After much anticipation, Congress passed‡ legislation known as the One Big Beautiful Bill (OBBB‡), which President Trump signed it into law. Many of the bill’s key provisions will take effect as of January 1, 2026. While there are many components to the bill, below are some highlights that will directly impact your finances.

Impact of individual tax rates

2017 Tax Cuts and Jobs Act (TCJA), are now permanent including lower individual income tax brackets and larger standard deductions. The existing tax brackets and standard deductions will continue to adjust with inflation annually.

Strategies to consider:

With the OBBB individuals may consider:

- Roth conversions

- Charitable and inter-family gifting opportunities

- Holistic asset allocation reviews

Now is the time for you and your financial team to proactively plan for taxes. Discuss with your team how these strategies can be implemented within your overall strategy.

State and Local Tax (SALT) Cap Impacts

Previously under the TCJA, the SALT cap was limited to $10,000 per year. Residents of certain states such as New York and Florida were losing valuable tax deductions every tax season. Under the OBBB, the SALT cap increases to $40,000 with a 1% yearly inflation through 2029 for certain taxpayers whose annual income is under $500,000 per year. For those individuals with income between $500,000 and $600,000, there would be a phaseout of the increased SALT deduction down to the existing $10,000 annual cap.

Discuss with your financial team before tax season how these changes could impact your tax bill.

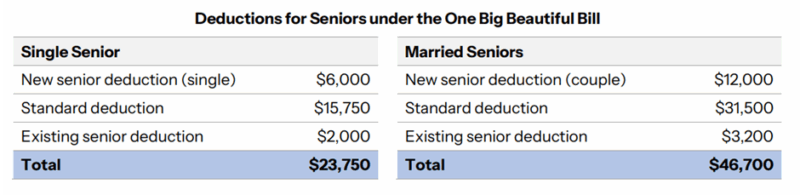

Senior Tax Deductions

There will be a new tax deduction for seniors ages 65 and older for tax years 2025 – 2028. Single filers who have taxable income under $75,000 and married couples with taxable income under $150,000 will get an added $6,000 deduction per filer. This is subject to income phaseouts whereby the deduction is eliminated at $175,000 (for single filers) and $250,000 (for married couples). This added deduction for seniors is on top of the standard deduction.

Per the White House‡, the potential tax impact for those eligible to claim the deduction are:

Estate Tax Exemption Changes

The estate tax sunset was a primary concern for ultra-high-net worth and high-net-worth individuals. With the OBBB, the exemption is permanently increased to $15 million per person indexed for inflation instead of the current $13.99 million per person.

Strategies to consider:

For ultra-high net worth individuals, there’s no longer a need to fund taxable gifts by the end of the year to take full advantage of estate and gift tax exemptions. It is still recommended your estate plan is a living document and something you review with your team annually to ensure you can optimize your tax benefits and align your investments with your goals.

Charitable Deduction Impacts

The OBBB will provide several key changes for the non-profit arena. First, there are new favorable provisions for non-itemized filers who have charitable intentions. Singler filers who do not itemize on their tax return may claim a $1,000 charitable deduction. Married taxpayers can receive a $2,000 deduction on a jointly filed return. Previously, taxpayers who did not itemize were unable to deduct charitable donations on a federal return.

Private foundations will now have a progressive excise tax on the net investment income based on the total asset value held by those organizations. In prior legislation, these private foundations paid a flat 1.39% tax. Under the OBBB, there will be four tax rates that will range from 1.39% to 10%. These tax rates are not marginal, which means that once the foundation’s assets exceed a certain bracket, it is taxed at the next level. Below are the asset size and tax rates for reference:

| Asset Size | Tax Rate |

|---|---|

| $0 – $50M | 1.39% |

| $50M – $250M | 2.78% |

| $250M – $5B | 5% |

| $5B + | 10% |

Strategies to consider:

Those people who are charitably inclined may consider options such as:

- Donor advised funds

- Appreciated security transfers to qualified charitable organizations

Discuss with your team how a charitable strategy can work within your overall financial and investment plan.

Education planning and child tax credit changes

The OBBB has increased the child tax credit, for those who are eligible, from $2,000 to $2,200 starting in 2026, indexed for inflation. Under the TJCA, the credit was scheduled to be halved to $1,000 beginning in 2026. Another new feature under the OBBB is the creation of “Trump Accounts” for those children born between 2025 and 2028. The U.S. government will make a one-time contribution of $1,000 for qualifying children into these vehicles. Parents can contribute an additional $5,000 annually. This money can be accessed by the child starting at age 18 for qualified purposes such as paying for college, starting a business, or buying a first home, and can be accessed by the child beginning at age 30 for any reason.

Strategies to consider:

If you are planning on having children (or grandchildren) within this timeframe, please contact your financial team to discuss if the “Trump Accounts” are appropriate for your situation.

Vehicle Credits and EV Changes

The OBBB has eliminated the tax credits for buying an electric vehicle effective September 30, 2025.However, those individuals who are in the market for a new car may be able to deduct up to $10,000 in auto loan interest if they buy a U.S. manufactured vehicle. To receive this maximum $10,000 deduction, the taxpayer must have income that is $100,000 or less. For those who exceed this income threshold, the deduction will phase out.

Strategies to consider:

Talk with your team about your options for purchasing a new car if you are in the market.

With all the changes coming, now is the time to talk to your financial team and build a financial plan that works best for you and your unique situation.

Interested in learning more about Private Wealth Management? With UMB, you have a guiding partner from financial advising and investment portfolio management, to wealth-building strategies and retirement and legacy preservation plans.

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. We have provided these links for your convenience. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully.

Financial planning services are offered by UMB Private Wealth Management, a division within UMB Bank, n.a. that manages active portfolios for individuals, fiduciary accounts, employee benefit plans, endowments and foundations. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This material is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities or engage in any specific investment strategy. Statements in the presentation are based on the opinions of the author and are subject to change at any time without notice. You should not use this presentation as a substitute for your own judgment, and you should consult the appropriate financial professional before making any tax, legal, financial planning or investment decisions.

| Securities and Insurance products are:

NOT FDIC INSURED | NO BANK GUARANTEE | NOT A DEPOSIT | NOT INSURED BY ANY GOVERNMENT AGENCY | MAY LOSE VALUE |