Capital markets update: Not-for-profit hospitals and project financing

With the uncertainty of the pandemic mainly behind us, many hospitals are now focused on capital needs that have been postponed during the past few years. This reality, combined with the recent increase in Medicaid payments, has caused many hospitals to evaluate capital projects and ask themselves how best to leverage the capital markets, given their financial resources. Here’s an overview of current conditions and financing options.

Financial markets update

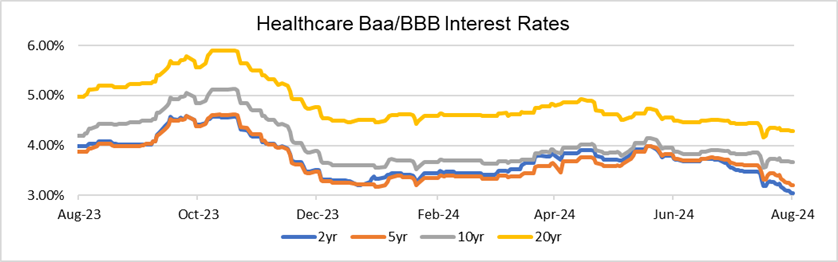

Tax-exempt interest rates have decreased significantly over the past nine months. The chart below shows this recent decline in interest rates for BBB-rated healthcare bonds.

Source: Bloomberg, TM3

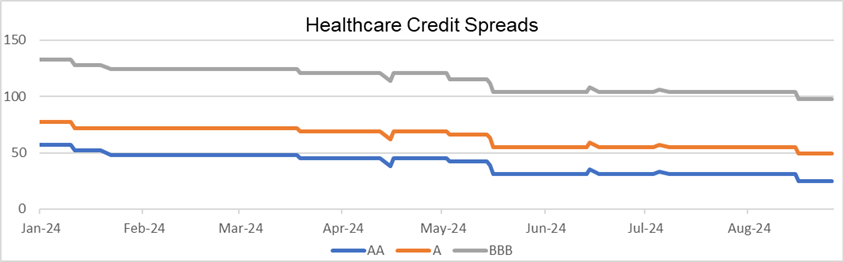

In addition to an overall decline in interest rates, credit spreads (the difference in interest rates between very high-quality and lower-quality credits) have also narrowed. This is partly due to the increasing demand we have seen recently for municipal bonds, which has at times exceeded the supply of new bonds in the market. This relative imbalance in supply and demand results in a scarcity of available bonds for investors to purchase and a willingness on the part of some investors to accept lower interest rates in order to purchase those bonds.

Source: Bloomberg, TM3

Inflation and construction markets

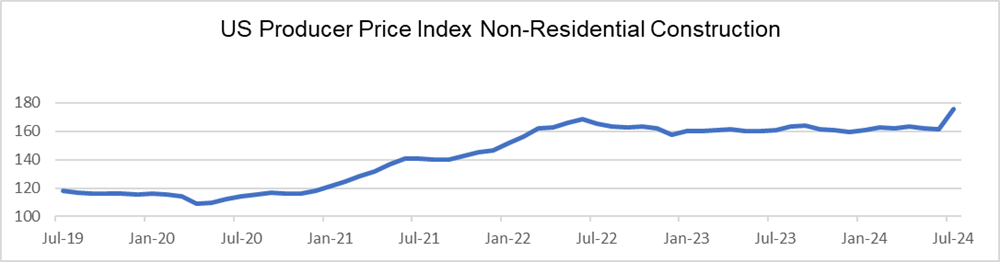

We have also observed an apparent return to equilibrium with regard to key construction costs. The cost of lumber and steel has dropped considerably from its peak during the pandemic and seems to have stabilized. This reduced volatility has improved the predictability of project costs in the planning phase, allowing more plans to proceed.

Source: Bloomberg

Financing options available for hospitals

With a lower-interest-rate environment and construction costs that appear to have stabilized, many hospitals are moving forward with their master facilities plan and pursuing capital projects that may have been on hold for the past few years. Hospitals have recently been utilizing two alternative financing structures in this environment to finance projects: hospital revenue bonds and USDA direct loans.

Hospital revenue bonds

Hospital revenue bonds can offer several advantages for hospitals when financing a capital project, including ease of issuance, speed to market, and interest rates that are still attractive from an historical perspective. Many governmental hospitals can issue tax-exempt revenue bonds directly to finance their projects, and other non-profit hospitals can typically work with their local city or county to issue the tax-exempt bonds on their behalf as conduit issuers. The bond issuance process normally takes 8 to 10 weeks to complete. With tax-exempt interest rates in the 4% to 5% range for most community hospitals, hospital revenue bonds may provide the best option to finance needed capital projects efficiently.

USDA direct loans

Another financing structure currently being used to finance capital projects involves a direct loan from USDA Rural Development. This financing structure typically requires an equity contribution from the hospital and third-party financing for a portion of the project cost (e.g., hospital revenue bond/loan). The balance of the project costs are financed through a 35- or 40-year direct loan from the USDA with a fixed interest rate currently near 3.50%. Approval for a USDA direct loan requires the following:

- An examined forecast prepared by a certified public accountant (CPA) which verifies the financial viability of the project

- A preliminary architectural report (PAR) prepared by the architect stating the need for the project and the anticipated cost

- Completion of the required application forms

- USDA approval of the construction drawings, bid process, and contracts associated with the project

This process typically takes 6 to 9 months to complete, and the construction period financing is normally funded through the issuance of construction notes that are paid off with the proceeds of the USDA direct loan upon substantial completion of the project.

Although interest rates are no longer at the historic lows we experienced in the years leading up to the pandemic, the recent decrease in interest rates and a narrowing of credit spreads have created an attractive environment for many hospitals to confidently move forward with needed capital projects. The best financing structure for these projects will depend upon the size of the project being considered, the hospital’s recent and prospective financial performance, and other factors specific to the hospital and its board of directors.

Learn more about how UMB Bank, n.a. Public Finance can support your organization’s financing and capital needs, or contact us to be connected with a public finance specialist.

Disclosure

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information and opinions expressed in this message are solely those of the author and do not necessarily state or reflect the opinion of UMB Bank, n.a. or UMB Financial Corporation. UMB Bank n.a., 928 Grand Boulevard, Kansas City, MO 64106

This communication is provided for informational purposes only and is (1) not an offer or solicitation for the purchase or sale of any financial instrument; (2) not a solicitation to participate in any trading strategy; (3) not a solicitation of any municipal underwriting services provided through UMB’s affiliate bank dealer, UMB Bank, n.a. Capital Markets Division; (4) not an official confirmation of any transaction; and (5) not a recommendation of action to a municipal entity or obligated person and does not otherwise provide municipal advisor advice. The content included in this communication is based upon information available at the time of publication and is believed to be reliable, but UMB Financial Services, Inc. does not warrant its completeness or accuracy, and it is subject to change at any time without notice. UMB Financial Services, Inc. and their affiliates, directors, officers, employees or agents are not liable for any errors, omissions, or misstatements, and do not accept any liability for any loss or damage arising out of your use of all or any of this information. You should review all related disclosures and discuss any information and material contained in this communication with any and all internal or external advisors or other professionals that are deemed appropriate before acting on this information. Past performance is no indication of future results.

Securities offered through the UMB Bank, n.a. Capital Markets Division and UMB Financial Services, Inc. are: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE