Contrary to expectations of a decline, interest in closed-end funds (CEFs) remained strong in 2024, according to new research from UMB Fund Services in partnership with FUSE Research Network: Unlisted Closed-End Funds: Proven Concepts Ready for Next-Generation Investors and Product Trailblazers.

Download our report to review a market update reflecting on data through the first half of 2024, as well as insights into top investment categories, strategies, pricing, and top-performing funds.

The paper explores the bright outlooks for:

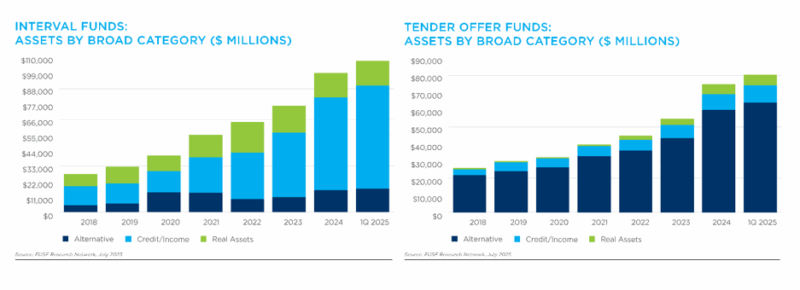

- Interval funds focused on credit/income and real assets strategies.

- Tender-offer funds with private equity and multi-alternative strategies.

It also explores investors’ attitudes. New investors and advisors are becoming more comfortable with the higher liquidity risk associated with alternative assets for longer-term investments.

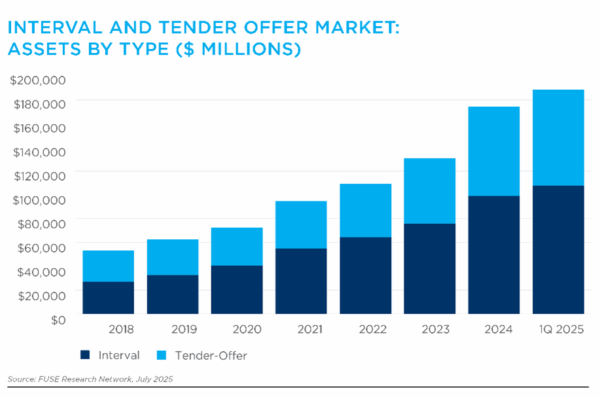

The following updated data as of Q1 2025 further highlights the trends we saw from the 2024 report:

Bolstered by historical performance, the market for unlisted CEFs has potential for further growth, and current market conditions favor the emergence of new product manufacturers in the unlisted CEF sector:

- Interval and tender-offer funds grew from $34.3 billion in assets under management (AUM) in 2014 to $188.1 billion in the first quarter of 2025.

- Interval fund assets have experienced record growth since 2014, sharply increasing from $6.5 billion in 2014 to $107.7 billion as of the first quarter of 2025.

- Tender-offer funds have grown steadily from $27.9 billion to $80.4 billion during the same period, nearly tripling their assets since 2014.

Focusing just on the first quarter of 2025, overall unlisted CEF assets are allocated to private credit ($83.4 billion), alternatives ($80.8 billion) and real assets ($23.9 billion).

Other findings include:

- The robust flows into credit/income strategies in the first half of 2025 coincided with investors actively seeking higher yields and potential capital gains than what was available to them in traditional markets.

- In the first half of 2025, investors continued to lean on real assets such as real estate, commodities and infrastructure to hedge against inflation and generate steady income streams.

- The overwhelming majority of private-equity assets are in tender-offer funds.

Accompanying the paper is a discussion by UMB leaders about planning for success with unlisted closed-end funds. Topics include structure, platform readiness and operational considerations. If you are exploring the launch of an unlisted closed-end fund—of any kind—we’d be pleased to share more from our experiences.

Learn more about how UMB can support your firm’s registered and alternative investment fund administration needs, or contact us to be connected with a fund services team member.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.