The first months of 2025 have been a whirlwind of activity as President Donald Trump’s second term is underway. The addition of political outsiders up and down the ranks of the executive branch has produced no shortage of new, out-of-the-box ideas and plans that are testing established norms. As change starts to take shape, one of the cornerstones of the administration’s economic policy is U.S. Treasury Secretary Scott Bessent’s 3-3-3 plan, which aims to stabilize the national debt at around 100% of GDP. Stabilizing the national debt at this level is undoubtedly an admirable and responsible goal, and the 3-3-3 plan is likely a step in the right direction, even if achieving all three components may prove elusive.

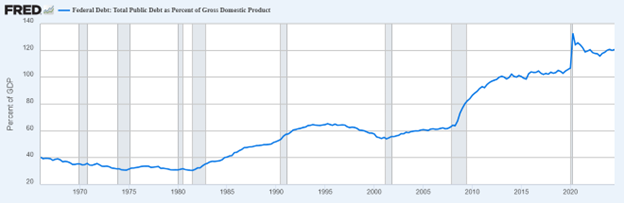

Before examining the plan in detail, it is important to frame the discussion about what it hopes to accomplish. The goal of the 3-3-3 plan is to stabilize the U.S. national debt as a percentage of GDP. Like any household or business, the nominal debt total for a country is not a particularly meaningful number. What’s more meaningful is the debt load relative to the income or earning power of the entity. As economic activity grows, the amount of debt a country can comfortably support grows, making debt relative to GDP a much more informative measure of the health of a country’s debt load. And, as the below chart shows, the U.S. debt load as a percentage of GDP has grown considerably over the past 25 years.

Sources: Federal Reserve Bank of St. Louis; U.S. Office of Management and Budget via FRED® Shaded areas indicate U.S. recessions

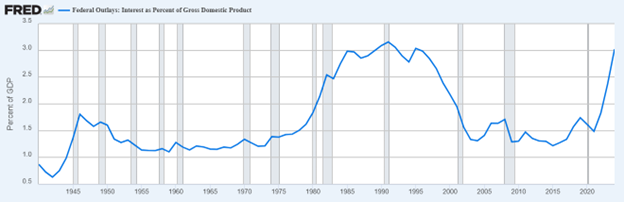

While the debate rages about how much debt a country can support and how much American exceptionalism and the dollar’s status as a reserve currency changes the equation for the U.S., it is clear the economy currently supports considerably more debt relative to its size than it has in previous years. Along with relative debt size, another important input in the equation is the cost of the debt. With interest rates set at considerably higher levels than in recent years, total interest payments as a percentage of GDP are poised to set new highs for the post-WWII era.

Sources: Federal Reserve Bank of St. Louis; U.S. Office of Management and Budget via FRED®

Shaded areas indicate U.S. recessions

As the federal budget projects to be increasingly strained by interest payment obligations, a renewed focus on fiscal responsibility appears to make sense. The new administration’s plan to tackle the problem is to pursue policies and spending that focus on achieving three outcomes – 3% GDP growth on average, 3% annual budget deficits (as a percentage of GDP) and increasing the U.S.’s domestic oil production by 3 million barrels/day.

GDP growth and budget deficits

The first two components of Bessent’s plan are a challenging combination. Intuitively, increased government spending leads to increased GDP growth. The current budget deficit is around 6.5% of GDP, so reducing that to 3% will require legitimate cuts, not marginal. Even before the pandemic, the annual budget deficit as a percentage of GDP trended closer to 4-5%, and since 2020 it has consistently exceeded 5% (ignoring the 2020 spike to 15%). The Congressional Budget Office (CBO) expects this to be closer to 6%. Yet, if the denominator in that ratio (GDP) increases significantly, that may be possible.

At the same time, achieving an average of 3% GDP growth will require an uptick in economic activity. Without leaning on government spending (or decreasing government revenues) to boost GDP to the desired 3% rate, the administration will have to pursue a fiscal policy agenda that stimulates businesses in other ways. With that backdrop, the early intense focus on reducing the size/cost of government agencies also makes more sense. The Department of Government Efficiency (DOGE) may potentially implement long-term savings and increase government efficiency.

Domestic oil production

Reducing regulation broadly while increasing a business-friendly approach to the oil and gas sector does seem to fit the goals of increasing U.S. oil production and overall economic activity. The U.S. is currently the world’s leading oil producer, producing around 13 million barrels/day. Increasing this total by approximately 25% would be an uptick in economic activity and boost GDP. It is also obvious the world’s leading producer increasing supply by 25% will impact the global oil market, perhaps challenging price stability and making the operating environment more difficult for the very producers the administration is hoping will grow.

Disrupting the oil market also always carries the threat of inflaming geopolitical tensions. But Bessent’s plan clearly counts on this outcome, as well as the strengthening of domestic manufacturing and perhaps decreased banking regulation to unlock some potential growth.

Reviewing the 3-3-3 impacts

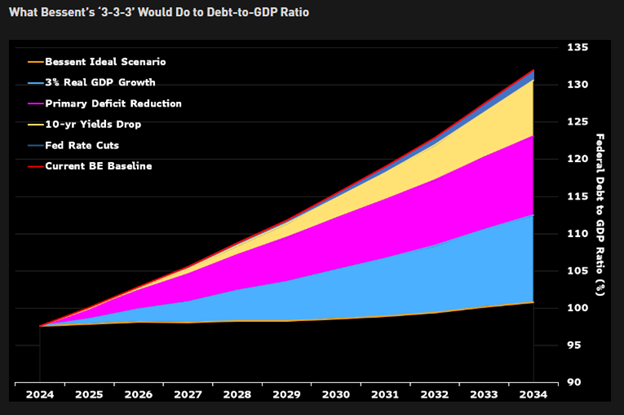

Below is a helpful breakdown of the difference between the status quo and the goals of the 3-3-3 plan:

Source: Bloomberg Economics

The chart shows that real GDP growth and deficit reduction (reduced spending) are the primary drivers here. The plan also factored in considerable savings from a forthcoming decrease in the 10-year bond yield. While a “goldilocks” combination of lower medium/long term yields, subdued inflation, and increased economic growth may prove difficult to manufacture. Even some progress on real GDP growth and deficit reduction can have a meaningful impact on our overall debt burden in the next decade.

With the current administration, we can expect political pressure on the Federal Open Market Committee (FOMC) to cut rates/push medium/longer-term rates lower in any way they can to remain considerable. The FOMC’s bias to lower rates as much as possible while retaining credibility was displayed in the last few months of 2024. Markets may expect more of the same in 2025, especially if economic conditions soften enough to give the committee further ammunition to cut rates.

The first step in the process is speaking with your UMB representative about what the best option is for your bank. Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

Disclosure:

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED

About the authors:

Stephen DuMont is a senior vice president and investment officer at UMB Bank, n.a. Capital Markets Division. He is responsible for serving institutional clients regarding interest rate risk management and fixed-income portfolio strategies. Mr. DuMont brings over 20 years of financial experience.

Winston Crowley joined the UMB Bank, n.a. Capital Markets Division in 2014 and has worked in the financial industry for 19+ years. As senior vice president covering the Colorado and Western markets, Winston is responsible for consulting institutional clients on the management of their fixed-income portfolios. He also leads UMB’s sales effort for FX and the Marketable Securities Reverse Repo program.

Matthew Wolczko joined the UMB Bank, n.a. Capital Markets Division in 2021. As a vice president and investment officer covering the state of Texas, Matthew is considered a fixed-income specialist. He is responsible for soliciting new potential community bank and institutional client relationships. His specialties are balance sheet analysis and fixed-income product sales.