As we have been expecting, 2025 is indeed proving to be the year of uncertainty and volatility. The global tariff storm is building with U.S. tariffs increasing and strong counter measures now being launched at the U.S. by our major trade partners. Listen to our current analysis by watching the recording below.

Tariffs make an impact

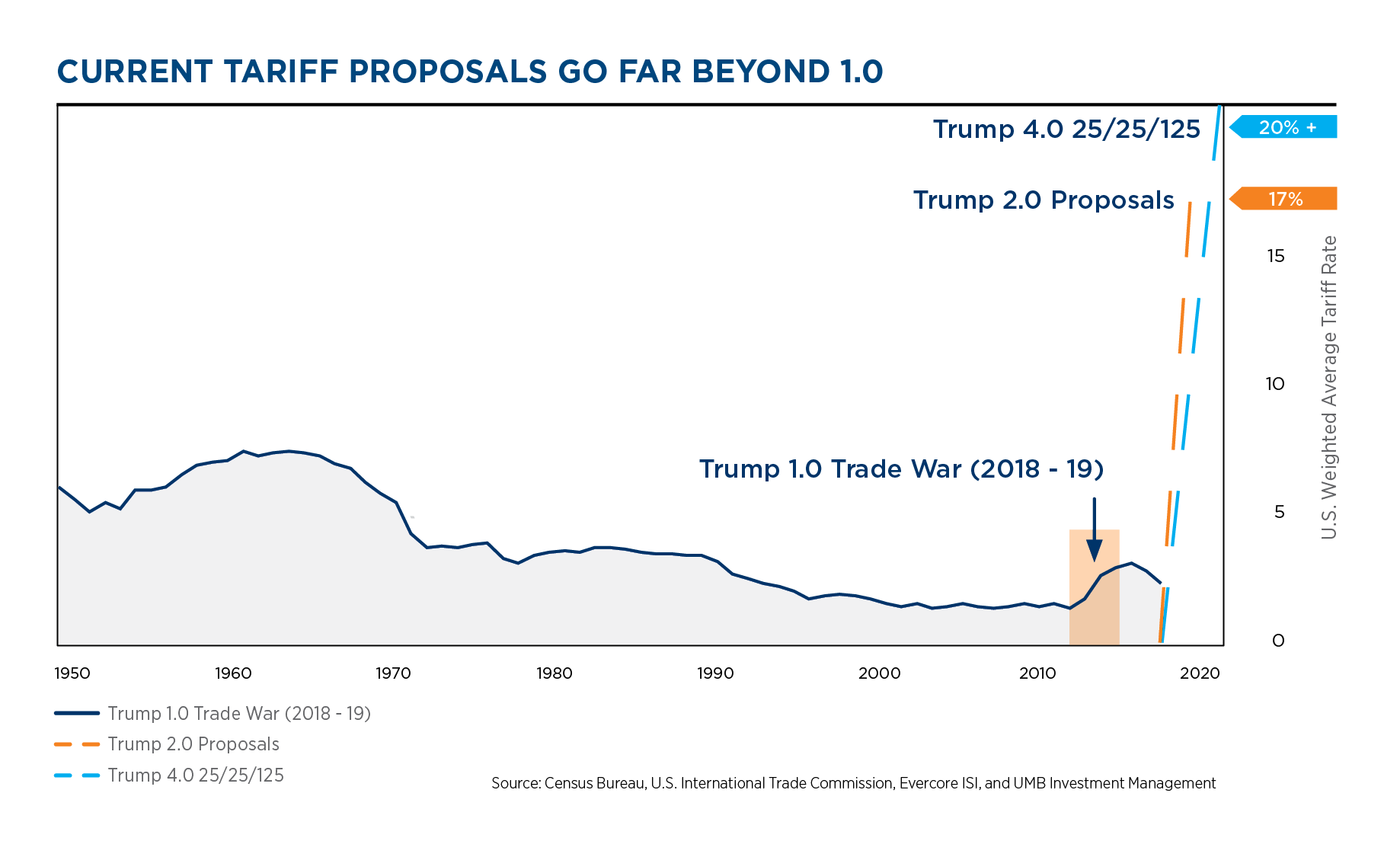

At this time, we’ve had huge tariff increases against China, paired with some reprieve for some of the other trade partners. At current levels, the new tariff regimes are virtually certain to drive prices up and consumption down around the globe.

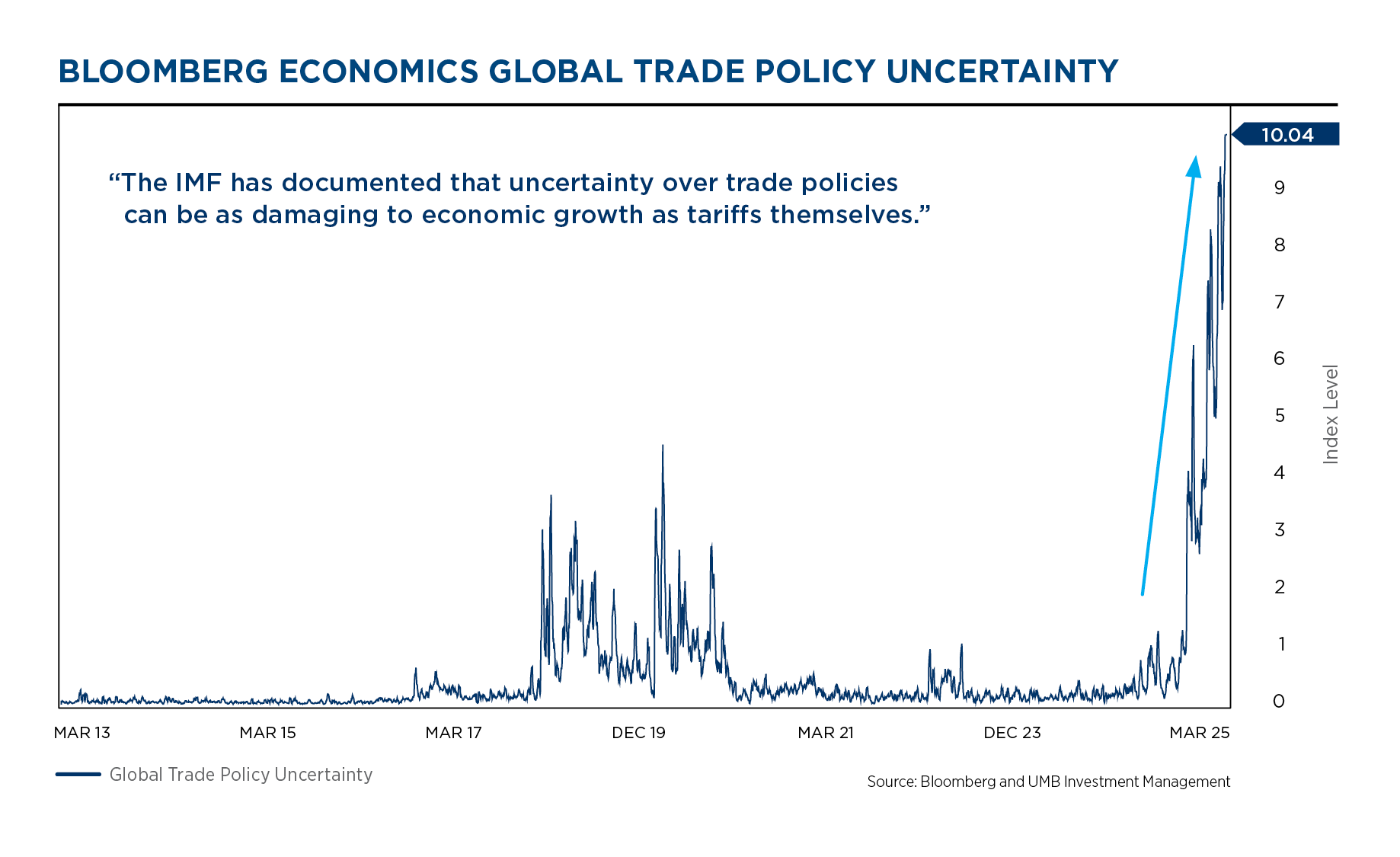

The countermeasures back towards the U.S. were widely anticipated, but the severity of the numbers and unwavering resolve of the Administration is spiking uncertainty and causing additional turmoil in the financial markets. Uncertainty around the entire situation is very high, and likely to remain that way. Global estimates of the probability of recession are increasing daily, with the average currently falling around 50%.

There are several efforts D.C. could launch to help soften the blow of the tariffs for example, tax cuts or regulation relief. We are likely to see proposals along these lines in coming weeks. The range of potential outcomes is quite wide and nearly impossible to discount at this time.

Fed’s tough decisions

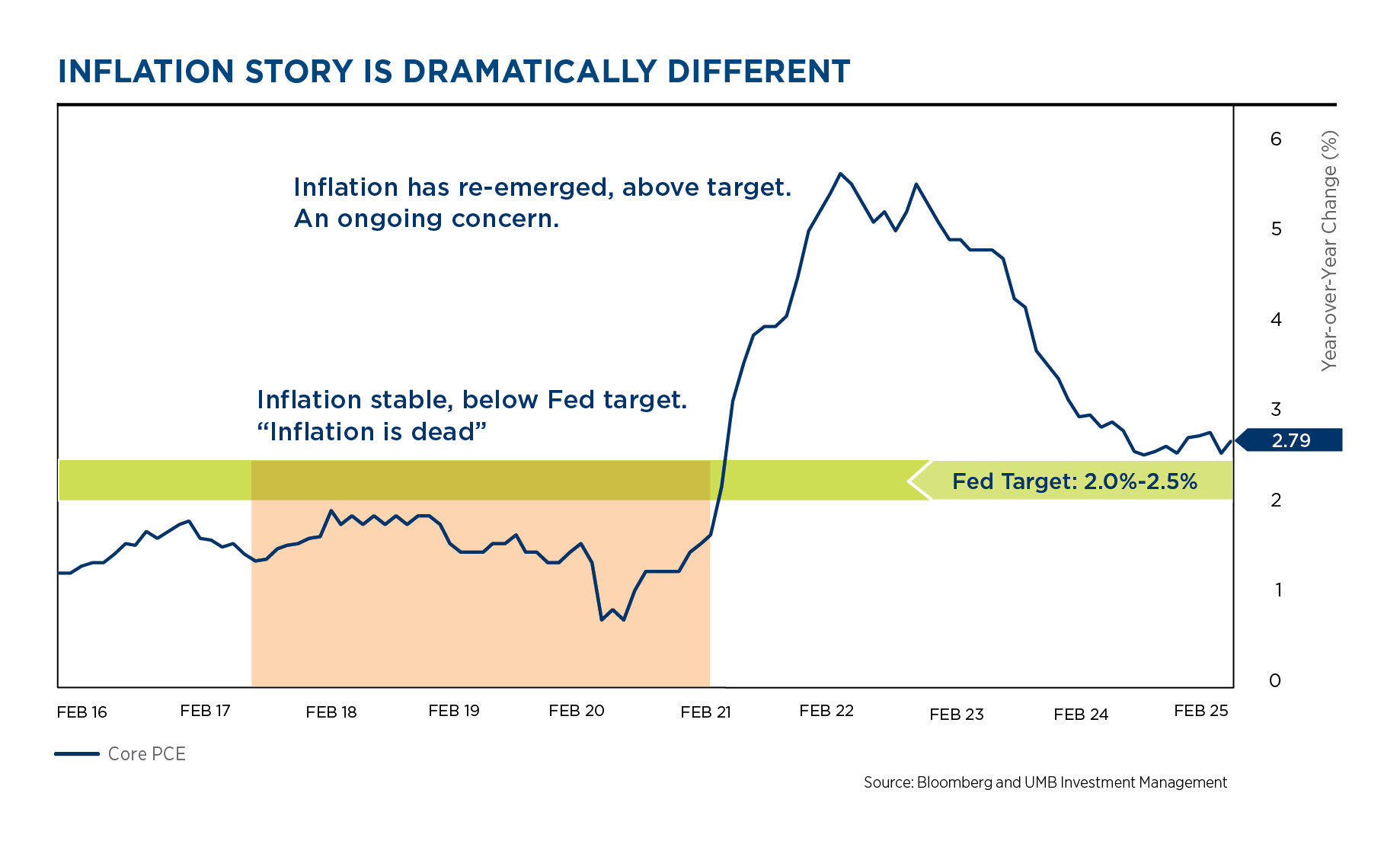

Current estimates from some major firms are calling for economic activity to slow to the 0-1.00% range for calendar year 2025. Many global forecasters are now calling for a 50% (or higher) probability of a short and mild recession in next 12 months. Also because of impending high tariff rates, many firms’ estimates show inflation pushing from around 2.7% up to the 3 – 3.5% range.

The prospect of a slowing economy with high-and-increasing inflation puts the Fed in a very difficult situation – rising inflation will make it very difficult for them to cut rates, but they will be under extreme pressure to push rates lower to help rescue a declining economy and financial market. In recent days, the Fed has clearly stated that they are not ready to cut rates yet, because of concerns over inflationary pressure from tariffs.

Over the longer term, if trade negotiations appear to be making progress, it would be rational to expect that they may declare the tariff-based inflation to be “transitory” and choose to focus on boosting the economy, moving rates lower later in the year. But over the shorter term, there will be lots of consternation over the conflicting signals facing the Fed, and their inability to “rescue” the economy or markets in the next few months. With inflation high and rising, they will only be able to cut rates in the near term if we show signs of clearly falling into a recession.

Softening economy

As we’ve been diligently highlighting over recent quarters, the U.S. economy was already beginning to soften before the tariff battle erupted. Leading indicators from the Labor Market have been pointing towards a meaningful slowdown for several months. Additionally, consumer sentiment has been deteriorating steadily — and that deterioration has accelerated in the face of the uncertainty around the global trade war. The economy will be more reactive, and more likely to slip into contraction, if the tariff battles are not resolved in a relatively timely fashion.

The Markets:

The financial markets entered 2025 after two years of stellar returns, which also means that valuations were “full” — some would say stretched. When fully valued markets get hit with economic surprises and high levels of uncertainty, we are assured a spike volatility. Volatility has erupted during the early stages of the trade war and the U.S. equity market has been under pressure. We’ve had a ~13% correction (peak to trough for the S&P) at the time we are writing this report, with YTD returns sitting right around –9%. This is a sharp re-pricing of risk, which is to be expected during times of accelerating uncertainty. f

The outlook:

The risk of a short recession is likely a flip-of-a-coin prospect at this time. Everything hinges on the timing and effectiveness of negotiations around the onerous trade tariffs that have recently erupted around the globe. It is impossible to have certainty around where the Administration intends to land once negotiations are complete – but we must remain hopeful that the situation will eventually be concluded in a manner that is more beneficial than what we are being faced with at this moment in time. We’ve had some “green shoots” of progress towards negotiations in recent days, but we still have a very long road ahead in stabilizing things with China and Europe. There is a risk that enough damage has already been done to confidence that we end up enduring a brief period of economic contraction but these issues have been created rapidly by political wrangling, and they can be resolved just as quickly through negotiation. We will have to wait out the fiscal thrust-and-parry and manage what we can.

Fixed Income outlook

Interest rates pushed steadily lower throughout the 1st quarter of 2025, as markets begin preparing for potential economic deceleration associated with the trade war. The 10-year treasury dropped 60 basis points, to 4.20, reflecting concerns that the battle over global trade would severely hamper global economic activity.

Since March, rates have been on a volatile path, dropping to 4.00, then spiking back up to 4.40 — reflecting the massive uncertainty surrounding the trade war. Economic momentum is slowing, but inflation is stuck well above the Fed’s target. The trade war is likely to push inflation higher and economic activity lower in coming months, putting the Fed into a very difficult situation. There will be cries to have them lower rates to help boost the economy and assuage the volatility in the financial markets, but upward pressure on inflation will likely keep them locked into a holding pattern for the next several months.

The Fixed Income outlook will hinge on the trajectory of the overall economy. Inflation coming from tariffs will likely be “transitory,” as most historical data show that inflation moves higher, then steadily grinds lower after a batch of new tariffs.

The economy was already weakening before Liberation Day, so the risk of the U.S. slipping into recession is not insignificant – the average estimate is somewhere around 50% at this time. Therefore, the most likely long-term direction for interest rates is lower. With carry yields around 5%, we would expect fixed income returns to be in the 5% or higher range over the next 12-24 months. The risk to this outlook is if Inflation moves higher and proves to not be transitory, which would force the Fed to increase rates — an outcome that would be damaging for both equity and fixed income returns.

Uncertainty over both Inflation and the federal budget deficit will likely add volatility to interest rates throughout 2025. As politicians wrangle over tariffs and tax cuts, bond market participants are likely to see higher levels of interest rate volatility. Over the longer-term, we think that rates in the current range offer reasonably attractive yield opportunities for investors.

Equity outlook

Stocks started the year strong, climbing to a new record high by the middle of February, before reversing course and falling in dramatic fashion. The S&P 500 briefly dipped into correction territory before finishing the quarter just under 10% off from its peak in February. Weakness was driven in large part by fears around tariffs and the potential hit to economic growth as a result. Softer economic data, worries over sticky inflation, and cracks in the AI secular growth narrative were also among the catalysts that contributed to the sharp selloff in the back half of the quarter.

Over the last two years, most of the gains in the S&P 500 were driven by the Mag 7 names. That theme has started to unravel in 2025 as big tech leadership faltered during the quarter, with Mag 7 stocks on average down 16% during the quarter and off 25% from their 52-week highs. This is important because any move within Mag 7 has huge implications for the market, with the group comprising about a third of the index. The S&P 500 goes as Mag 7 goes, so it shouldn’t be surprising to know Mag 7 stocks were responsible for the entire -4.3% drop in the S&P 500 index this quarter, with each one posting a loss. The group’s weakness was tabbed in part to emerging cracks in the AI secular growth narrative, particularly after the January DeepSeek selloff, growing fears around slowing of AI-related capex from major hyperscalers (like Microsoft), and a slowdown in cloud spend as AI models become cheaper and more efficient. While we think these Mag 7 names are still high-quality in nature, earnings growth is slowing, and we’ve been looking to reduce what had been a consistent overweight within our equity portfolios as we diversify the portfolio into additional high-quality names with less cyclical / more resilient earnings and strong moats while we wait for more opportunities to come our way.

As the economic environment remains highly uncertain, we expect a choppy market to continue until more economic clarity can be found. The average drawdown for bear markets without a recession is -27%, however if the economy does continue to slow and we do enter a recession, the average drawdown for bear markets with a recession is -43%. In times like these, regardless of which direction the economy heads from here, it’s important to remember to stay calm, stay disciplined, and focus on the long-term plan. Downside risk is the price that stock market investors are willing to pay for long-term performance.

What does it mean for your portfolio and assets?

2025 is already a year of extraordinary uncertainty and volatility. The Fed will likely be caught in a “Fiscal Pickle” — grappling with high and increasing Inflation, while simultaneously dealing with a decelerating economy. The uncertainties around the tariff skirmish will almost certainly push our economy towards near-zero growth rates, so the risk of slipping into a mild recession is not insignificant. However, if Inflation is pushing higher, it will be very difficult for the Fed to pursue lower rates in order to help stimulate the economy and markets.

The best thing to do in uncertain times is to stay anchored in a long-term financial plan that doesn’t shift in response to market volatility or elevated noise in the media. Take time to understand your long-term risk posture and asset allocations. Trying to time the market seldom works and instead you should speak with your financial team to determine what is best for your financial picture. Staying rooted in your plan will help you weather the storm ahead.

Taking a closer look

- Tariff proposals and countermeasures are changing almost daily

- Latest figures show an average tariff rate on our trade partners above 20%

- This is the largest increase in tariffs in nearly a century

- Prices on imported goods are certain to see upward price pressure

- Overall global economic activity is likely to be put under severe pressure if current proposals are left in place longer-term

- The tariff war has dramatically increased uncertainty around the globe

- Rising uncertainty puts pressure on all types of discretionary spending

- Hiring and CapEx will be expected to drop substantially if uncertainty stays elevated

- Massive increase in uncertainty puts pressure on all corners of the financial markets

- Falling prices in financial assets puts further pressure on sentiment and consumption

- Inflation is currently too high, stuck well above the Fed’s target of 2.00%

- The tariff war is nearly certain to increase prices of many goods in the U.S.

- Inflation rates are expected to rise from current levels over the next several months

- It is possible that core inflation will be pushed back up to the 3 – 3.5% range

- High and rising inflation data will make it very difficult for the Fed to consider lowering rates (to help stimulate the economy)

- Tariff-based inflation may be transitory, as it should taper back off 12-24 months from now

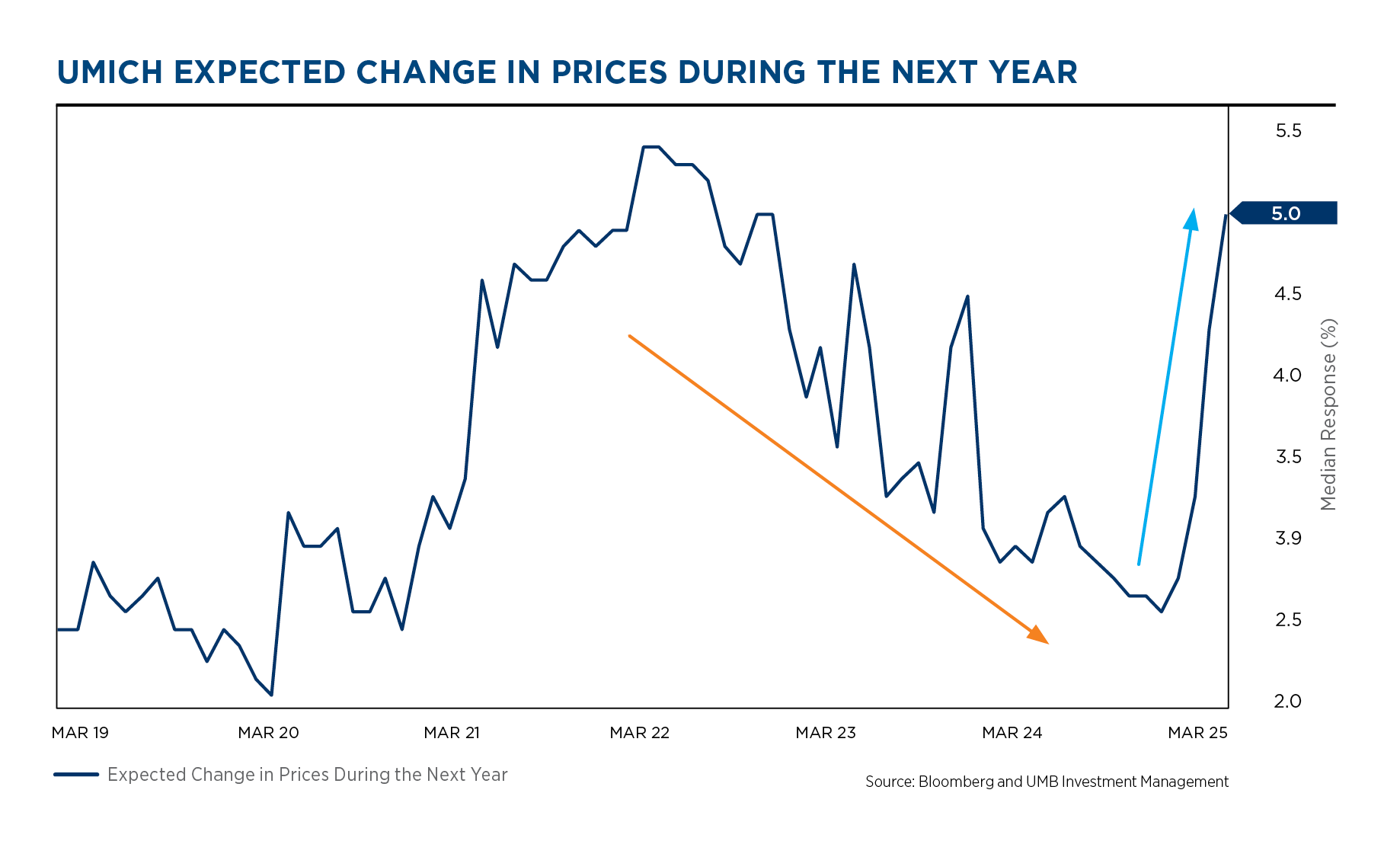

- Consumers and the markets are expecting higher-than-normal inflation in coming years, and the runup in Inflation expectation has been severe

- Expectations for the future level of Inflation have been rising steadily and are at unacceptably elevated readings

- Additionally, both consumers and the Fed are reporting increasing uncertainty around the outlook for inflation. The combination of elevated expectations and elevated uncertainty are both issues that the Fed is highly concerned with

- The Fed likely will need to see these variables soften before they are able to move rates meaningfully lower

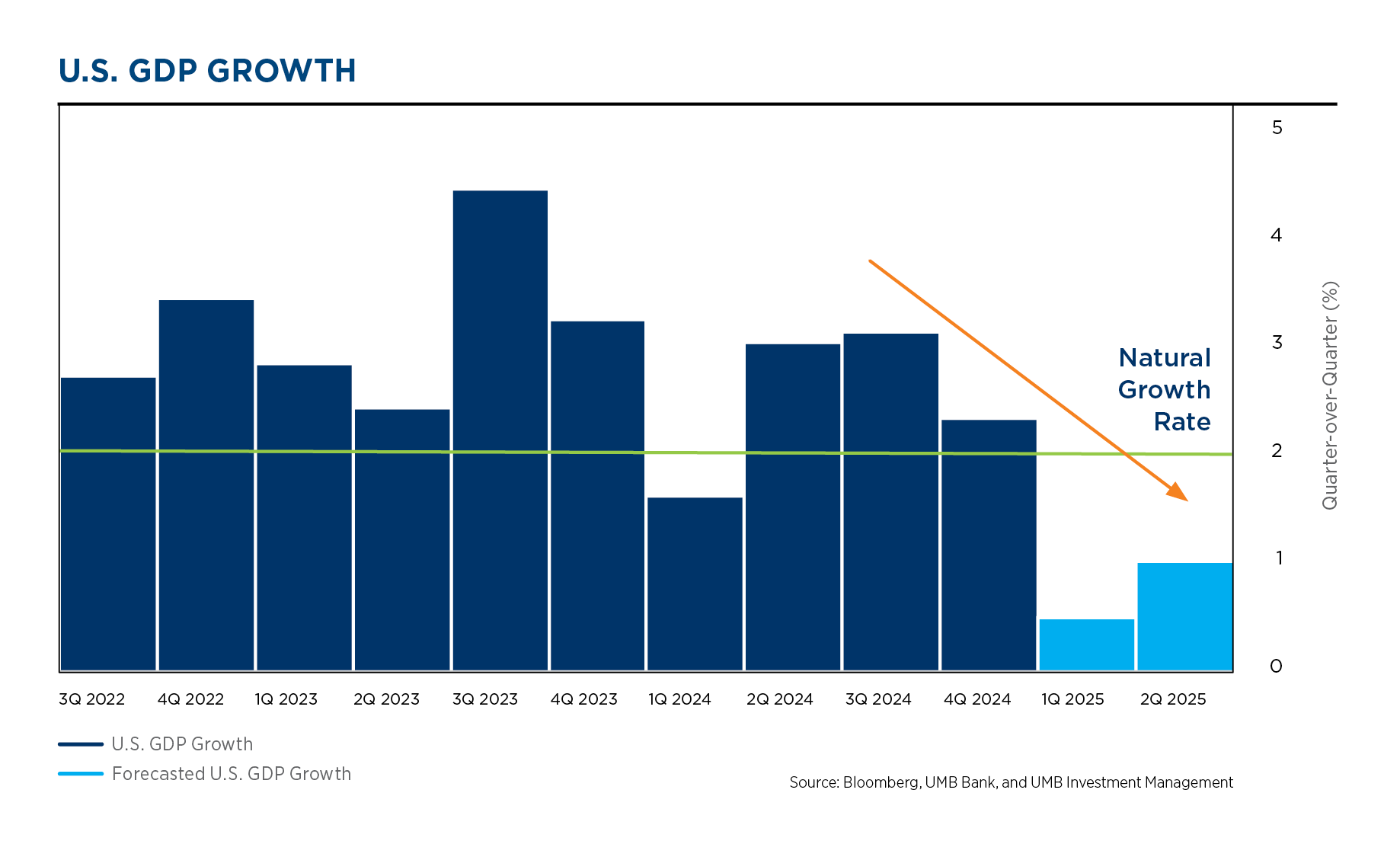

- The U.S. economy was already on a path of decelerating growth coming into 2025

- The above-average growth rates of 2023 and 2024 were unsustainable, and had caused the Inflation problem we’re now grappling with

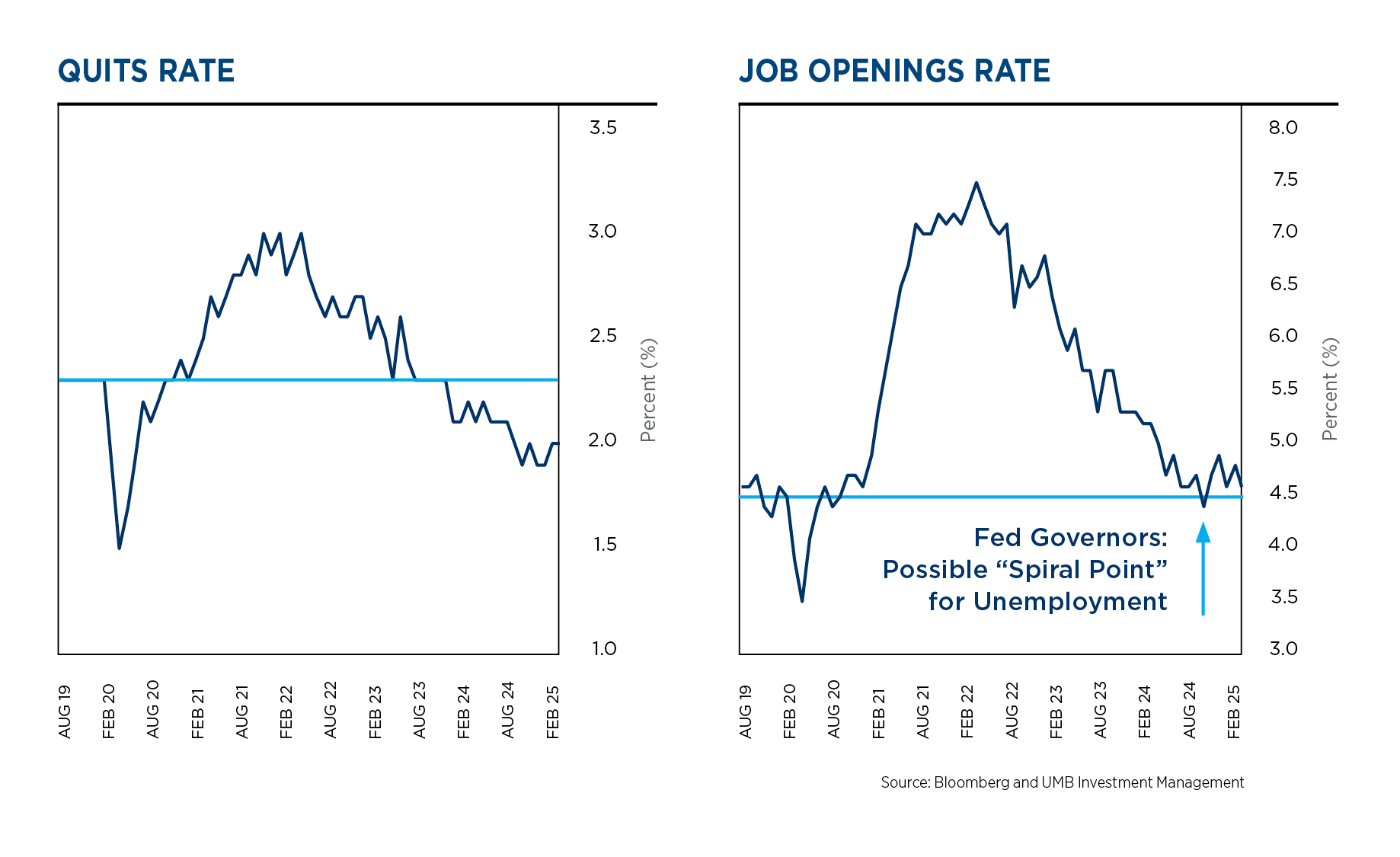

- Labor markets have been showing signs of deceleration for quite some time (see below)

- Consumption patterns had been driven, in large part, by excess savings from the Covid stimulus

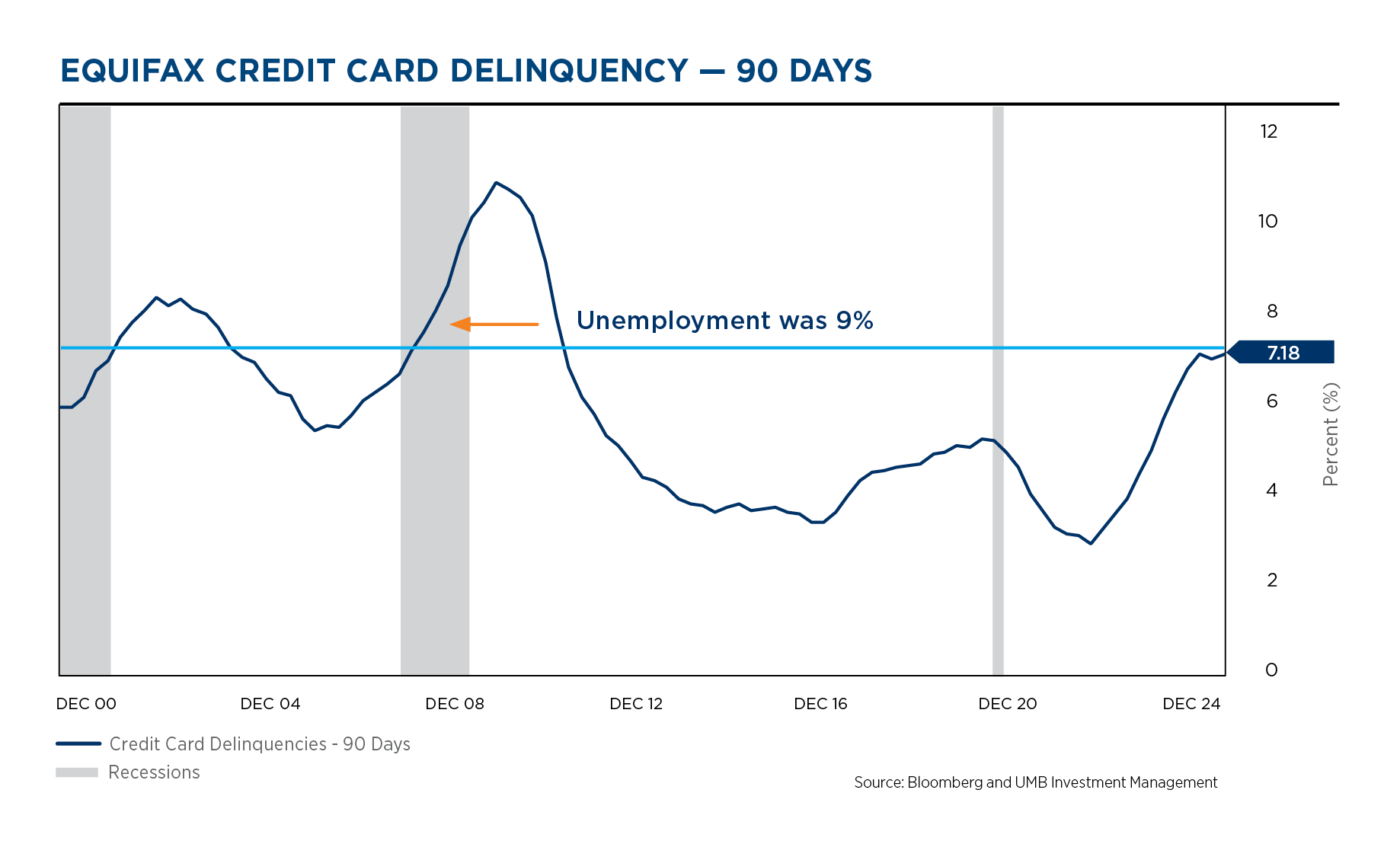

- Excess savings are completely burned off and consumers are showing signs of stress (see next page)

- Economic deceleration was expected in 2025, and the uncertainty from the tariff war will only exacerbate the magnitude of the slowdown.

- The probability of recession in 2025 is approaching 50%.

- Leading Indicators on jobs are in clear decline, indicating a weakening labor market

- The Unemployment rate is expected to climb over 2025

- These trends were in place before the recent efforts from DOGE

- Softening labor conditions will put further downward pressure on consumption

- Uncertainty over global trade will exacerbate trends in the labor data

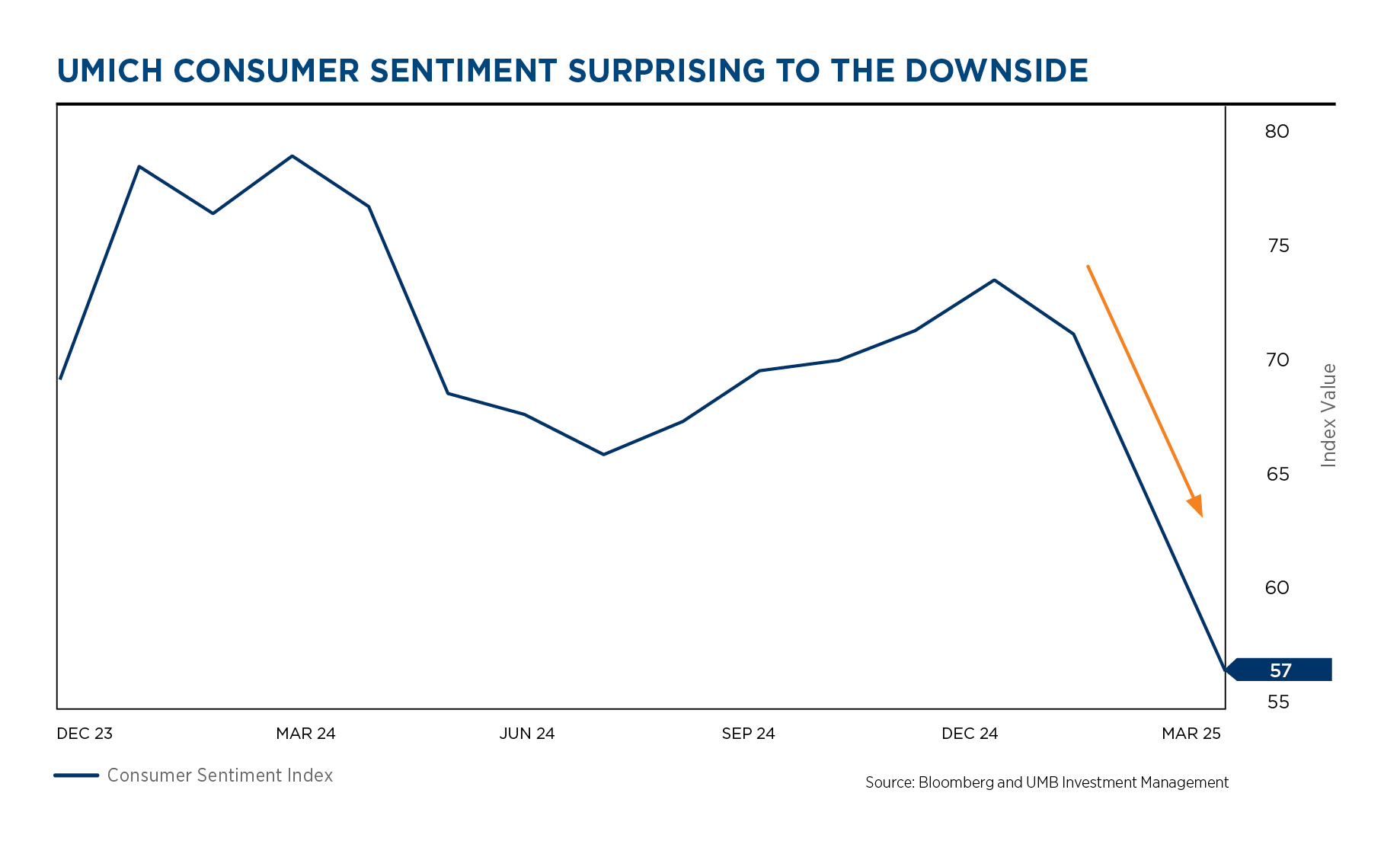

- Consumer sentiment is part of the “soft data” that comes from surveys

- Sentiment has been in a clear downturn

- The downturn in sentiment is worsening as the trade war ramps up

- Falling sentiment, plus softening labor data and the burn-off of extra covid savings, is highly likely to lead to reduced consumption in coming months/quarters

- Consumers are showing some signs of stress

- Delinquencies are rising in the credit card space

- Across all age cohorts, credit card delinquencies have risen to levels previously indicative of recession

- This change would seem to corroborate the notion that excess savings from Covid have been completely drawn down

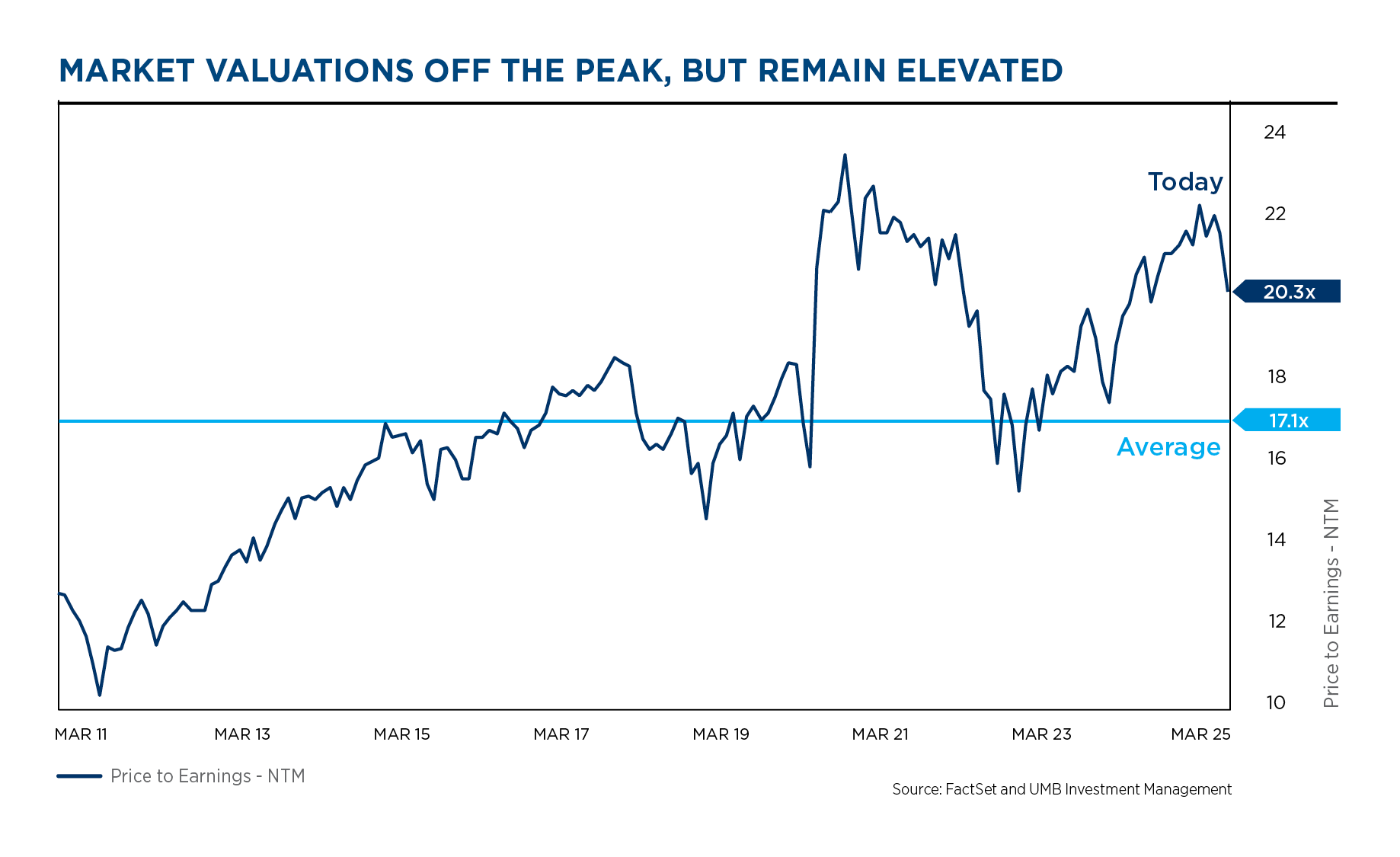

- Equity price appreciation has outpaced earnings growth

- Valuation multiples have expanded powerfully over the last 2 years

- Current valuations are well above the long-term averages

- Elevated valuations will require ongoing robust earnings growth, which may be challenged if the economy decelerates

- Current valuations have come down a touch, but remain elevated, and make the equity market vulnerable to higher levels of volatility

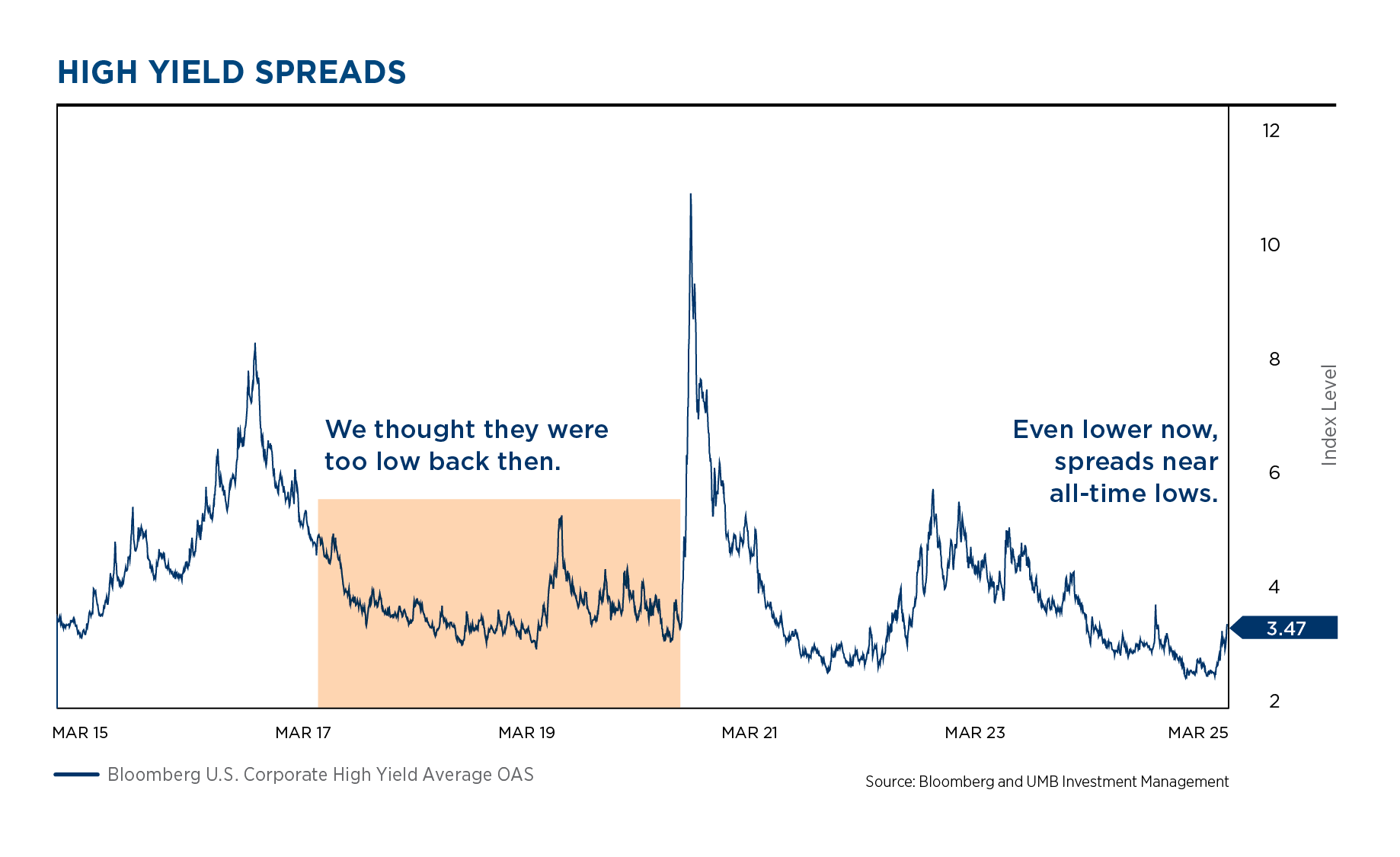

- The Credit markets have enjoyed equally robust expansion in valuations

- Credit spreads (yield relative to treasury rates) are compressed, at nearly all-time lows

- The compensation for taking on credit risk is very low at this time

- Credit markets are anticipating very healthy economic expansion and very low default rates

- Much like the equity market, the credit markets are vulnerable to any disruptions to the economic outlook

Follow UMB‡ on LinkedIn to stay informed of the latest economic trends.

Disclosure and Important Considerations

UMB Investment Management is a division within UMB Bank, n.a. that manages active portfolios for employee benefit plans, endowments and foundations, fiduciary accounts and individuals. UMB Financial Services, Inc.* is a wholly owned subsidiary of UMB Financial Corporation and an affiliate of UMB Bank, n.a. UMB Bank, n.a., is a subsidiary of UMB Financial Corporation.

This report is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. Statements in this report are based on the opinions of UMB Investment Management and the information available at the time this report was published.

All opinions represent UMB Investment Management’s judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a substitute for your own judgment, and you should consult professional advisors before making any tax, legal, financial planning or investment decisions. This report contains no investment recommendations, and you should not interpret the statements in this report as investment, tax, legal, or financial planning advice. UMB Investment Management obtained information used in this report from third-party sources it believes to be reliable, but this information is not necessarily comprehensive and UMB Investment Management does not guarantee that it is accurate.

All investments involve risk, including the possible loss of principal. Past performance is no guarantee of future results. Neither UMB Investment Management nor its affiliates, directors, officers, employees or agents accepts any liability for any loss or damage arising out of your use of all or any part of this report.

“UMB” – Reg. U.S. Pat. & Tm. Off. Copyright © 2025. UMB Financial Corporation. All Rights Reserved.

- Securities offered through UMB Financial Services, Inc. Member FINRA, SIPC, or the UMB Bank, n.a. Capital Markets Division

Insurance products offered through UMB Insurance Inc.

You may not have an account with all of these entities.

Contact your UMB representative if you have any questions.

| Securities and Insurance products are:

Not FDIC Insured * No Bank Guarantee * Not a Deposit * Not Insured by any Government Agency * May Lose Value |