated with the balance sheet and income statement over the next three years.

Once this foundational system is in place, additional reporting services can be provided, including:

- Liquidity and Contingency Funding

- Liquidity Planning

- Capital Analysis and Assessments

- Capital Planning

- Dynamic Strategic Plan Reporting.

These systems further enable us to run stress tests and “what-if” scenarios, further empowering your institution’s executive management.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED