Economic development is vital for the growth and sustainability of communities. It is the engine that drives job creation, increases property valuations, attracts investment, and enhances the quality of life. This article highlights common financing mechanisms and shares some challenges and considerations relevant now.

For more on these ideas, we invite you to listen to a recent webinar presentation by UMB Municipal Advisors professionals Melissa Buck and Nate Summers.

Economic development and financing tools

Each of the following common mechanisms has advantages… and comes with certain challenges. By carefully selecting and implementing these tools, municipalities can leverage future economic growth to jumpstart projects now to make economic vibrancy possible. Whether it is job creation, more affordable housing, or providing developer incentives, there are a myriad of financing tools available to municipalities to foster developer aligning with their long-term goals and community preferences.

Special districts

Special districts, such as Metropolitan Districts (MDs), Business Improvement Districts (BIDs), General Improvement Districts (GIDs), and Special Improvement Districts (SIDs), are instrumental in addressing specific local infrastructure and service needs. These districts can fund a wide range of public improvements, from construction and maintenance of facilities to beautification projects and environmental remediation. While they allow for the levy of additional taxes or fees to finance these improvements, voter approval is often required as they typically involve additional new taxes. Also, state statutes dictate what kind of special districts local municipalities can create – meaning, one or more of these financing tools may or may not be available depending on where you live.

Tax increment financing

Tax Increment Financing (TIF) is a strategic tool to encourage redevelopment and infrastructure improvements within designated areas, making it the kind of special district warranting its own separate category. By capturing the incremental increase in tax revenues resulting from development projects, TIF districts can finance public improvements upfront without the imposition of new taxes. This mechanism not only facilitates immediate enhancements but also promises long-term benefits for all taxing entities within the district once the TIF expires.

Local support

Local governments can also provide some sort of credit enhancement or internal loan to help a project get off the ground. Whether through a moral obligation pledge (i.e., credit enhancement on the project’s municipal bonds) or internal loans from general funds, these strategies can provide initial capital with the expectation of refinancing at more favorable terms in the future. This approach requires careful planning to balance immediate needs with long-term financial sustainability.

Municipal bonds

Municipal bond financing remains a cornerstone for funding economic development projects. The type used can range from general obligation bonds, revenue bonds, to private activity bonds, each having its pros and cons. The choice among these bonds depends on the project’s nature, the desired risk level, and the available financial resources. Regardless of what type makes sense for the project, municipal bonds offer a way to leverage future cashflows to support a project in the near term as opposed to waiting until the associated tax revenues actually increase from redevelopment efforts.

Public-private partnerships

Public-Private Partnerships (P3s) represent a collaborative approach to large-scale infrastructure or social projects, leveraging the strengths of both private and public sectors to future a common end goal. However, the success of a P3 project hinges on optimal risk allocation between the public and governmental parties and a robust contractual framework to ensure accountability and long-term benefits.

Current economic development challenges and considerations

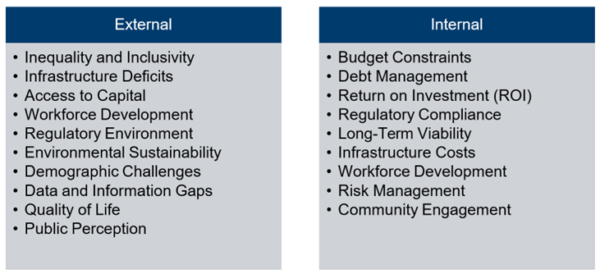

In addition to financing-specific challenges, municipalities face other realities that need strategic attention. Municipal leaders must balance immediate needs with long-term goals and engage their communities. As they do, they face a number of challenges, both external and internal, including these listed below:

Municipal leaders also must navigate emerging trends in society. Here are four recent trends in the economic development space:

- Green investing: The growing emphasis on environmental sustainability has increased the popularity of green bonds and renewable energy projects. The Inflation Reduction Act also offers new opportunities for municipalities and non-profits to finance renewable energy projects through tax-exempt borrowing, receiving direct payments from the federal government. Check out this previous UMB blog on how the Inflation Reduction Act levels the renewable energy playing field for municipalities.

- Technology and innovation: The expansion of financing options for digital infrastructure, like broadband, reflects the critical role of technology in modern economies.

- Social impact investing: Investments aimed at generating positive social outcomes, such as affordable housing and recidivism, are some innovative approaches to solving social issues.

- Increasing use of public-private partnerships (P3s): Collaborations between the public and private sectors are increasingly used for large-scale projects, particularly in affordable and workforce housing.

Concluding thoughts

Economic development is important because economically vibrant municipalities are better equipped to provide for their communities, e.g., jobs, homes, transportation, etc. Attracting and growing businesses and other types of desired development strengthens the economy and increases tax revenues, available jobs, and opportunities for residents. The challenge for municipal leaders is to identify and implement the most appropriate financing vehicle while navigating both traditional and emerging challenges and opportunities.

Learn more about how UMB Financial Services, Inc. municipal advisors can assist with learning more about the economic development financing tools available to your jurisdiction and how they can be leveraged to support a project. Contact us to connect with a municipal advisory team member.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information and opinions expressed in this message are solely those of the author and do not necessarily state or reflect the opinion of UMB Bank, n.a. or UMB Financial Corporation. UMB Bank n.a., 928 Grand Boulevard, Kansas City, MO 64106

This communication is provided for informational purposes only and is (1) not an offer or solicitation for the purchase or sale of any financial instrument; (2) not a solicitation to participate in any trading strategy; (3) not a solicitation of any municipal underwriting services provided through UMB’s affiliate bank dealer, UMB Bank, n.a. Capital Markets Division; (4) not an official confirmation of any transaction; and (5) not a recommendation of action to a municipal entity or obligated person and does not otherwise provide municipal advisor advice. The content included in this communication is based upon information available at the time of publication and is believed to be reliable, but UMB Financial Services, Inc. does not warrant its completeness or accuracy, and it is subject to change at any time without notice. UMB Financial Services, Inc. and their affiliates, directors, officers, employees or agents are not liable for any errors, omissions, or misstatements, and do not accept any liability for any loss or damage arising out of your use of all or any of this information. You should review all related disclosures and discuss any information and material contained in this communication with any and all internal or external advisors or other professionals that are deemed appropriate before acting on this information. Past performance is no indication of future results.

Securities offered through the UMB Bank, n.a. Capital Markets Division and UMB Financial Services, Inc. are: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE