Community banks are facing a new challenge with unrealized losses lowering tangible equity capital. The Federal Home Loan Banks (FHLB) has come out and said it will stop providing funding to banks with a negative equity capital ratio. The rising rate environment has led to unrealized losses on available-for-sale (AFS) securities. These securities have become much less desirable to investors because of declining valuations on the securities.

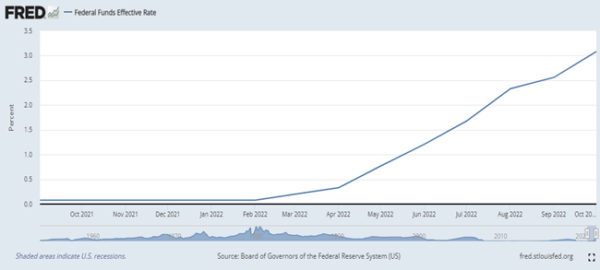

In late 2021, the Federal Reserve (Fed) Funds Target Rate was sitting at 25 basis points and very uncertain times were ahead. Price inflation across all parts of the economy forced the Fed to engage in an aggressive, restrictive monetary policy to maintain its mandate of low inflation. Some were wanting to maintain a slow pace of rate increases to avoid pushing the economy into a recession. With several countries worldwide still struggling with the effects of the COVID-19 pandemic, a U.S. recession could make everything worse for just about everyone.

Others believed rate hikes were the proper route to take to regain some normalcy in prices. As quickly as the Fed was to lower the target rate to zero at the start of the coronavirus, it has now generated the highest rate increase in nearly 40 years.

In November 2022, at the most recent Fed meeting, rates were raised by another three quarters of a point, and it was the fourth time they have done that in 2022. With the Fed Funds Target Rate now sitting at around 4.0%, this rate rise is two times as fast as the rise in 1989-1999.

Source: Board of Governors of the Federal Reserve System (U.S.)

With the Fed’s aggressive approach from one extreme to the next, one must wonder: what is their plan going forward?

Rates will continue to rise

As of December 2022, the Fed has raised the Fed Funds Target Rate in six straight meetings, which is something it has not done since 2005. The Fed has raised rates 375 basis points in the past seven months, which has not been done since the 1980s. And, it appears the Fed is not done yet. Fed Chair Jerome Powell has signaled officials will likely raise rates even higher in early 2023, although the destination for the Fed Funds Target Rate is unclear.

Back in September 2022, we were looking at a projection of raising rates to a target of 4.5 to 4.75 percentage points. Chairman Powell has stated they would like to raise a little higher than that. However, they may take more of a “baby-step” approach to get there. Rather than raising 75 basis points at a time, we could be looking at something more like a 50-basis-point increase and then settling in at 25 basis points thereafter.

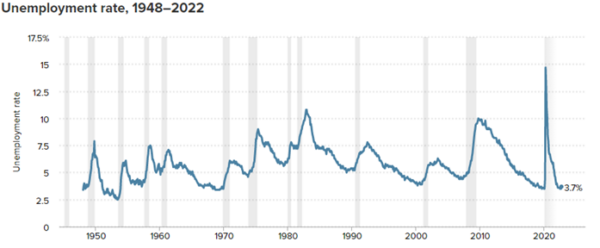

The ultimate decision that the Fed will make will rely on inflation and the labor market in the coming months. The Consumer Price Index has inflated at the quickest rate in almost 40 years. At one point, late summer 2021, it appeared inflation may expand beyond gas, energy and food prices. At one time, inflation was linked to supply shocks from the coronavirus pandemic, but it could now be linked to the job market.

According to the Fed and Fed Chair Powell, job creation hasn’t slowed, and data also shows it could be outpacing population growth.

Source: EPI Analysis of Bureau of Labor Statistics

Recession projections

Citizens and industries worldwide are fearing a recession. The picture is even less clear because it takes time for interest rate changes to have an effect on the economy. Sometimes it can take almost a year or so for the changes to be fully realized.

Unrealized losses and negative equity

The phrase “unrealized losses” (or unrealized gains, losses, etc.) gets tossed around quite a bit in the finance and banking industry. However, few understand what it implicates or means. It’s normal to see investments increase and decrease in value over time. Gains and losses on a specific day, or even hour, doesn’t mean they’re permanent.

Portfolio gains and losses are considered “unrealized” until you sell the investment. This could be a stock, a bond or any other type of security in your portfolio. These can sometimes be considered a “paper” loss that results from holding an asset that has decreased in price, but not selling it and realizing the losses.

Some investors may prefer to hold onto the security that has decreased in value hoping it will eventually recover in price. Bonds always mature at par, but stocks may never recover full value. Bond losses always go away (assuming the final principal payment is made), but stock losses may not.

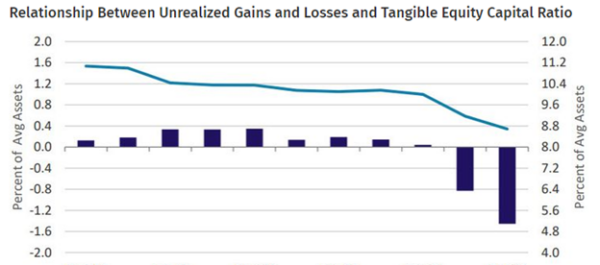

It’s been uncommon recently to see equity capital value at anything other than a positive number. However, due to the increasing rate environment, securities purchased when the market had lower yields have become less enticing to investors, which has resulted in declining valuations (and left an impact on community bank’s tangible equity capital ratio). As valuations on AFS securities have started to incur unrealized losses, the tangible equity capital ratio has steadily declined.

Source: Federal Reserve reports of Condition and Income

Negative equity arises when the value of an asset falls below the current book value of that security. It normally occurs when the value of the asset depreciates rapidly over the period of use. Unrealized losses have a direct impact on the negative equity number

The impact

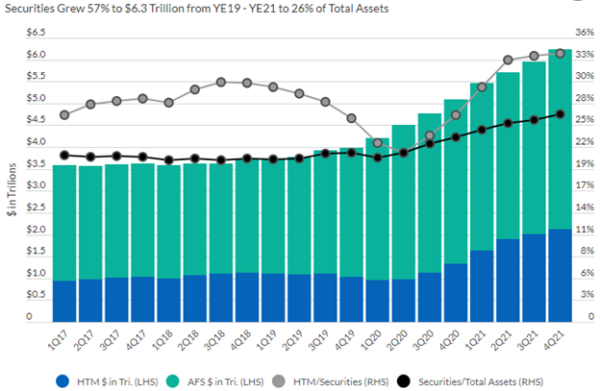

The growth in securities holdings since the start of the pandemic has had a large impact on the earnings ability of community banks nationwide. The rapid rise in rates has made a direct impact on banks’ equity capital.

Source: Fitch Ratings, Federal Reserve Bank of St. Louis

The significance of this is that since rates have risen so rapidly, unrealized losses across community banking organizations (CBOs) has risen to around $25 billion, which is about 9% of Tier 1 capital.

Community banks are reporting as much as 90% increases in unrealized loss positions, which is up from 20% just a year and a half ago. At the end of 2021, there were only a handful of community banks with an equity capital ratio below 5%. As of Q3 2022, that number has increased to around 350. This indicates that a bank’s ability to handle economic shocks is a little more shaky than normal. Banks’ balance sheets are comprised of higher percentages of securities from a historical perspective. This is impacting the ratio more than it would, say, in “normal times”.

The FHLB has come out and said they will look at refraining from engaging in providing funds to community banks that hold a negative equity capital number or ratio. It can cause a headache for community banks as they search for other ways to scrum up liquidity. However, the FHLB does have to be careful as a lender, much in the same way that a mortgage lender won’t lend money to someone with a sub-par credit score.

The financial services group at UMB can offer ways to model these scenarios for you so that you are well-equipped and informed for the times that are ahead. Dynamic balance sheet modeling is an opportunity to alter your balances to even the most extreme scenarios to see how drastic changes could impact asset-liability outcomes.

We can couple this with a stress test showing the effect of changes in rates and changing balance sheet structure on your net interest income and equity capital. We can develop a scenario that determines the factors that contribute to a possible decline in equity capital to the point where the book value equity is negative (i.e., “break the bank” scenario). The changes we would apply include loan and deposit growth/shrinkage, loan and deposit pricing, deterioration in financial markets, etc. These also incorporate zero funding from FHLB borrowings or brokered CDs.

Learn how UMB Bank Capital Markets Division’s fixed income sales and trading solutions can support your bank or organization, or contact us to be connected with a team member.

This communication is provided for informational purposes only. UMB Bank, n.a. and UMB Financial Corporation are not liable for any errors, omissions, or misstatements. This is not an offer or solicitation for the purchase or sale of any financial instrument, nor a solicitation to participate in any trading strategy, nor an official confirmation of any transaction. The information is believed to be reliable, but we do not warrant its completeness or accuracy. Past performance is no indication of future results. The numbers cited are for illustrative purposes only. UMB Financial Corporation, its affiliates, and its employees are not in the business of providing tax or legal advice. Any materials or tax‐related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. The opinions expressed herein are those of the author and do not necessarily represent the opinions of UMB Bank or UMB Financial Corporation.

Products, Services and Securities offered through UMB Bank, n.a. Capital Markets Division are:

NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED