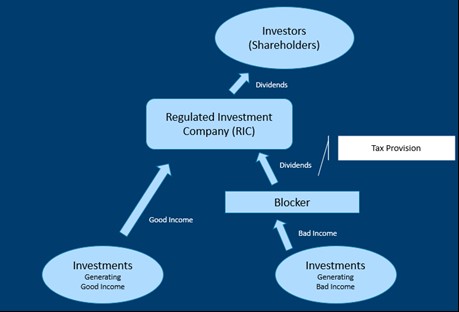

In the context of interval and tender-offer funds, tax blockers are tax-paying corporate entities used to transform “bad income” into “good income.” Interval and tender-offer funds are particularly attractive for investments in asset classes such as real estate, private equity, and debt instruments, where traditional liquidity mechanisms are not readily available. At the heart of managing these funds is the challenge of maintaining tax efficiency, a critical factor that can significantly impact the fund’s net return and its attractiveness to investors.

The U.S. tax code mandates that regulated investment companies (RICs), including interval and tender-offer funds, must derive at least 90% of their income from specified sources of “good income” such as dividends, interest and gains on the sale of securities to maintain their tax-advantaged status. (“Bad income,” by contrast, isn’t a technical term. Rather, it’s any income not specified as “good income.”)

Failure to meet the annual 90% income test could result in the loss of the RIC status, subjecting the fund to corporate taxes and potentially diminishing the returns available for distribution to investors. In our experience, the below are common sources of “bad income” for interval and tender-offer funds:

- Commodity derivatives

- Physical metals

- Publicly traded partnerships (PTPs) other than qualified publicly traded partnerships (QPTPs)

- Real estate (rental or gain)

- Ordinary trade or business income, such as fee income from loan origination

- Virtual currency gains

Tax blockers transform “bad income” into dividends

A tax blocker, typically structured as a C-corporation, intercepts income that does not meet the “good income” criteria. The blocker pays corporate taxes on this income and distributes what remains in the form of dividends, which are “good income” under RIC requirements.

Historical context for tax blockers

Blockers have long been used in private funds, in the context of a master/feeder structure. This arrangement typically consists of a master fund that pools investments from multiple feeder funds. The feeders “block” certain types of income that could otherwise have negative tax implications for investors such as pension funds and tax-exempt entities.

Adapting the feeder concept to interval and tender-offer funds is a more recent innovation.

Tax blockers may be domestic or offshore

When implementing a tax blocker, fund managers must decide between establishing a domestic or an offshore entity, such as a Cayman Islands corporation. Typically, U.S.-based blockers are preferable when the investments generating the “bad income” are conducting business in the U.S.

Funds with investments outside the U.S. may benefit from offshore blockers. In this case, fund accountants must estimate the U.S. tax liability, if any, of the offshore entity. Keep in mind that for interval funds—which offer daily liquidity—this must be done each day.

Some funds have both U.S. and offshore blockers. Of course, using any blocker introduces additional legal, regulatory, administrative and tax complications—and maintaining them in multiple tax jurisdictions only adds to the complexity.

Operational and financial implications of using tax blockers

Using tax blockers adds layers of complexity to fund management, such as:

- Separate financials. Tax blockers, being separate legal entities, require their own set of financial records and accounting practices.

- For financial reporting purposes, the activities of the tax blocker must be consolidated with the fund’s overall financial statements.

- Tax liability management. Fund managers and their accounting teams must accurately calculate the tax implications of blocker activities, including the recognition of deferred tax assets or liabilities based on the blocker’s unrealized gains or losses.

- Strategic tax planning. The use of blockers requires a forward-looking approach to tax planning, considering both immediate tax liabilities and future tax implications.

Figure: Diagram of typical RIC structure with tax blocker entity

Bottom line

By mitigating adverse tax implications, tax blockers allow tender offer and interval funds to operate tax efficiently without significant alteration of their intended investment strategy. Blockers mitigate the risk of RIC qualification failure and allow investment managers to choose from a broad variety of investment classes without fear of subjecting the fund and its shareholders to double taxation.

However, using tax blockers introduces costs—both direct costs, including corporate taxes paid by the blocker, and indirect costs, such as administrative and compliance expenses—that fund managers must weigh against the potential for enhanced tax efficiency and investor appeal.

This communication should not be construed as tax advice. In the event any information contained herein is deemed to be tax advice, it was not intended or written to be used for the purpose of avoiding tax penalties.